While some countries race to renewables, others see natural gas wealth, but it may be short-lived

Russia’s war on Ukraine has cast a shadow over this year’s United Nations climate summit in Sharm el-Sheikh, Egypt, where officials from around the world are discussing the costs of climate change and how to cut emissions that remain near record highs.

The war has dramatically disrupted energy markets the world over, leaving many countries vulnerable to price spikes amid supply shortages.

Europe, worried about keeping the heat on through winter, is outbidding poor countries for natural gas, even paying premiums to reroute tanker ships after Russia cut off most of its usual natural gas supply. Some countries are restarting coal-fired power plants. Others are looking for ways to expand fossil fuel production, including new projects in Africa.

These actions are a long way from the countries’ pledges just a year ago to rein in fossil fuels, and they’re likely to further increase greenhouse gas emissions, at least temporarily.

But will the war and the economic turmoil prevent the world from meeting the Paris climate agreement’s long-term goals?

There are reasons to believe that this may not be the case.

The answer depends in part on how wealthy countries respond to a focus of this year’s climate conference: fulfilling their pledges in the Paris Agreement to provide support for low- and middle-income countries to build clean energy systems.

Europe speeds up clean energy plans

A key lesson many countries are taking away from the ongoing energy crisis is that, if anything, the transition to renewable energy must be pushed forward faster.

I work with countries as they update national climate pledges and have been involved in evaluating the compatibility of global emissions reduction scenarios with the Paris Agreement. I see the energy crisis affecting countries’ plans in different ways.

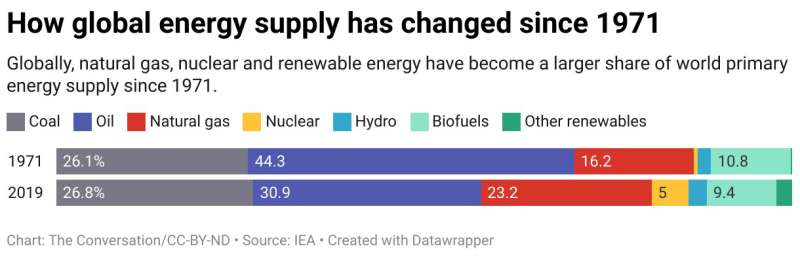

About 80% of the world’s energy is still from fossil sources. Global trade in coal, oil and natural gas has meant that even countries with their own energy supplies have felt some of the pain of exorbitant prices. In the U.S., for example, natural gas and electricity prices are higher than normal because they are increasingly tied to international markets, and the U.S. is the world’s largest exporter of liquefied natural gas.

The shortage has led to a scramble to find fossil fuel suppliers in the short term. European countries have offered to help African countries produce more natural gas and have courted authoritarian regimes. The Biden administration is urging companies to extract more oil and gas, has tried to pressure Saudi Arabia to produce more oil, and considered lifting sanctions against Venezuela.

However, Europe also has a growing renewable energy supply that has helped cushion some of the impact. A quarter of the European Union’s electricity comes from solar and wind, avoiding billions of euros in fossil fuel costs. Globally, investments in the clean energy transition increased by about 16% in 2022, the International Energy Agency estimates.

Developing countries face complex challenges

If Russia’s invasion of Ukraine is a wake-up call to accelerate the clean energy transition in wealthier countries, the situation is much more complex in developing countries.

Low-income countries are being hit hard by the impact of Russia’s war, not only by high energy costs, but also by decreases in grain and cooking oil exports. The more these countries are dependent on foreign oil and gas imports for their energy supply, the more they will be exposed to global market gyrations.

Renewable energy can reduce some of that exposure.

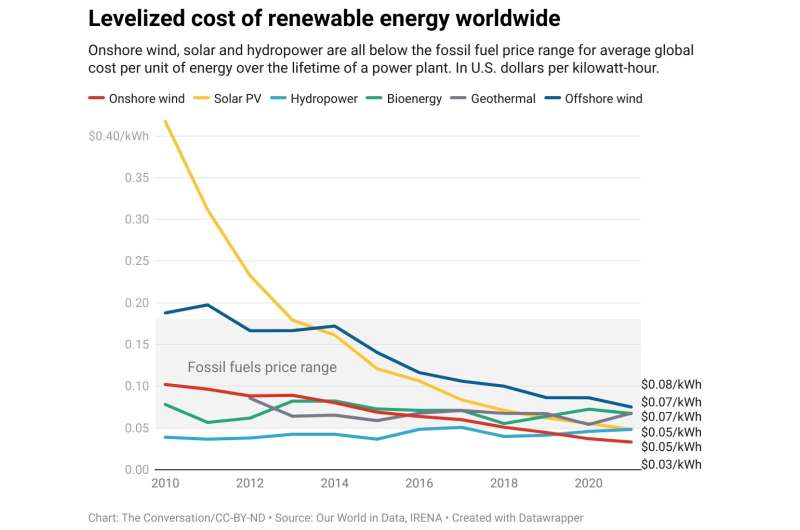

The costs of solar and wind energy have dropped dramatically in the last decade and now represent the cheapest sources of energy in most regions. But advances in expanding access to clean electricity have been set back by the war. Borrowing costs can also be a barrier for low-income countries, and those costs will increase as countries raise interest rates to fight inflation.

As part of the Paris Agreement, wealthy countries were supposed to make good on promises to make US$100 billion per year available for climate finance, but the actual amounts provided have fallen short.

To achieve the Paris Agreement targets, coal, oil and natural gas consumption must decrease dramatically in the next decade or two. International cooperation will be necessary to help poorer countries expand energy access and transition to low-emissions development pathways.

Africa’s fossil fuels and stranded asset risks

A number of developing countries have their own fossil fuel resources, and some in Africa have been calling for increasing production, although not without pushback.

Without a strong alternative within local contexts for sustainable energy resources, and with wealthy countries scrambling for fossil fuels, developing countries will exploit fossil resources—just as the wealthiest countries have done for over a century. For example, Tanzania’s energy minister, January Makamba, told Bloomberg during the U.N. climate conference that his country expects to sign agreements with Shell and other oil majors for a $40 billion liquefied natural gas export project.

While this intersection of interests could boost some developing countries, it can also set up future challenges.

Encouraging the construction of new fossil-fuel infrastructure in Africa—presumably to be earmarked for Europe in the short to medium term—may help ameliorate some near-term supply shortages, but how long will those customers need the fuel? And how much of that income will benefit the people of those countries?

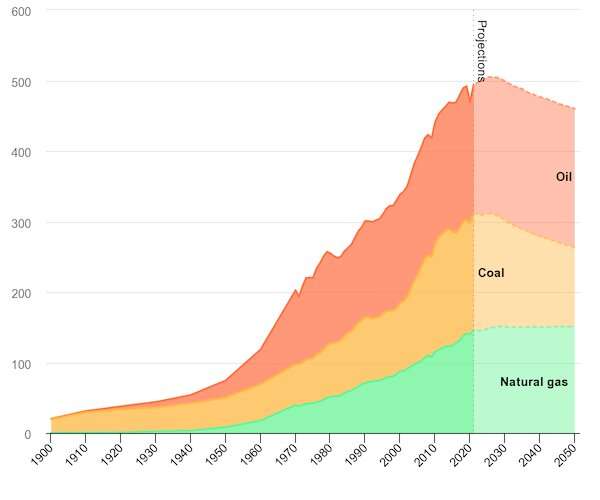

The IEA sees natural gas demand plateauing by 2030 and oil and coal demand falling, even without more ambitious climate policies. Any infrastructure built today for short-term supplies risks becoming a stranded asset, worthless in a low-emissions world.

Encouraging developing countries to take on debt risk to invest in fossil fuel extraction for which the world will have no use would potentially do these countries a great disservice, taking advantage of them for short-term gain.

The world has made progress on emissions in recent years, and the worst warming projections from a decade ago seem to be highly unlikely now. But every tenth of a degree has an impact, and the current “business-as-usual” path still leads the planet toward warming levels with climate change costs that are hard to contemplate, especially for the most vulnerable countries. The outcomes from the climate conference will give an indication of whether the global community is willing to accelerate the transition.

This article is republished from The Conversation under a Creative Commons license. Read the original article.![]()

Citation:

While some countries race to renewables, others see natural gas wealth, but it may be short-lived (2022, November 14)

retrieved 14 November 2022

from https://techxplore.com/news/2022-11-countries-renewables-natural-gas-wealth.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.