Andrew Bailey changed his tone on inflation this week, making it clear that the Bank of England would act to curb pressure from UK prices that are expected to stay higher for longer than in other countries.

The BoE governor’s admission that there will be “a bit more persistence” in the rising price of goods in Britain is a view shared by many economists. They point to the mechanics of the UK’s energy price cap and the country’s tight labour market as drivers of the gap.

The UK is heavily exposed to “soaring energy prices” like Europe, while at the same time having a similar experience to the US of excess demand pushing prices up, said Adam Posen, president of the Peterson Institute for International Economics.

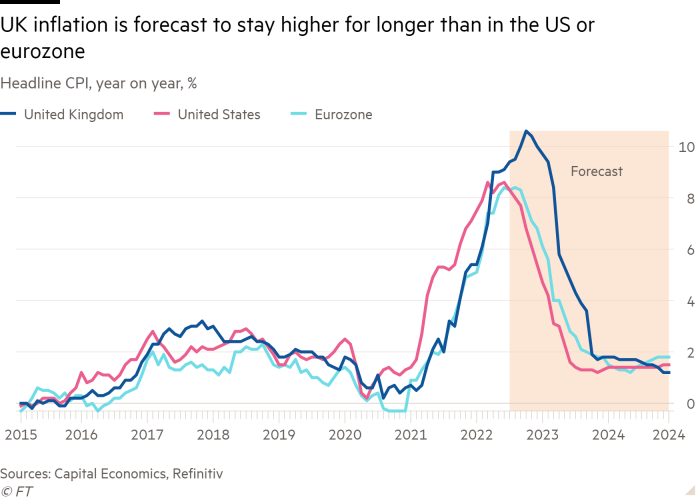

Paul Dales, chief UK economist at research group Capital Economics, expects UK inflation to peak beyond the 10 per cent mark this autumn. By contrast, inflation in both the US and the eurozone should have already begun to fall by then from a lower peak.

“What you can see in our forecast is that, relative to the US and Europe, inflation in the UK didn’t rise quite as far quite as fast [up to this point],” said Dales, but now would “be stuck at a higher level for longer”.

Like the eurozone, the UK is heavily reliant on gas imports, which has left it exposed to volatile energy prices. These have been driven first by a resurgence in demand in the wake of the coronavirus pandemic and then by the Ukraine war.

However, labour market dynamics are another factor. UK employment patterns are more reminiscent of the US than eurozone nations. Tight jobs data and greater wage pressures could play more of a role in sustaining price growth than on the continent.

“In both the US and UK you’ve got core inflation year on year close to 6 per cent, with some similar underlying drivers if you think about the tightness of the labour market, and extremely high job vacancies,” said Chris Hare, senior economist at HSBC.

He added that in the eurozone, by contrast, vacancy levels were not as high, which had led to less severe “supply and demand” imbalances.

According to Dales, one driver of tightening in the UK labour market has been leaving the EU.

“[Brexit] is a factor that the UK has experienced that the US has not, and that the eurozone is on the other side of. And that, probably, has contributed to some restraints on the supply of workers,” said Dales.

The pandemic also looms large over Britain’s employment sector. According to Sanjay Raja, chief UK economist at Deutsche Bank, 400,000 people have “dropped out of the workforce” compared to pre-pandemic levels.

While “both of these [the impact of the pandemic and Brexit] are really hard to forecast for, it doesn’t seem as though we’re going to get a sudden big fall in inactivity or a massive surge in workers coming into the labour market from the EU”, added Dales. This “is likely to keep at least some upward pressure on wages”.

The mechanics of the UK’s energy price cap have also led to the inflation gap widening between Britain and its peers, with some economists identifying this as the key point of difference.

“The most obvious reason why UK inflation is likely to take a little longer to come down than, say, the eurozone average is that the energy price cap has created a longer lag between higher gas prices and the pass-through to consumer prices,” said James Smith, developed markets economist at ING.

The cap limits the amount suppliers can charge customers who are on a default tariff. Its next reset is due to take effect in October, with the level determined by wholesale market prices observed over the previous months.

Once in place, the cap currently lasts for six months, which “can work both ways” for inflation, said Raja. Ofgem predicts it is due to rise by 42 per cent in October after April’s 54 per cent increase.

FT survey: How are you handling higher inflation?

We are exploring the impact of rising living costs on people around the world and want to hear from readers about what you are doing to combat costs. Tell us via a short survey.

“It can lock in lower [energy] prices or, in the situation that we’re currently in, lead to significant jumps in CPI that don’t have any run-off point. No matter what happens in the wholesale market, prices will stay the same for the next six months,” he added.

The regulator is holding consultations on shifting to a three-month price cap which, if introduced, would mean “the UK inflation rate won’t remain quite as high for as long” if “wholesale gas prices fall back as expected”, said Dales.

The persistent weakness of sterling is also likely to accentuate price rises in the UK, given the country is a net importer of goods that are suffering acute cost pressures — such as food and energy.

The pound has lost more than 10 per cent of its value against the US dollar over the past year, while remaining broadly stable against the euro.

The sheer economic heft of the eurozone and US makes this less of an issue for these countries.

“If you have a bigger boat, you’re going to be less buffeted by waves; you just have more mass to disperse the shock” said Posen.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.