Xero Review (2023): Pricing, Features, Pros and Cons

Xero’s fast factsPricing: Starts at $13 per month. Key features:

|

Xero is a cloud-based, double-entry accounting software tool that is designed with small businesses in mind. More than 3.5 million users all over the globe use Xero to manage their billing and invoicing each month. In this Xero accounting software review, we’ll break down the pros and cons to help you figure out whether Xero is the right accounting tool for your needs.

Jump to:

1

Rippling

Rippling is the first way for businesses to manage all of their HR, IT, and Finance — payroll, benefits, computers, apps, corporate cards, expenses, and more — in one unified workforce platform. By connecting every business system to one source of truth for employee data, businesses can automate all of the manual work they normally need to do to make employee changes.

Learn more

2

Paycor

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

Learn more

3

OnPay

Payroll and HR that move you in the right direction. We give you everything you need to navigate payroll, HR, and benefits — so you can keep running your business smoothly.

Get your first month free, or join a demo to see everything we can do!

Learn more

Xero pricing

Xero offers three transparent pricing places: the Early plan, the Growing plan and the Establish plan. Xero offers a 30-day free trial period so that you can try out all the software’s features before committing to a paid plan.

SEE: Learn about the best enterprise accounting software for 2023.

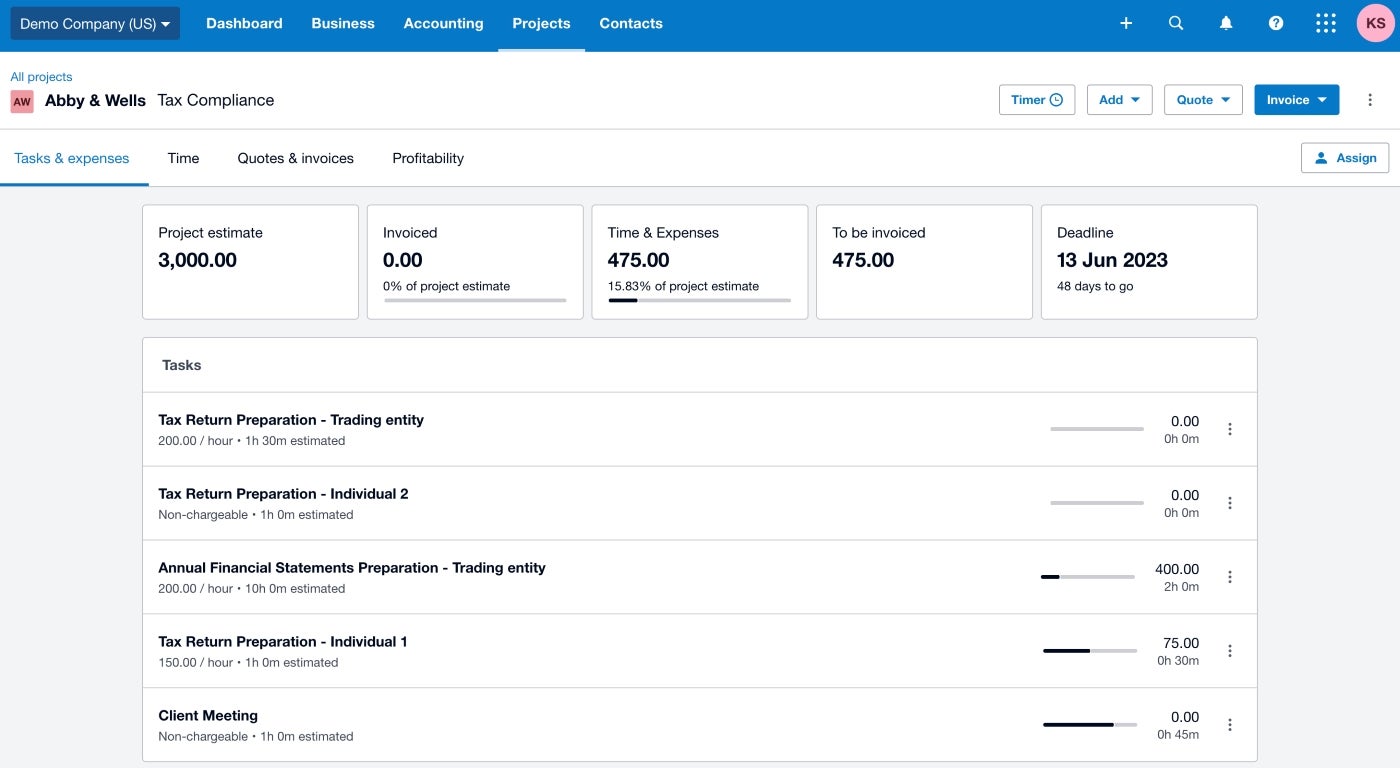

The Early plan costs $13 per month and lets users send up to 20 invoices and schedule up to five bills per month (Figure A). Other features include reconciling bank transactions and capturing bills and receipts with Hubdoc.

Figure A

Image: Xero. Xero Accounting invoice

The Growing plan costs $37 per month and includes unlimited numbers of invoices and bills. In addition to the features on the Early plan, the Growing plan also includes bulk transaction reconciliation to speed things up.

The Established plan costs $70 per month and includes unlimited numbers of invoices and bills. In addition to all the features of the other two plans, the Established plan also includes the use of multiple currencies, tracking time and projects, claiming expenses and viewing in-depth analytics.

Xero also offers the option to add full-service payroll support from Gusto to any plan. This Gusto-Zero integration starts at $40 per month plus $6 per employee. If you are looking for payroll software in addition to accounting software, be sure to check out our guide to the best payroll software for 2023.

Xero key features

Documentation management

Xero offers a built-in integration with Hubdoc, a tool that extracts the data from bank statements and financial documents and uploads it into the system based on rules that you specify. Xero also has a mobile app, Xero Expenses, that allows you to snap pictures of receipts and create an expense instead of having to manually enter all the information.

Project and time tracking

The Established plan gives users access to Xero’s native project and time-tracking tool, so they can track how much time they spend on tasks and invoice it to a specific project. This feature is helpful for businesses that charge an hourly rate or that want to track how much time they’re spending on jobs to ensure that they stay profitable.

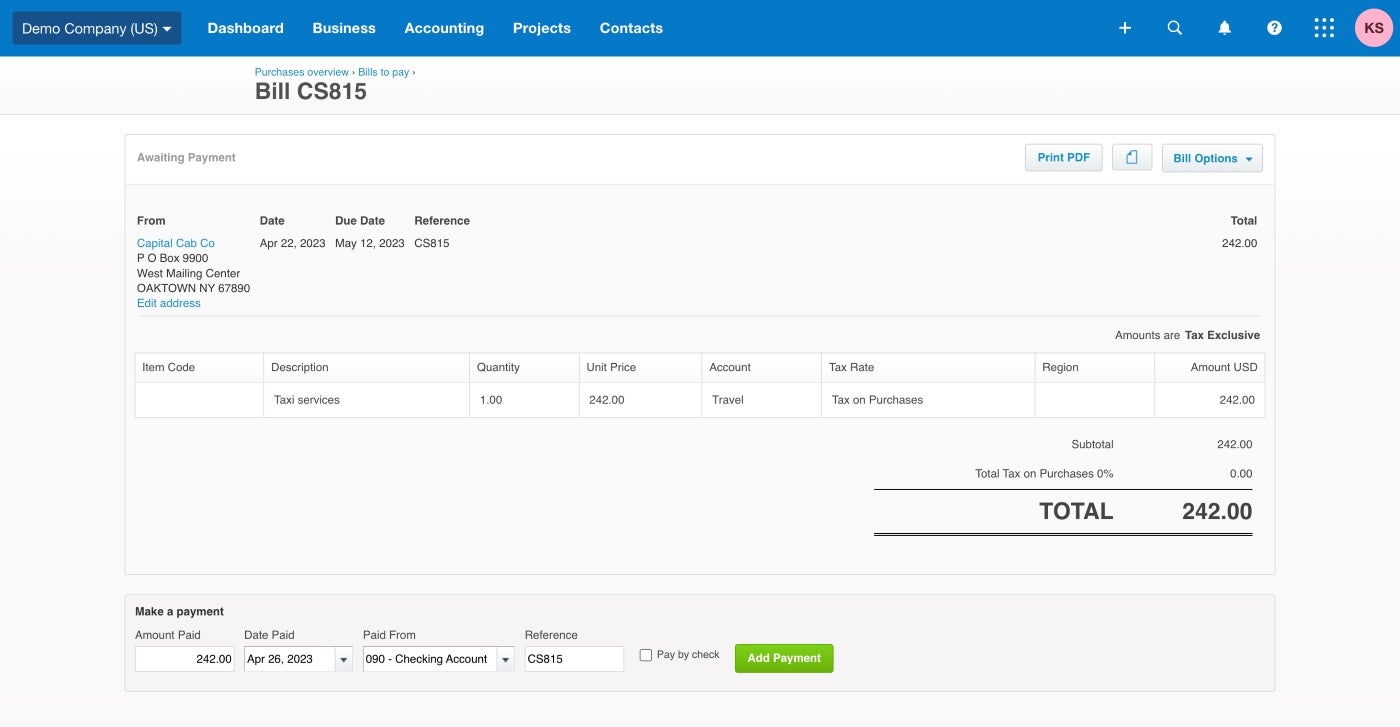

Financial reporting

In addition to billing and invoicing capabilities, Xero goes one step further by providing financial and accounting reporting features (Figure B). Options include a 1099 report, a balance sheet report, aged receivables report, aged payables report, inventory report and more. These reports help small business owners identify areas for improvement and make evidence-based decisions in real time.

Figure B

Xero pros

Unlimited users

One of Xero’s main distinguishing features is the fact that it offers unlimited users even on the lowest tier plan. If you’re part of a small business where multiple people need to access the accounting software, Xero will let your team have multiple users without forcing you to upgrade to a more expensive plan to get more seats.

Lots of integrations

The Xero app store offers more than 1,000 prebuilt connections that integrate with third-party apps. This is more integrations than all its main competitors, including QuickBooks and FreshBooks. If you are looking for accounting software that will seamlessly connect with the rest of your software stack, then the odds are high that Xero will integrate with whatever tools you are already using.

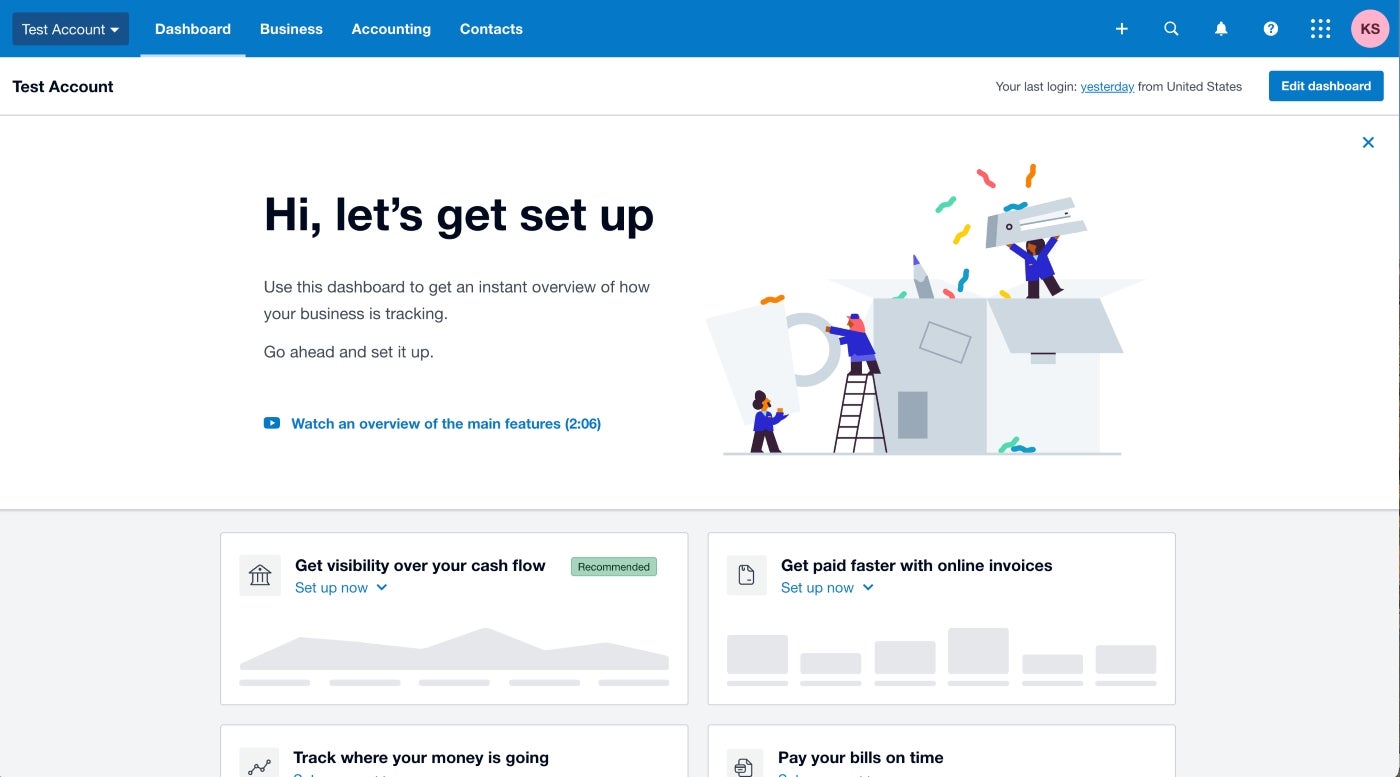

Guided set-up process

Xero offers a highly guided setup process that walks you through every aspect of the software with pop-up windows and tutorials (Figure C). It also provides a demo company account that allows you to practice on dummy data. Customers who are brand new to accounting software will especially benefit from this level of help.

Figure C

Xero cons

Entry-level plan limits

While Xero offers unlimited users, it compensates for that by significantly limiting the number of invoices and bills allowed on the Early plan (20 invoices and five bills). Most businesses will soon find themselves needing to upgrade to a more costly plan. Most of Xero’s more advanced features — including multiple currencies and time tracking — are also limited to the most expensive plan, meaning that businesses must be willing to shell out $70 a month to get access to them.

One organization per account

Xero only allows one organization per subscription, so if you need to do accounting for more than one business, you’ll need to purchase an account for each one. If you own multiple small businesses, or you’re a bookkeeper working with multiple clients, a competitor like QuickBooks that allows multiple companies per subscription might be more cost-effective for you.

Telephone support is limited

While Xero advertises its 24/7 online support, it doesn’t provide a phone number where you can call the company directly (Figure D). The Zero website states: “We don’t have a support phone number, but we do call customers if we need to. If you come across a phone number on the internet that claims to be Xero support or charges for support, it’s fraudulent.”

Figure D

Xero alternatives

QuickBooks Online

Intuit QuickBooks Online starts at $15 a month and sets the standard in accounting and invoicing software. Features include branded invoice templates, budgeting capabilities, automatic matching between payments and invoices and a user-friendly mobile app.

Unlike Xero, QuickBooks allows unlimited invoices but the Simple Start plan is limited to one billable user and two accountant firm users. This means that QuickBooks is a good choice for businesses who only need one person to use the software but need to send a high volume of invoices and bills per month.

Check out our full review of QuickBooks Online.

FreshBooks

FreshBooks starts at $8.50 per month and incorporates standout features like team roles and time tracking on all plans. The basic plan allows users to send unlimited invoices and estimates and track unlimited expenses up to five clients.

The number of users is also technically unlimited, but FreshBooks does charge an extra fee per user. This means that FreshBooks is a good choice for small businesses that need to send more invoices than the Xero basic plan allows and need more users than the QuickBooks basic plan allows.

To see how it stacks up, check out our QuickBooks vs. FreshBooks comparison.

Zoho Books

Zoho Books offers a forever free plan of its accounting and invoicing software, which sets it apart from competitors, in addition to five paid plans that start at $15 per month. Helpful features include quote sharing with clients, multiple payment options and auto-charging for recurring transactions.

If you’re a solopreneur or freelancer looking for a simple invoicing and accounting tool, Zoho Books’ free plan may suffice for your needs if you can’t justify paying a monthly fee for accounting software.

SEE: For more recommendations, here are the best invoicing apps for small businesses and self-employed individuals.

Review methodology

To review this software, we signed up for a free trial of the Xero Established plan. We also reviewed official product documentation, watched demo videos and consulted user reviews on third-party websites.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.