VPA: What is it, full form, how to create VPA in UPI, how to find it on Google Pay, PhonePe, and PayTM | 91mobiles.com

Digital payments have amassed high popularity lately thanks to the constant efforts by the government to push organisations and businesses to implement UPI at various customer buying points. One such aspect of UPI payments is VPA, which is a term not commonly used but plays a massive role in enabling UPI transactions. In this guide, we take a look at what exactly is VPA, how one can create a VPA, its use cases & benefits, and will also be answering some common questions around this particular term. So make sure to read till the end to grasp the full knowledge.

What is a VPA?

VPA, which stands for Virtual Payment Address, is a unique financial ID for your bank account that is used for sending and receiving money through the UPI platform. This particular ID is also commonly presented in the form of a QR code for swift and on-the-go payments to merchants and other UPI users. Furthermore, many banking and payments apps allow the facility to create multiple VPAs to be linked with a single bank account.

How to create VPA in Google Pay, PayTM, and PhonePe UPI apps

A VPA can be created by simply linking it with your debit and credit cards. Here’s how to create VPA popular payment and wallet-based apps such as Google Pay, PayTM, and PhonePe.

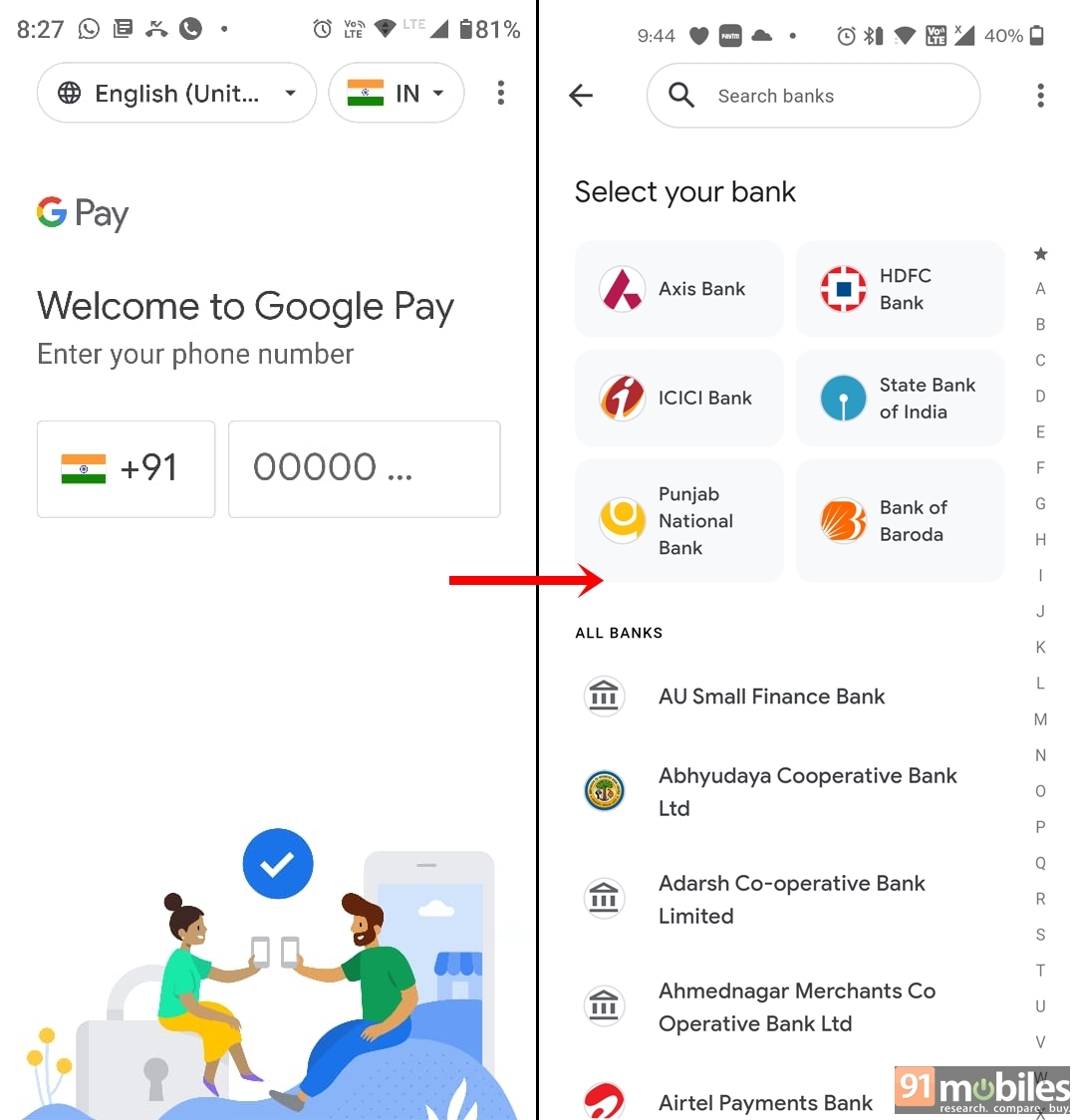

Google Pay

- Firstly, go to Play Store or App Store and download the Google Pay app, if you haven’t already. Alternatively, you can download it from here for Android and here for iOS

- Next, launch the app on your phone and enter your mobile number to be used and linked with a UPI ID

- Now choose your concerned bank which is linked with your mobile number

- You may receive an OTP via SMS or email for verification

- Once entered the OTP and verified, you can create your UPI ID (VPA), though Google Pay generally creates one by default on the basis of the user’s Gmail ID

- When the UPI ID is created, you’re all set for transacting via UPI

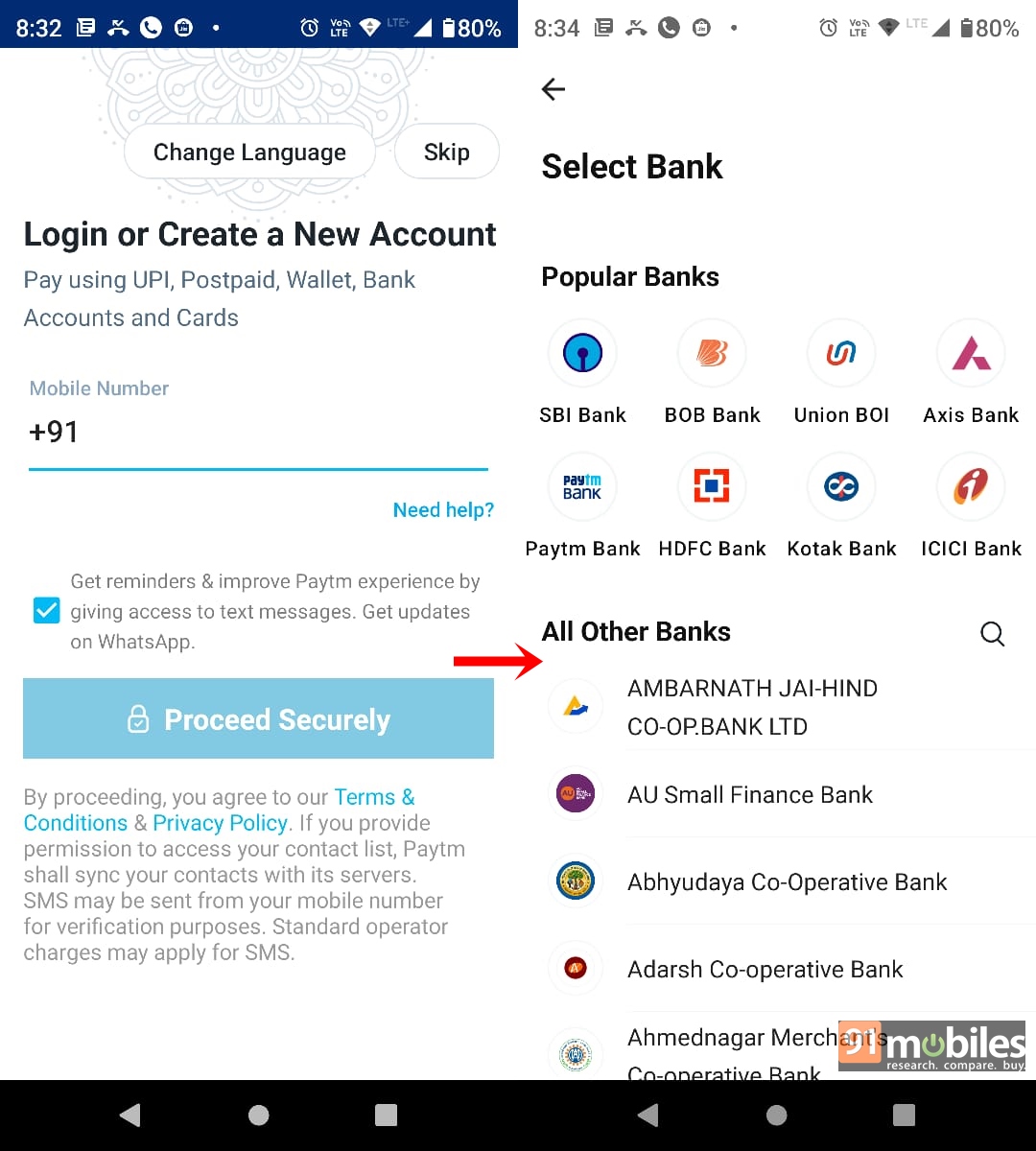

PayTM

Create VPAs in Paytm by following these steps:

- Firstly, launch the Paytm app on your Android phone or iPhone. If you haven’t installed it, download it from here for Android and for iOS here.

- Next, create and register as a new account by entering your phone number to be linked with Paytm UPI

- Once done, the next step is to choose your bank

- The app will automatically search for the bank account linked with your mobile number registered on the previous step

- You may receive an OTP via SMS or email for verification

- Enter the OTP and create your own UPI ID to start sending and receiving money

- Similarly, you can create more UPI IDs using the same procedure

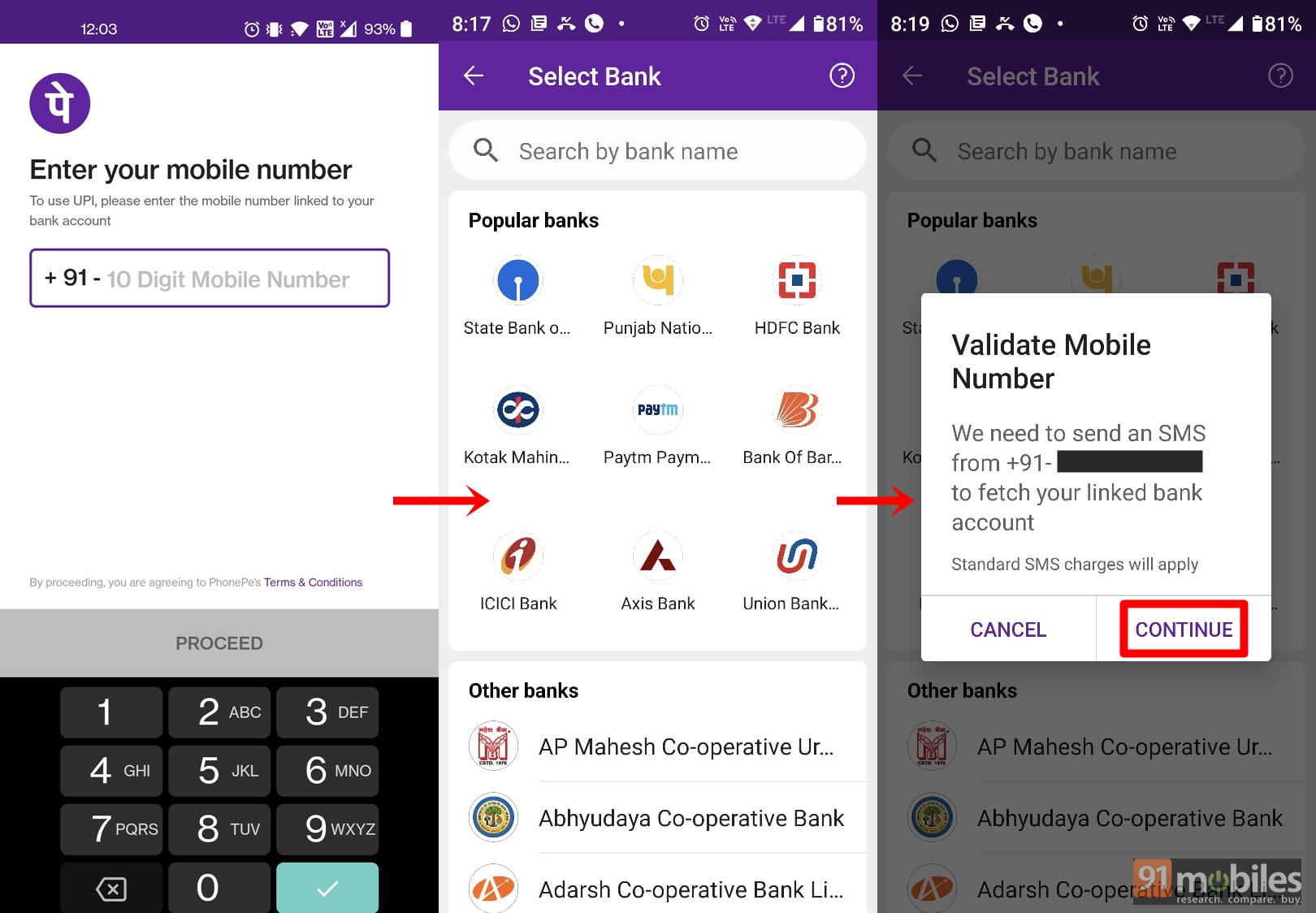

PhonePe

Creating a VPA on PhonePe is similar to Google Pay and PayTM. Here’s the step-by-step process:

- Head over to Play Store or App Store and download the PhonePe app

- Now open the app and enter your mobile number linked to your bank account

- You’ll receive an OTP. Wait for the app to automatically detect the OTP from SMS, if not enter the digits manually

- Once the OTP is verified, your PhonePe account should be created

- Next, choose your bank from the list that appears

- The app will prompt you to send an SMS in order to search for your bank account linked with your mobile number. Hit ‘continue’

- Once that’s done, enter a VPA of preferred choice and you’re good to go

How to find VPA in Google Pay, PayTM, and PhonePe

A VPA ID is generally denoted by UPI ID in the payment and wallet apps. So if you want to know your VPA, you’ll have to look for the UPI ID on these apps.

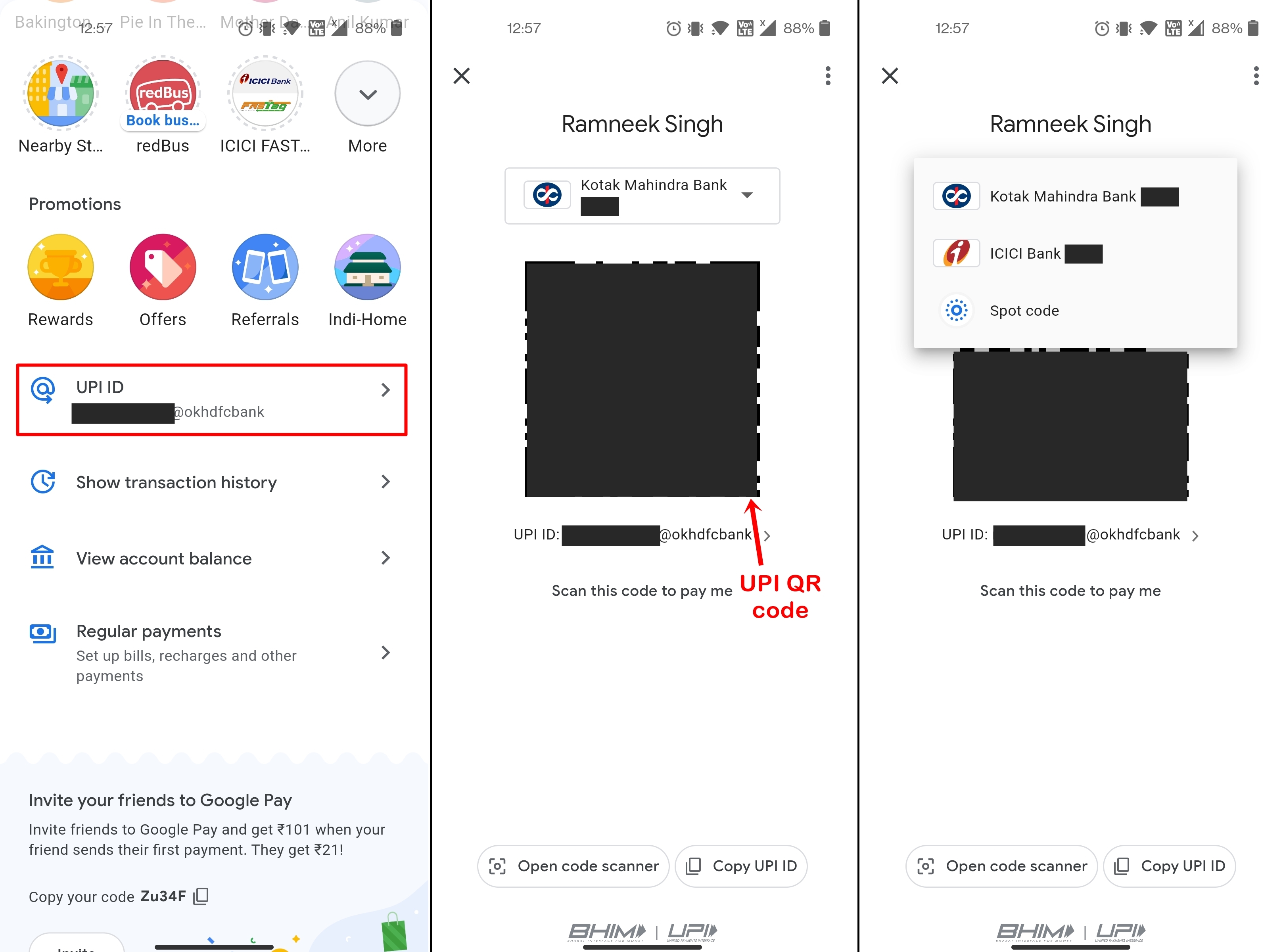

Google Pay

Here’s how to find your VPA (UPI ID) on the Google Pay app:

- Open the Google Pay app on your Android phone or iPhone

- Scroll down through the app and your VPA will be visible right there, below the rewards tab

- If you have created more than one UPI ID then select the arrow and you’ll be taken to the next page

- On this page, you can select the dropdown menu to reveal other UPI IDs as well as the QR code associated with the ID

- Alternatively, you can also check all the VPAs by tapping on the profile icon in the top right corner

PayTM

Here’s how to find your VPA (UPI ID) on PayTM:

- Head over and open the PayTM app on your Android phone or iPhone

- On the main home screen itself, the VPA (UPI ID) will be visible

- To view other UPI IDs you’ve created in the app, tap on the top right corner of the app, which will also reveal the QR code

- Use this QR code to receive payments right in your bank account

PhonePe

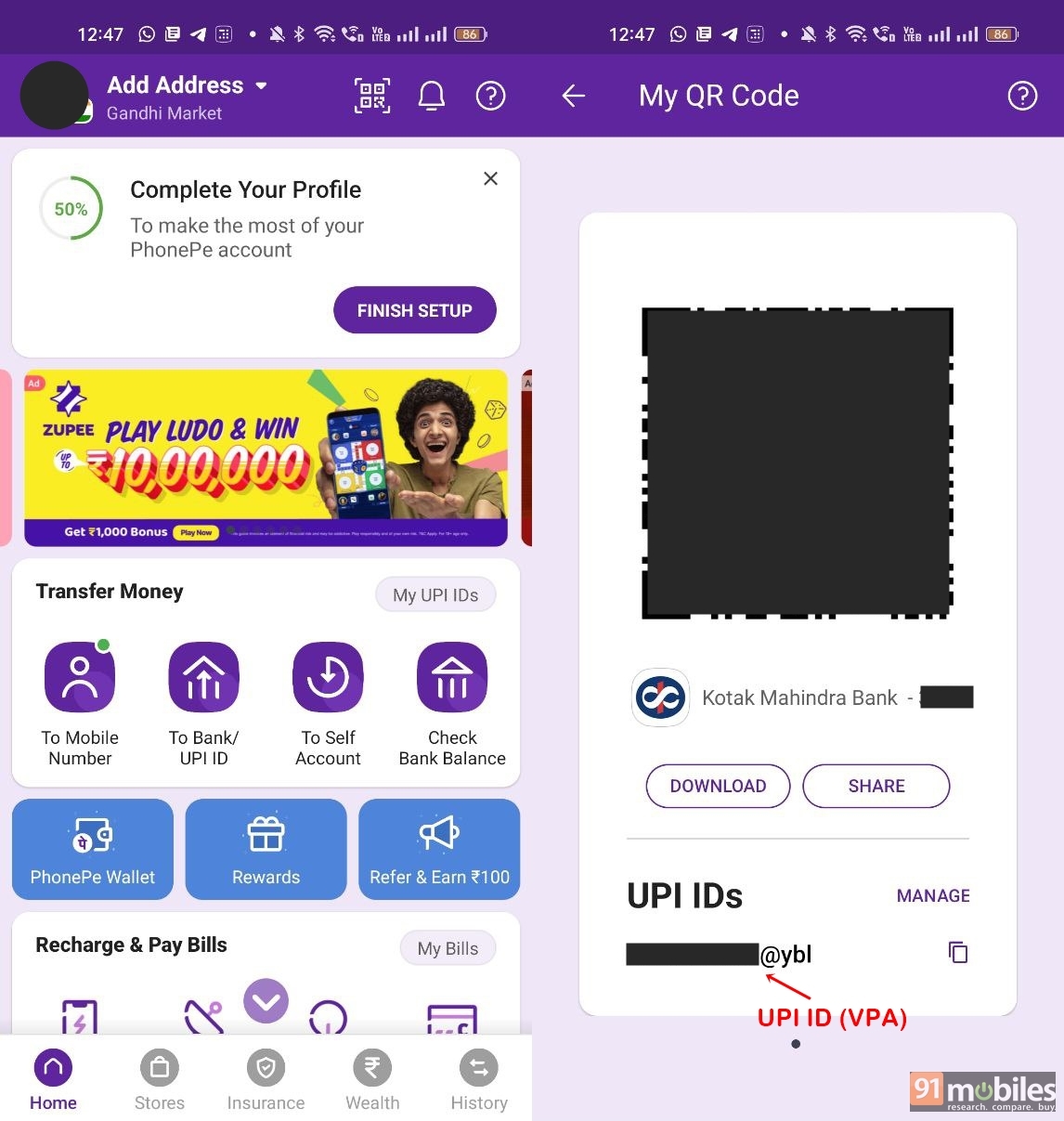

Here’s how to find your VPA on PhonePe

- Open the PhonePe app on your Android phone or iPhone

- Now within the main home page of the app, you’ll find a small text ‘My UPI IDs’. Select it

- From here, all your created UPI IDs (VPAs) will be visible along with the QR code associated with the ID

How to send and receive money using VPA

Once you’ve successfully created a VPA on payment apps, you can start sending and receiving money in your bank account. Here we’ll be taking an example of Google Pay for the same.

Send money using VPA

- Open the Google Pay app on your Android phone or iPhone

- Now, there are several ways to send money through VPA (UPI ID) – through scanning recipients’ UPI QR code, entering their UPI ID, or even by entering the recipient’s mobile number

- Accordingly, choose the preferred method and enter the amount you want to send

- Lastly, type in the UPI pin to confirm the payment and even add remarks if you wish to for that particular payment

Receive money using VPA

- Just like sending money, one can receive money via VPA in different ways

- Simply provide the other person with your UPI ID and QR code. If they’ve saved your contact number and it is linked with a VPA, the sender can easily send money by selecting your name within the contacts as well

- Once the sender has made the payment, expect the money to be received in your bank account within a couple of minutes, until and unless something goes wrong with the servers

What are some of the benefits and use cases of a VPA?

- Quick way of sending & receiving money – VPA (UPI) is one of the quickest and easiest modes of digital payment available today. You just require a smartphone with an active internet connection to scan a QR code and make payment to the concerned person or merchant. Alternatively, if you’re on a low network area, UPI payments can still be made by entering certain codes in the dialer.

- Instant settlements – Unlike other modes of payment such as IFSC and NEFT, you don’t need to enter the banking details of the other person to add them as a beneficiary. Just a VPA or a QR code linked with UPI ID is more than enough to send and receive money. Although, UPI payments are generally restricted to certain transfer amounts.

- Popular digital payments medium – From small shops to large businesses, most have implemented VPAs for accepting payments which means there’s a sense of satisfaction of making payments through your smartphone itself. Similarly, it takes away the burden of carrying cash, at least for routine payments such as shopping.

- Maintains privacy & security – When paying to a VPA, your phone number is not transferred over to the receiver and vice-versa, unlike digital wallet payments. On the other hand, the UPI platforms have several security protocols within the system that maintain and secure the personal information of the user.

Some popular VPA suffixes

VPA suffixes denote the particular payments app it is originated from. Here are some of the popular VPA suffixes you may find while sending or receiving money.

- SBI Pay: @SBI

- PNB UPI: @PNB

- Axis bank: @axis

- ICICI Bank UPI: @icici

- Bank of Baroda: @barodapay

- HDFC Bank UPI: @HDFC

- Yes Bank: @YBL

- BHIM: @upi

- Paytm UPI: @paytm

- Google Pay: Suffixes depends upon your bank

FAQs

Are VPA and UPI ID the same?

Yes, VPA and UPI ID are the same terms. Consider them as email IDs that are unique to only one person, but for making payments through the UPI network. Simply put, a UPI ID is a conventional way of referring to the actual VPA (Virtual Payment Address).

Can you change your VPA?

VPA on many payment and banking apps can be changed but the suffix will always remain the same according to the app. However, you can choose from several default suffixes the apps offer. For instance, on Google Pay when you go to ‘manage UPI IDs’ settings, you can create new IDs by choosing one of the suffixes and even get rid of the previously created UPI ID. But the functionality to create or use your own suffix in a VPA (UPI ID) is not possible, at least for now.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.