8 best mutual fund investing apps in India in 2023: Charges/ fees, top features and more | 91mobiles.com

Mutual funds are one of the easiest ways to invest money in the market, and there are several apps that facilitate this process. One can quickly get started by downloading a mutual fund app from the Play Store or App Store and start investing in the relevant funds, as per their knowledge. Each mutual fund app boasts unique features that make investing a worthwhile activity and can provide long-term results if done on a continuous basis. On that note, here are some of the best mutual fund apps in India such as Groww, Coin, Paytm Money, and many more which you can download on your phone right now:

Best apps to invest in mutual funds

Here are some of the best and most renowned apps you can use to invest in mutual funds:

Note: The list is solely based on the mutual fund apps’ ratings and downloads on Google Play Store and App Store. 91mobiles does not sponsor or promote any of these money-earning gaming apps.

Groww

Groww is one of the simplest and most straightforward mutual fund apps in India. Coming with an easy signup process, users can set up their profile by submitting a couple of necessary documents, such as PAN and Aadhaar card, and start investing in the best mutual funds as per their knowledge. Along with that, users can also start a Systematic Investment Plan (SIP) on a monthly basis through the app. Groww claims to be registered with SEBI, RBI, and AMFI making it a trustworthy platform for both new and experienced investors.

- Rating: 4.5/5

- System requirement: Android 5.0 and above, iOS 11.0 or later

- Downloads: 10,000,000+

- Download links: Play Store, App Store

Upstox

Next up on the list is Upstox. People interested in investing in mutual funds can create an account on Upstox free of charge. Along with mutual funds, the app also lets you invest in stocks, IPOs, F&Os, commodities, and other means of investment. Backed by prominent personalities such as Mr Ratan Tata, the platform has a simple-to-understand user interface with every option having its own dedicated section. Users can track their mutual fund investments from their dashboard and also glance through the current market trends with the help of live charts. Upstox also has a dedicated learning panel called UpLearn through which users learn more about trading and investment options.

- Rating: 4.2/5

- System requirement: Android 5.0 and above, iOS 13.0 or later

- Downloads: 5,000,000+

- Download links: Play Store, App Store

Paytm Money

Developed by the renowned payment and digital wallet giant, Paytm, Paym Money is a one-stop solution for anyone seeking to invest in mutual funds, stocks, and IPOs. With more than 45 AMCS to choose from, Paytm Money offers one percent higher returns in Direct Mutual Fund Schemes than other platforms available in the market. Paytm users can directly log in with their Paytm registered mobile number, however, the app might require you to go through a one-time KYC process in order to invest in mutual funds. Besides that, Paytm Money does not have any hidden charges for buying or selling mutual funds.

- Rating: 3.9/5

- System requirement: Android 5.0 and above, iOS 11.0 or later

- Downloads: 10,000,000+

- Download links: Play Store, App Store

Coin by Zerodha

Coin is an online mutual funds platform that lets you buy mutual funds directly from Asset Management Companies (AMC) without any hidden charges or commission pass backs. With an extremely minimal UI, Coin by Zerodha is perfect for beginners as the app contains only the relevant options required for investing in mutual funds, SIPs, and other financial schemes. For convenient buying, users can place purchase orders through UPI payments.

- Rating: 4.2/5

- System requirement: Android 5.0 and above, iOS 11.0 or later

- Downloads: 1,000,000+

- Download links: Play Store, App Store

ET Money

ET Money is a dedicated app for mutual funds and SIPs where users can invest in India’s top mutual fund schemes. The process to get started is fairly easy and secure. It just requires a couple of documents for KYC verification. The app also provides the option to carry forward all your Lump Sum or SIP mutual funds from other platforms like Groww, Paytm Money, myCAMS, and Zerodha Coin to the app in a simple and easy manner. With no transaction or hidden charges involved, ET Money users can purchase different types of mutual funds including equity mutual funds, ELSS mutual funds, small-cap, large-cap mutual funds, balanced funds, gold mutual funds, sector mutual funds, or international funds. Lastly, all the transactions and investments can be viewed through a well-designed investment portfolio within the dashboard.

- Rating: 4.6/5

- System requirement: Android 5.0 and above, iOS 12.0 or later

- Downloads: 5,000,000+

- Download links: Play Store, App Store

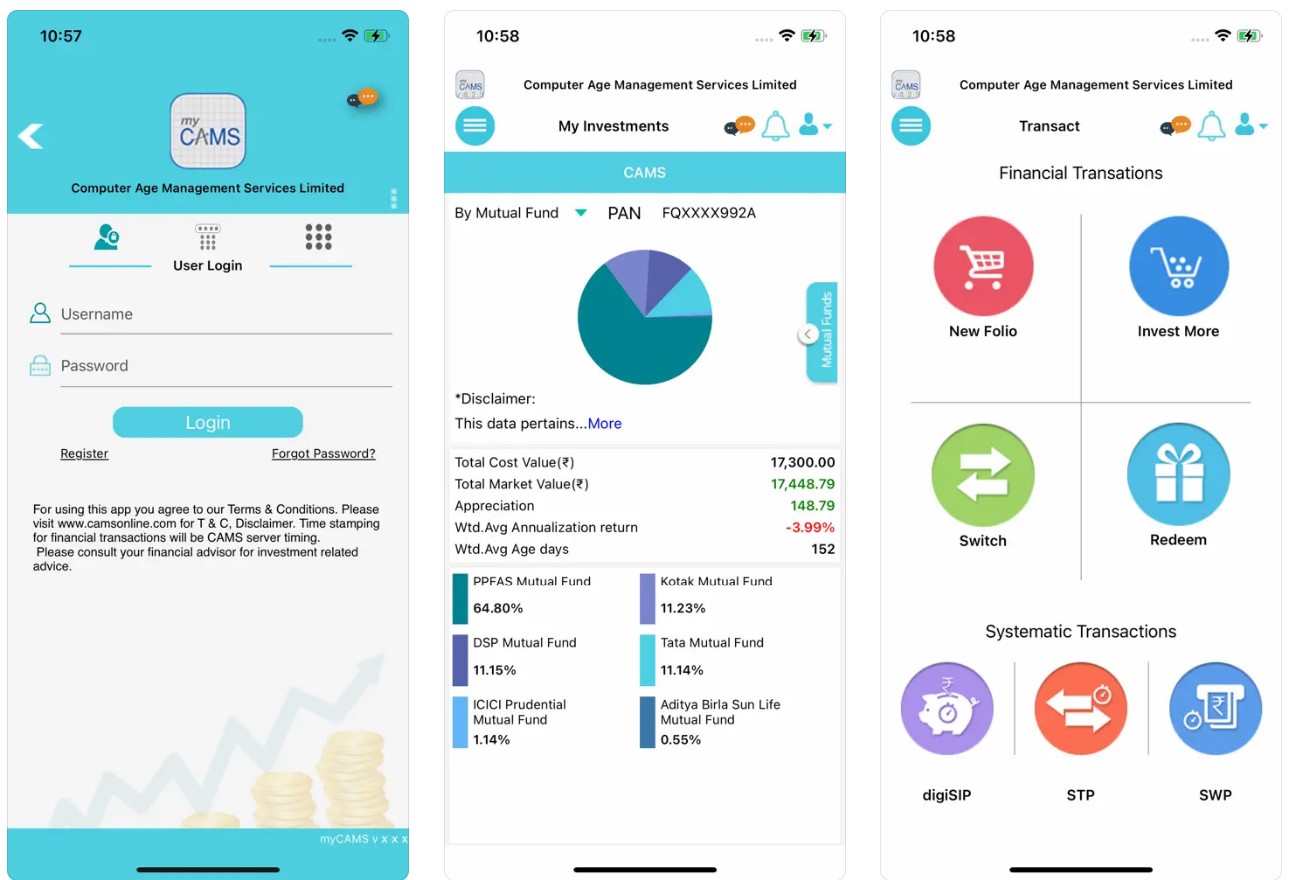

myCAMS

While some may find myCAMS’ layout a bit dated, this app is a reliable option for those wanting to invest in mutual funds and grow their portfolio. The app comes with a set of various security features that prevent others from messing around with your investments, even opening the app. These include PIN and pattern unlock, two-factor authorisation, and biometric lock. Just like other apps on the list, myCAMS allows you to open new folios and purchase SIPs in a quick and easy manner without many formalities involved.

- Rating: 4.0/5

- System requirement: Android 7.0 and above, iOS 9.0 or later

- Downloads: 5,000,000+

- Download links: Play Store, App Store

Angel One

Previously known as Angel Broking, Angel One is an all-in-one investment app that lets you purchase stocks, IPOs, and mutual funds. The platform lets you invest in a wide range of mutual funds like debt funds, liquid funds, small cap, large cap, mid cap mutual funds, hybrid funds, and more. With a beautifully laid out portfolio, users can quickly glance through their mutual fund investments from their profile and see how well the progress has been.

Apart from that, those who are willing to start their investment and trading journey can head over to the Smart Money section to learn more about the stock market and trading options including mutual funds that can help them in increasing their wealth. Angel One has also partnered with Sensibull for providing expert advice and trading strategies to its users.

- Rating: 3.9/5

- System requirement: Android 5.0 and above, iOS 12.4 or later

- Downloads: 10,000,000+

- Download links: Play Store, App Store

Kuvera

The last app on the list is Kuvera, which is a grouped investment platform that allows you to create a family account and invest on behalf of your parents, spouse, or children. The app accounts for more than 5000 mutual plans to choose from that can be purchased without paying any hidden charges or commissions. Investment types for which orders can be placed include Systematic Investment Plan (SIP), Systematic Transfer Plan (STP), and Systematic Withdrawal Plan (SWP). For ensuring the maximum security of users’ accounts, Kuvera has deployed 128-bit bank-grade encryption.

- Rating: 4.3/5

- System requirement: Android 5.1 and above, iOS 12.0 or later

- Downloads: 1,000,000+

- Download links: Play Store, App Store

FAQs

1. Are mutual fund apps legal?

Yes, mutual funds apps are completely legal in India as these provide interested users with access to the markets for building their investment portfolios and gaining tax-saving benefits. However, before installing these apps, always do your part of verifying the app’s legitimacy by going through some reviews, watching videos, and reading articles or guides online. Apart from that, always install financial or investment-related apps through official sources such as the Google Play Store on Android and the App Store on iOS devices.

2. How do I know if a mutual fund app is safe to use?

To know if a mutual fund app is safe to use, check whether the app is recognised or is registered with official bodies such as SEBI, RBI, and AMFI.

3. What are the benefits of using an app to invest in mutual funds?

A mutual fund app comes with several benefits that make investing a less tedious task. Some of the benefits include:

- Ease of transactions: Mutual fund apps present you with an end number of options and schemes to invest in. With just a few taps on your mobile screen, you can build an investment portfolio that can provide great long-term results.

- Efficient: Mutual fund apps can be accessed from anywhere and anytime provided you have a stable internet connection. This allows you to book an investment order according to your availability. Furthermore, since no paperwork is required, the signup process is completely seamless that happens digitally.

- Portfolio at your fingerprints: Once you start investing in mutual funds or any other options and schemes, these apps create a portfolio through which you can track all your investments in a quick and easy manner. This type of record-keeping is what makes mutual fund apps beneficial for users.

4. What factors should I consider when choosing a mutual fund app?

Here are various factors you can consider before choosing and signing up on a mutual funds app:

- Decent user interface: Whether you are a beginner or a seasoned investor/trader, the mutual fund app you plan to install should have a friendly user interface with segregated sections for every option.

- Transaction charges or commissions: Check whether the app takes transaction charges or commissions from the user for placing mutual fund orders.

- Mutual fund options: Ensure whether the app boasts a high number of mutual funds to choose from, especially the ones you are willing to invest in.

- Allows shifting of mutual funds: This is a significant factor to look into when going from one mutual fund app to another.

5. Which is the best app to track mutual funds in India?

There are several apps you can use to track mutual funds across ELSS, largecap, flexicap, and other funds without signing up or logging in. These include:

- Moneycontrol

- ICICIdirect

- Paytm Money

- ET Money

- Coin by Zerodha

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.