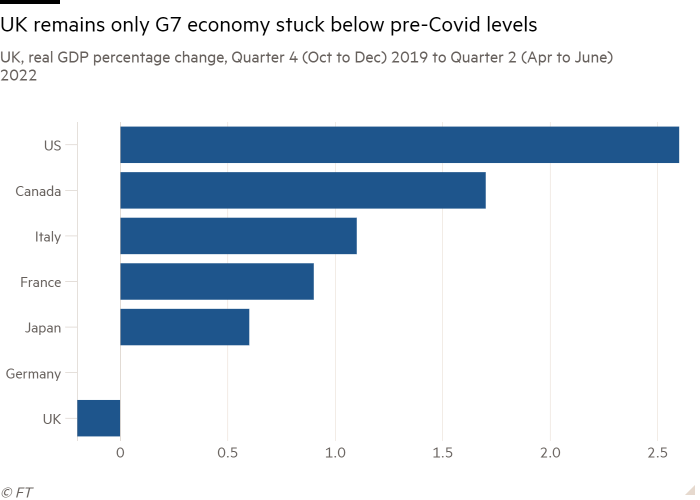

UK remains only G7 economy to languish below pre-pandemic levels

Significant revisions to UK data indicate that Britain is the only G7 economy that remains smaller than it was before the pandemic, despite an improved performance in the second quarter that diminished fears of recession.

Office for National Statistics figures released on Friday showed that UK gross domestic product for the three months to June this year remained 0.2 per cent below the level it reached in the final quarter of 2019.

Previously, official data had indicated that GDP had risen 0.6 per cent above pre-pandemic levels by June.

By contrast with the UK’s failure to return to pre-pandemic levels, the eurozone economy reached 1.8 per cent above 2019 levels in the second quarter. The US had recovered to pre-pandemic levels by the start of last year.

Friday’s UK growth downgrade was largely due to a lower ONS estimate of 2020 output. However, growth for 2021 and this year was revised higher.

The ONS now says the economy grew 0.2 per cent between the first and the second quarters of 2022.

This compares with its previous estimate of a 0.1 per cent contraction for the period — an improvement that will allay fears that the UK economy is already sliding into recession. The change was driven by a better than expected performance of professional and financial services.

The data suggest the UK economy entered the cost of living crisis before it had managed to fully recover from the pandemic, laying bare the challenge facing Britain’s new prime minister, Liz Truss.

In a reference to the tax cut and borrowing plans of Kwasi Kwarteng, Paul Dales, chief UK economist at Capital Economics, said the data “makes the chancellor’s fiscal plans look even more untenable”.

Kwarteng’s announcement last week of £45bn of debt-funded tax cuts triggered turmoil in the sterling and gilts markets, pushing the Bank of England to take emergency action to avoid a meltdown in the UK pensions sector. With the government’s planned tax cuts forecast to keep inflation higher for longer, markets are now pricing in significantly higher interest rates by mid-next year.

“The overall picture is that the economy is in worse shape than we previously thought even before the full drag from the surge in inflation and leap in borrowing costs have been felt,” Dales said.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the figures will compel the Office for Budget Responsibility, the UK fiscal watchdog, to revise down further its estimates for future potential GDP. They would also mean that the tax-to-GDP ratio will be slightly higher than previously estimated.

“The damage inflicted to the economy’s supply side by Covid and Brexit is even larger than previously thought,” Tombs said.

Some details in the data release also revealed that households have been hurt by high inflation. Real household disposable income fell 1.2 per cent in the second quarter, the largest of the four successive drops as fast-rising prices diminished the value of wages.

The household saving ratio fell to 7.6 per cent, from 8.3 per cent in the previous quarter and from 26.8 per cent at its peak in the second quarter of 2020, when the country was in a stringent lockdown. This is still above pre-pandemic levels, suggesting households have scope to absorb some future income shocks.

Grant Fitzner, ONS chief economist, said: “These new figures include more accurate estimates of the financial sector and how the costs facing the health sector changed throughout the pandemic.”

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.