Column: The guilty parties escaping blame for the Southwest meltdown are its board members

The Southwest Airlines flight schedule is returning to normal, its top executives have issued their ritual apologies and promises to do better, and those front-line workers who bore the brunt of customers’ fury during the last week are (hopefully) recovering their mental and emotional equilibrium.

That leaves one set of Southwest figures who have, so far, evaded the finger-pointing after the airline’s epic meltdown: the board of directors.

That’s a shame, because the airline’s 11 outside directors are arguably the guiltiest of the guilty parties in the company’s recent fiasco, the most deserving of obloquy.

Operational mishaps and technology shortcomings occur far too often…flight attendants are often stranded alongside Southwest customers without information.

— Southwest flight attendants union

These are the people who have presided over the airline’s evolution from a company respected for its devotion to customer service into one that demands respect because it “returns value to shareholders” via generous dividends and stock buybacks.

It’s true that severe weather triggered the airline’s service collapse, but that’s not much of an excuse.

Newsletter

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Other major airlines recovered quickly, but not Southwest. Its complex flight map may also have contributed, but that’s because Southwest hadn’t kept its scheduling technology up to date with its challenges.

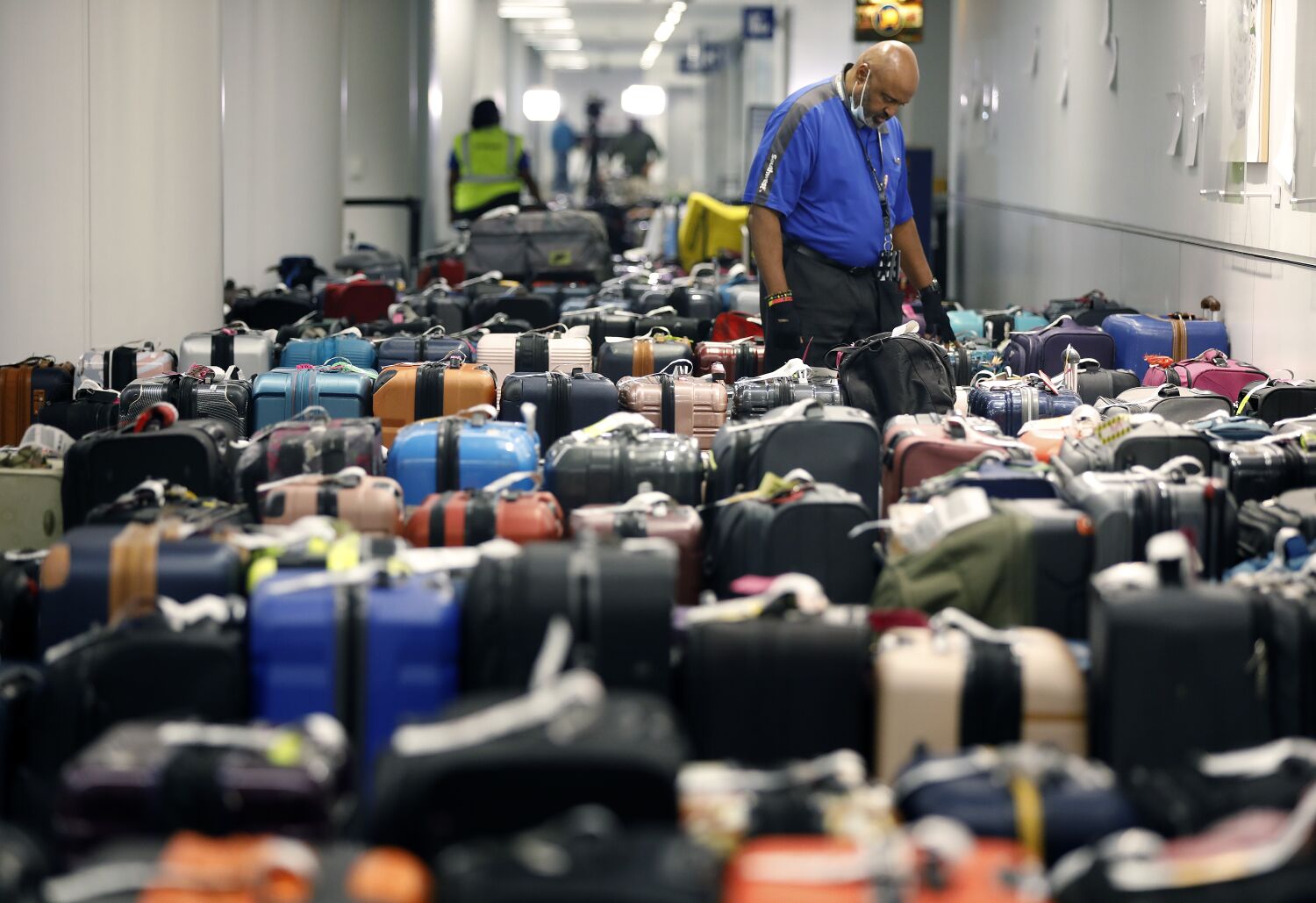

During the airline’s meltdown, which started on Dec. 22, more than 15,000 flights were canceled. The cancellations kept millions of would-be passengers from their holiday getaways, stranded legions in airport terminals without hope of prompt rescheduling, and separated untold numbers of travelers from their baggage

If there’s a silver lining in all this, it may be that the role of its board receives long-overdue scrutiny.

The main question should be: What do these people do to earn compensation that, according to the company’s most recent proxy statement, averaged more than $284,000 in 2021?

Where were they during the years in which employees and their unions continually warned that Southwest’s crew and aircraft scheduling technology was hopelessly outdated?

Why did the board not take matters in hand when Southwest’s on-time performance cratered in 2014 due to bad planning and an effort to expand its service on the cheap, without adding planes to its fleet or upgrading its antiquated reservations system? Or in June or October 2021, when the airline had to cancel thousands of flights because of technological problems?

While the Christmas meltdown was still going on, CEO Bob Jordan issued a video mea culpa to the airline’s employees in which he acknowledged that “we’ve talked an awful lot about modernizing the operation, and the need to do that.”

Any self-respecting corporate director would take that as a slap in the face and a wake-up call. It’s the board’s job to make sure that top management translates talk into action.

Boards of directors are generally the least-heavily covered components of corporate governance, in part because boards tend to be insular, secretive bodies whose members seldom expose themselves to media scrutiny.

Their role shouldn’t be overlooked, however. Whenever a company descends into dysfunction, often there’s a do-nothing board at the top. Directors are supposed to be independent from management, but typically they’re cat’s-paws of the top executives who nominate them and ask shareholders to vote them into office.

Although pressure has increased on American companies in recent years to diversify their director corps, it’s a slow and uncertain process. Commonly, directors closely resemble executives in experience and general outlook.

Board members seldom take a strong stand against management unless a top executive becomes embroiled in a major public scandal. If there’s major disagreement on a corporate board, that’s typically taken as a sign of board dysfunction.

The Southwest board doesn’t seem on the surface to be much different from the standard issue — no worse, but no better. The board has a modicum of diversity in the areas that get most public attention: Its 11 members — not counting insiders Jordan and his predecessor, Gary Kelly, who reigns as executive chairman — include three who tick the boxes for gender and racial diversity.

In terms of experience and outlook, however, the board is as homogeneous as they come. There are four ex-CEOs of other companies, three former corporate lobbyists, a current and a former business professor, a director of an executive search firm and a board member of several nonprofits.

According to Southwest’s latest proxy, issued in April, “the Board of Directors unanimously recommends a vote for the election of each of the nominees for Director.” Since only one of the nominees was joining the board for the first time, this meant that the directors were unanimously recommending votes for themselves.

As my mother might have said, this could be translated as: “I like me, who do you like?” Unlike other companies, especially in the oil and gas business, where insurgent shareholders nominated their own director slates (and sometimes succeeded in ousting board members), no such proposals made it onto Southwest’s annual meeting agenda last year.

The proxy explains in corporate boilerplate why each director should be reelected, generally because their experience and expertise allow them to “contribute significantly” to the board, etc., etc.

There’s no glimmer in these mini-bios of any familiarity with Southwest customers’ experience or the workforce’s problems, which might — if it existed — have animated a board discussion about when the company would stop talking about modernizing its system and start, you know, modernizing.

Certainly none of the directors has a background in consumer advocacy that might prompt him or her to questions management about how it serves anyone but shareholders.

Even if one judged solely from the company’s recent performance that as a group they have been in place too long, their lengths of service would tell the tale.

Lead outside director William H. Cunningham, has been a board member for 22 years. Seven have served for more than a decade. In other words, they’ve remained in place, gripping their seats with what George Orwell referred to as “prehensile bottoms,” throughout the company’s period of declining customer service and during its scheduling disaster.s

The directors’ average age — not including inside directors Jordan and Kelly (the current and former CEO, respectively) — is 72. Their average compensation in 2021 was more than $284,000, with Cunningham topping the list at $314,000.

No one would claim that this compensation recognized the huge burden on the directors’ time. During 2021, the board held seven meetings, some of which spanned two days. Each of the directors attended “at least 75%” of the meetings, the proxy says, or at least five of those meetings.

As I reported earlier, Southwest’s problems are emblematic of a corporate culture that has forgotten why a corporation exists. The venerated management expert Peter Drucker was always very clear about this: The purpose of a corporation, he held, is to create and hold customers by delivering value.

After that, and after serving employees so they’re in a position to deliver that value, the shareholders are entitled to partake of what is left. If the company has managed those first imperatives well, there should be plenty of value to upstream to the shareholders.

Like many American companies, Southwest turned those imperatives on their head. In May 2019, then-CEO Kelly issued a news release itemizing all the benefits that the company had provided for its shareholders.

It had just increased its quarterly dividend to 18 cents per share — “the 171st consecutive quarterly dividend” the company had declared. Southwest also instituted a new $2-billion share buyback plan to follow a previous $2-billion buyback.

Over the previous decade, Kelly said, Southwest had “returned more than $11 billion of value to Shareholders through share repurchases and dividends.” Among its financial priorities were to “grow earnings, margins, and capital returns; and maintain healthy Shareholder returns.”

What was missing from this statement was any reference to Southwest’s operational performance, say by reducing late flights and cancellations. What was unacknowledged was that increasing earnings, expanding profit margins and maintaining healthy returns to shareholders are always in tension with the costs of providing service. The more revenues Southwest devoted to upstreaming cash to shareholders, the less remained to keep its planes flying on schedule.

As it happens, Southwest was the first major airline to reinstate its dividend after the pandemic, announcing on Dec. 7 that it would resume its 18-cent-per-share quarterly payout this month. That will cost $107 million in the quarter, money that won’t be available for “modernizing.”

The burgeoning technology deficit at Southwest could not have been a secret to its directors — or would not have been a secret had any of them paid attention.

The Transport Workers Union that represents Southwest flight attendants warned at least as long ago as 2018 that its systems were leaving its workers exhausted and dispirited.

“Operational mishaps and technology shortcomings occur far too often,” the union said. When flights are delayed or canceled, the union observed, “flight attendants are often stranded alongside Southwest customers without information.”

The pandemic, the union warned, had made conditions immeasurably worse. Southwest suffered a sharp slowdown in business during the pandemic, but received $7.2 billion in grants and loans from the federal government.

Transportation Secretary Pete Buttigieg has warned Southwest that he will be watching closely to make sure the airline meets its legal obligations to affected passengers, but he could take a stronger stand by questioning whether the airline’s executives and board members are fit to continue in their roles (not that he has the legal authority to force them out).

The power to force change remains with the shareholders. They may have enjoyed receiving value via dividends and share buybacks, but the cost of recovery for Southwest is going to be high. The airline will have to spend billions of dollars to compensate passengers and billions more to perform the technological upgrades it has been putting off for years.

PR types say memories of Southwest’s meltdown will melt away in short order, but that may not be so certain. For many affected passengers, this was a cataclysmic failure that played out on the front pages of the nation’s newspapers and top-of-the-hour cable news. It will not soon be forgotten.

This year, like every year, shareholders will get the chance to bring board members to account for their inaction. They should take the opportunity to do so.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.