Shopify shares fall as earnings underwhelm

Shopify became the latest ecommerce company to suffer from the slowdown in the pandemic-fuelled boom after it reported first-quarter earnings below expectations and saw its shares drop almost one-fifth.

The Canadian company, whose software helps merchants and brands create an online storefront, on Thursday reported sales for the three months to March up 22 per cent, year on year, to $1.2bn — its slowest ever growth rate.

The figures were marginally below consensus expectations of $1.25bn. The Ottawa-based company posted a net loss of $1.4bn, its second consecutive quarter in the red.

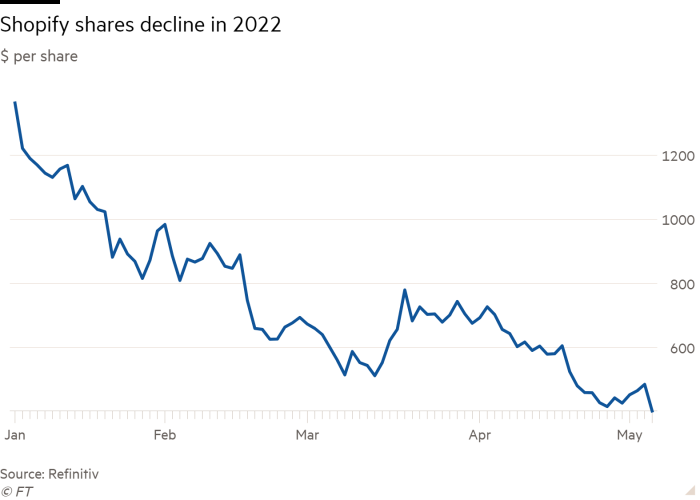

Shopify shares, which have lost more than 70 per cent of their value so far this year, dropped nearly 20 per cent in early trading on Thursday, momentarily falling below $400 a share.

Shopify was one of the biggest winners from the pandemic as lockdowns pushed millions of small businesses to open online stores. However, the recent return of shoppers to bricks-and-mortar outlets has weighed on Shopify’s outlook.

The group on Thursday reiterated its confidence in the growth of ecommerce by agreeing to pay $2.1bn to acquire Deliverr, a San Francisco-based fulfilment start-up. The deal will be 80 per cent funded by cash, with the rest in Shopify shares.

The acquisition is part of Shopify’s effort to expand its logistics network in its battle against Amazon.

“I do not think people are moving away from online shopping,” said Shopify president Harley Finkelstein. “Some of it was pulled forward over the past two years but online is still a very small percentage” of retail, he said.

For the first three months of 2022, Shopify reported gross merchandise volume — a measure of consumers’ total spending through the group’s network of stores — of $43.2bn, up 16 per cent year on year but roughly half the growth rate registered in the previous quarter.

The company said revenue growth this year would be “lower in the first half and highest in the fourth quarter”.

Shopify’s services allow brands and independent stores to sell directly to customers through their own websites or social platforms such as Instagram as an alternative to trading through Amazon or other marketplaces.

Shopify in April proposed a 10-for-1 share split and put forward a plan to protect founder and chief executive Tobi Lütke’s voting power. The changes propose setting and preserving his voting power at 40 per cent of the total for the group’s outstanding shares.

“[Lütke] has proven that he can deliver returns at over 60 per cent per year, compounded annually since our IPO,” Finkelstein said. “We would have done something like this earlier, but during Covid-19 all of our focus was on emergence [from the pandemic],” he said.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.