Linking PAN to Aadhaar has been made compulsory by the government of India. Failing to do so can have several negative consequences such as restricting individuals from carrying out tax and income-related transactions. While the last date to link an Aadhaar with a PAN card without a late fee was June 30th, people can still go ahead and connect both cards with each other officially. In this article, we have laid out the step-by-step procedure to link PAN with Aadhaar after the deadline and have also provided several key details that you should keep in mind.

How to link PAN with Aadhaar card after the deadline period

If you failed to link your PAN card with your Aadhaar card before the deadline, the former will be inoperative and you won’t be able to avail tax related services. However, the Income Tax Department is allowing defaulters to still link both cards through its portal by paying a penalty. Here’s how.

- Firstly, head over to Income Tax Department’s official website on your laptop/desktop or mobile phone

- Now from the left menu, select ‘Link Aadhaar‘

![Link PAN with Aadhaar after last date]()

- Fill in your PAN and Aadhaar number in the given fields and select ‘Validate‘

![Link PAN with Aadhaar after last date]()

- If the PAN is not linked with an Aadhaar, a message will pop up prompting you to make the payment for linking the cards after the last date

- Simply click ‘Continue to pay through E-Pay Tax‘ button

![Link PAN with Aadhaar after last date]()

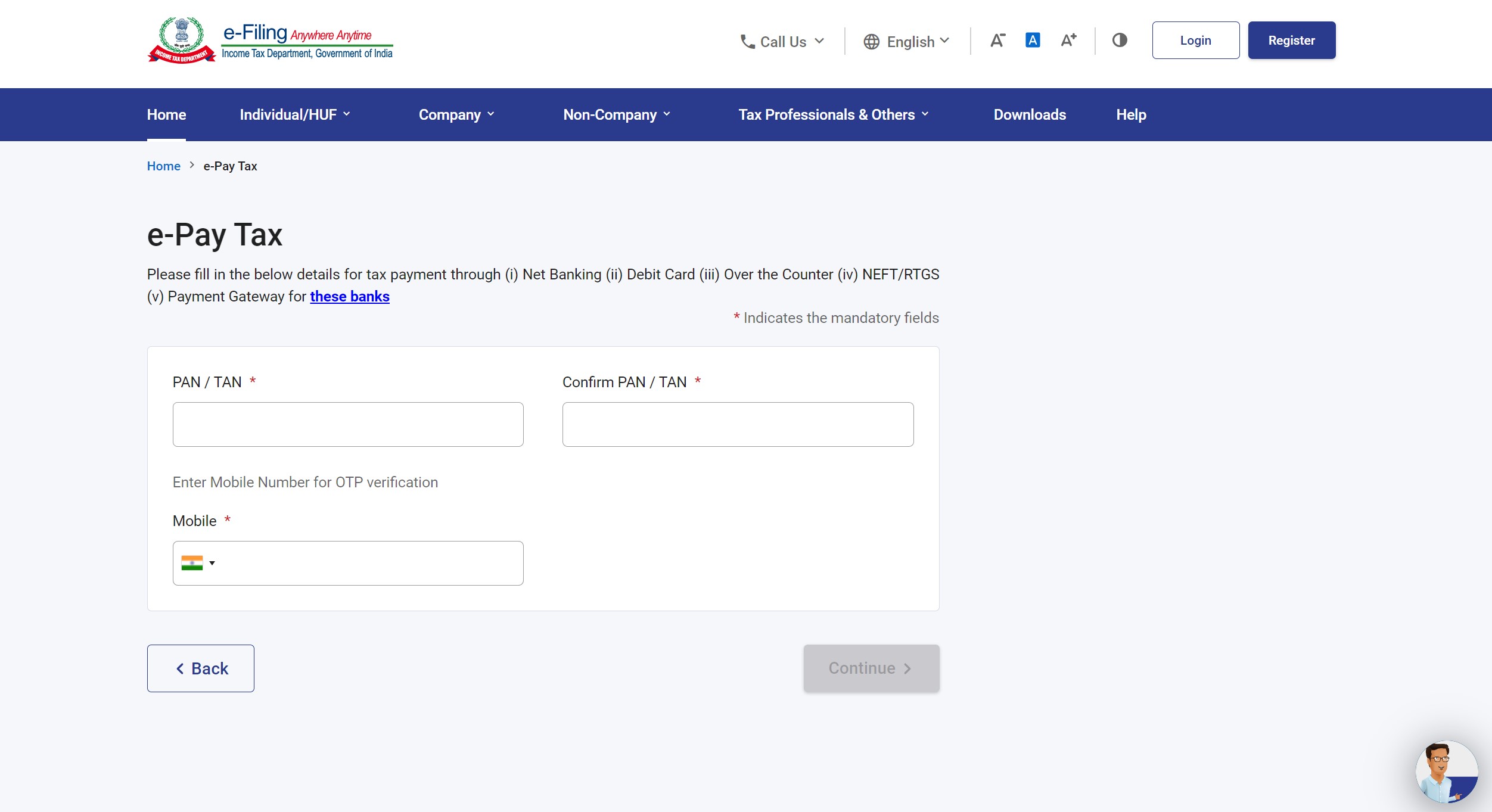

- On the next screen, enter your PAN number in the given fields. Along with that, enter your active mobile number as well and hit ‘Continue’

![Link PAN with Aadhaar after last date]()

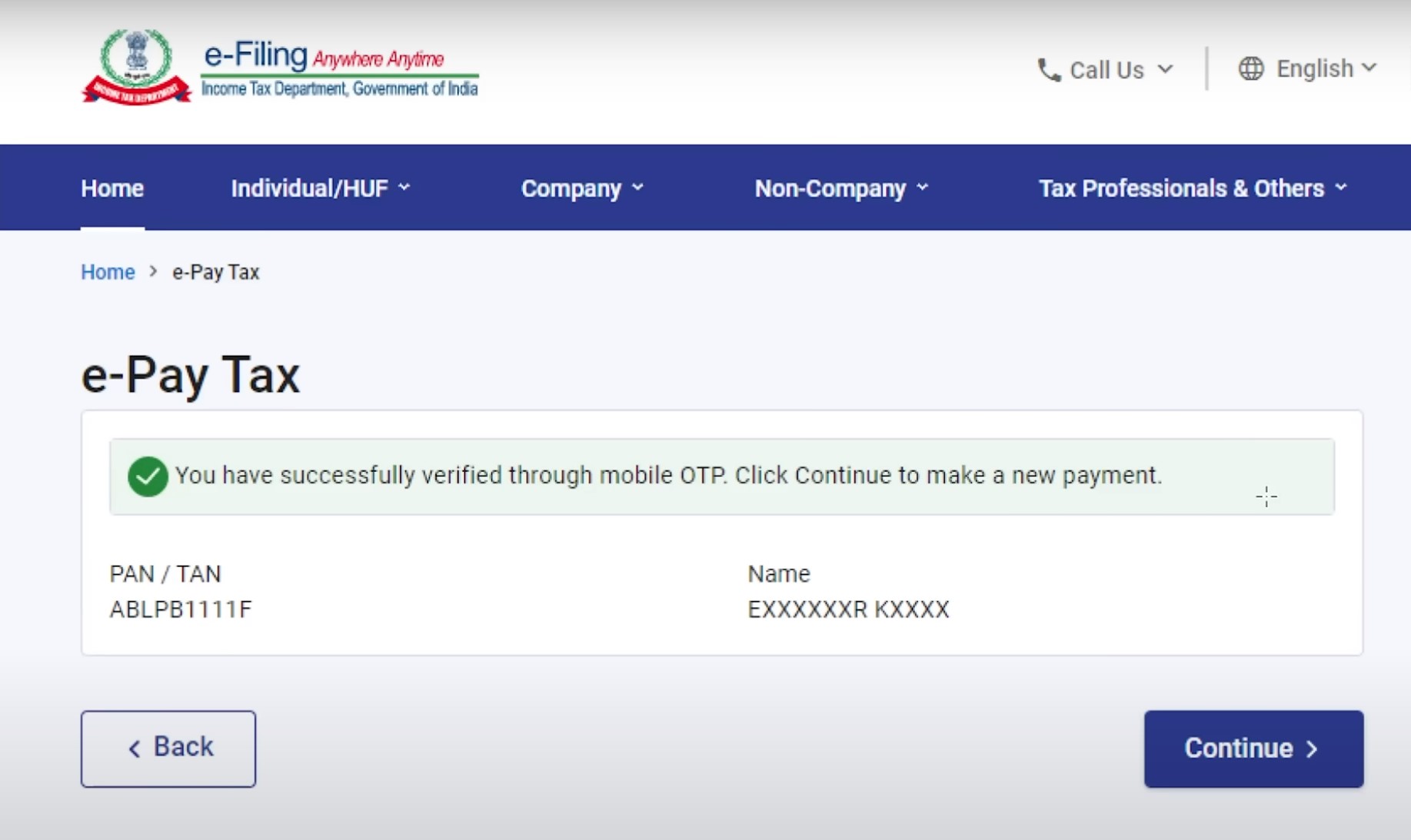

- Type in the OTP you receive through SMS and you will be verified to make the payment

![Link PAN with Aadhaar after deadline]()

- Next, select ‘Proceed’ within the ‘Income Tax‘ box

![PAN - Aadhaar link after due date]()

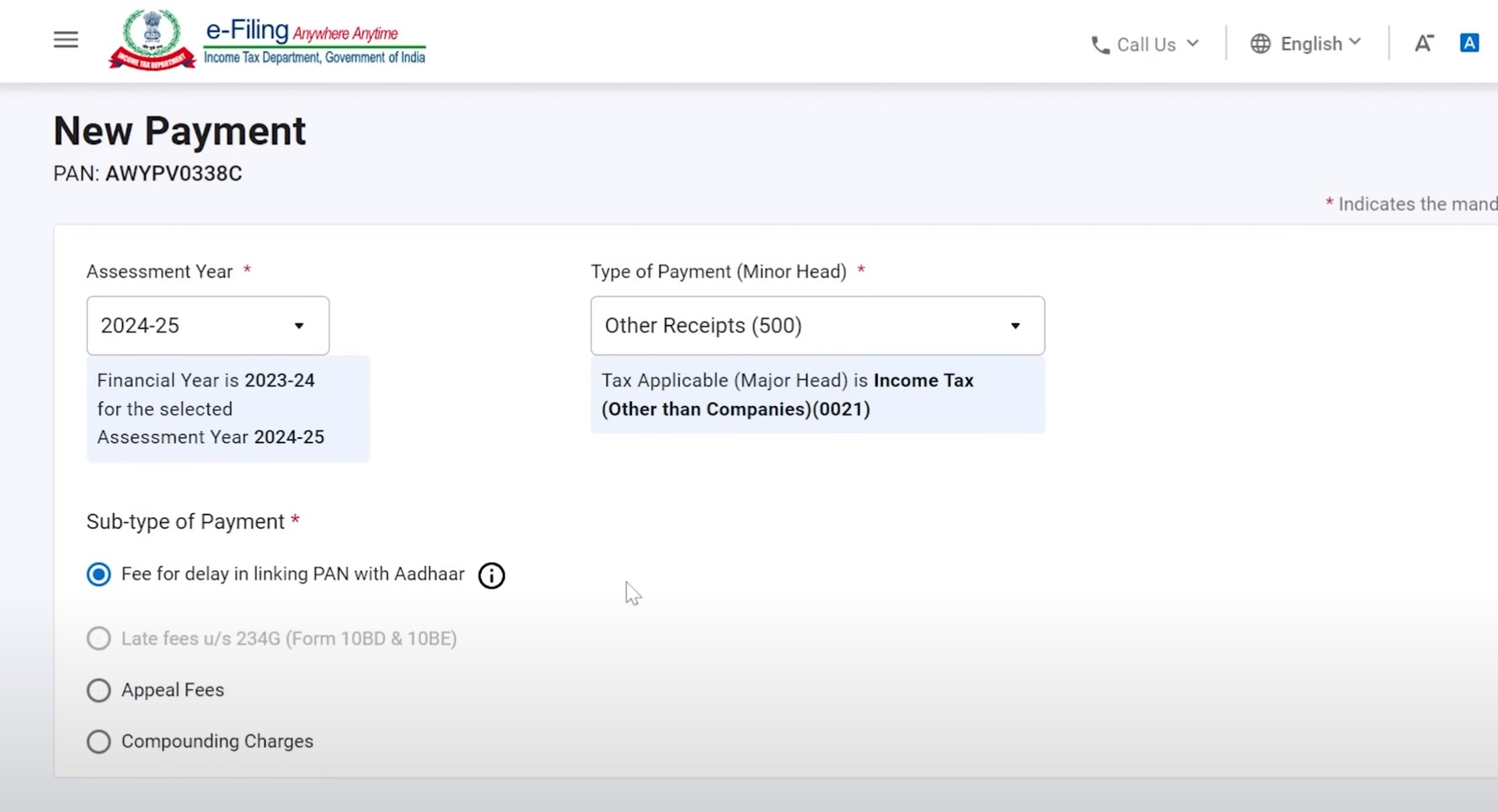

- Now select the assessment year as ‘2024-25‘. If the ‘Type of payment’ dropdown is not filled automatically, select the ‘Other receipts‘ option

![PAN - Aadhaar link after deadline period]()

- In the ‘Sub-type of Payment’, click on ‘Fee for delay in linking PAN – Aadhaar‘ and finally select ‘Continue’

- On the next screen, an amount of Rs 1000 will be displayed which is your late penalty fee

![Link PAN with Aadhaar after last date]()

- After hitting ‘Continue’, the portal will provide various options to make the payment including net banking, debit card, RTGS/NEFT, payment gateway (UPI), etc.

![PAN - Aadhaar link to make PAN operative]()

- Select your preferred payment mode and click ‘Pay now‘

- Once the payment is done, a challan form will be generated. Keep this form handy as this is proof that you have successfully made a payment.

After going through the whole linking and payment process, your Aadhaar won’t be linked to the PAN instantly. It will take approximately four to five days to process your request.

How to check PAN-Aadhaar linking status?

To know the linking status, head over to the IT department’s website and select the ‘Link Aadhaar Status’ option from the left menu. From there, enter your Aadhaar and PAN number and hit ‘Validate’ and you’ll get the message ‘Your PAN is already linked to the given Aadhaar’.

If your PAN-Aadhaar linking is done after the June 30th due date, your PAN card will become operative only after 30 days from the date of paying the penalty fee (payment). Within that period, the PAN will be considered inoperative and the cardholder will have to bear consequences such as higher TDS on income and won’t be able to avail income tax refunds. For instance, if an individual links their Aadhaar with PAN and pays the fine on July 5th, their PAN will be operative only on August 4th.

FAQs

How much is the penalty for linking PAN with Aadhaar after the last date?

A penalty of Rs 1000 will be charged if a PAN is not linked with Aadhar after the last date, i.e. June 30th, 2023.

Can I link my PAN to Aadhaar without paying a penalty fee?

No, once the deadline is over, an individual must pay the penalty fee to link their PAN with Aadhaar. Failing to do so will result in the PAN card becoming inoperative.

Why should I link my PAN with Aadhaar card?

Here are various reasons why you should link your PAN with Aadhaar card:

- To prevent identity theft – Once you have linked both PAN and Aadhaar, it prevents fraudsters to misuse your personal details for frauds or scams as your identity is protected at all times through biometrics.

- Difficulties in obtaining FDs and MFs – Since a PAN card becomes inoperative if it is not linked with an Aadhaar, the person may face difficulties in investing in mutual funds are opening a fixed deposit as banks and other authorities compulsorily require an operative aka a valid PAN card to proceed with the application.

- Getting a debit or credit card – Another reason why linking an Aadhaar to a PAN card is important is that banks may not accept PAN cards that are inoperative in nature. This means they won’t issue new debit or credit cards to an account holder.

What will happen if I don’t link my PAN with Aadhaar?

Here are several consequences one may have to go through if they don’t link PAN with their Aadhaar before the due date:

- No income tax refunds – The person won’t be able to claim income tax refunds

- No interest on refunds – The interest on refunds won’t be given for the period during which the PAN remains inoperative

- TDS and TCS deducted at a higher rate – People who fail to link their PAN with their Aadhaar will have to pay higher rates of TDS on their income. Similarly, TDS will be charged at a higher rate.

- Late penalty fee – A fee of Rs 1000 will have to be paid if the PAN – Aadhaar linkage is done after the due date.

For whom is PAN-Aadhaar linking not compulsory?

People falling under these categories are not required to link PAN and Aadhaar card:

- People who are Non-Resident Indians (NRIs)

- People who are not a citizen of India

- People who are more than 80 years of age

- People who reside in Assam, Meghalaya, or Jammu & Kashmir

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.