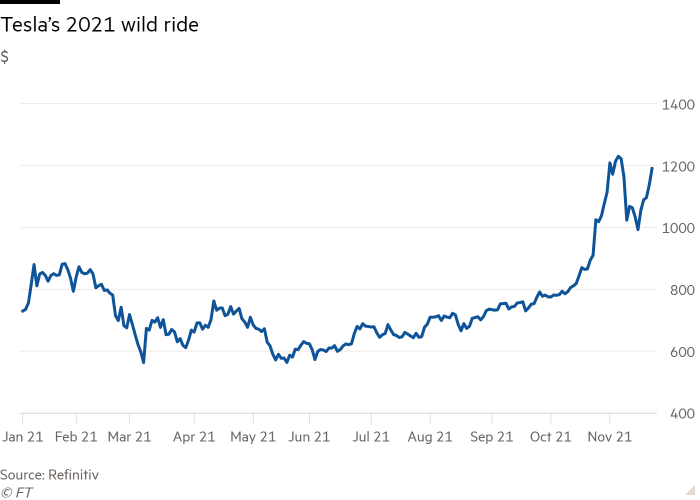

Wall Street stocks fall with Tesla slipping further from November peak

Wall Street stocks slipped on Monday as shares in several 2021 high-flyers including Tesla and Nvidia pulled back from their recent peaks.

The blue-chip S&P 500 share index inched lower, while the technology-focused Nasdaq Composite fell 0.2 per cent. Tesla had fallen more than 4 per cent by afternoon trading in New York, leaving it down a fifth from a high it hit less than two weeks ago. Elon Musk’s electric carmaker remains up roughly 40 per cent for the year.

Other big Nasdaq laggards on Monday included chipmakers Nvidia and AMD, both of which have also posted robust gains this year.

Francesco Sandrini, senior multi-asset strategist at fund manager Amundi, said although quarterly earnings season had been strong, stock markets were likely to enter “a period of inertia” in coming months.

“The level of economic growth, while slowing down, remains elevated,” he said. Meanwhile, Sandrini noted, analysts expected corporate earnings growth to fall from current levels next year while markets are betting on the US Federal Reserve raising interest rates from their record low by the summer. “So it is also hard see a short-term catalyst for markets to move much higher,” he added.

Government bond markets traded calmly on Monday, having whipsawed in recent weeks as concerns about prolonged inflation and interest rate rises reduced the appeal of fixed income-paying securities. The yield on the benchmark 10-year Treasury note, a yardstick for global borrowing costs, ticked up 0.05 percentage points to 1.61 per cent.

Investors were also anticipating a batch of economic data and political events this week. US president Joe Biden is due to speak to Chinese leader Xi Jinping on Monday following a period of tense relations between the economic powers.

UK inflation data on Wednesday are expected to show consumer price increases hit 3.9 per cent last month, their highest level in a decade.

The European Stoxx 600 index rose 0.3 per cent, building on a record high reached last Friday after six consecutive weeks of gains. London’s FTSE 100 traded flat. Meanwhile, China’s CSI 300 index dipped 0.1 per cent and Hong Kong’s Hang Seng rose 0.2 per cent.

The dollar index, which measures the US currency against six others, rose 0.3 per cent to its strongest level in 16 months. Sterling nudged higher against the dollar at $1.34.

Brent crude, the oil benchmark, began retracing earlier losses in the New York afternoon but remained 0.6 per cent lower for the day at $81.68 a barrel.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.