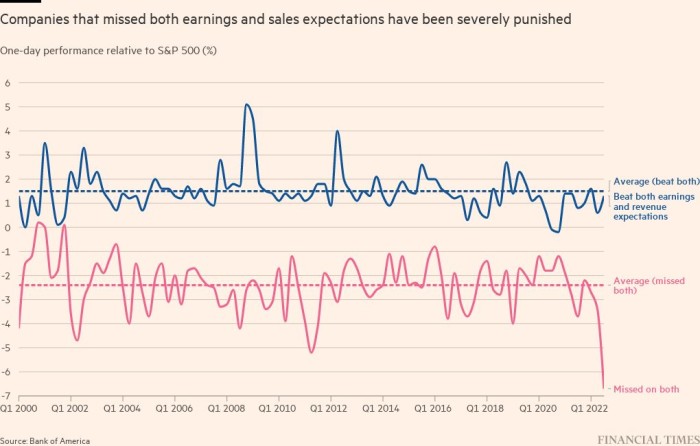

US companies that missed already low Wall Street earnings expectations in the third-quarter reporting season have been punished more severely than any time since at least the turn of the millennium.

Groups that revealed sales and profits that were weaker than analysts had anticipated underperformed the blue-chip S&P 500 by 6.7 per cent in the day following the release of their figures, according to Bank of America. It said the decline was the largest on record and much sharper than the average fall in previous years of 2.4 per cent.

The big responses to disappointing results are a sign of how gloomy sentiment has become for companies listed on the S&P 500 index, which are on course to post the most tepid profit growth since the depths of the coronavirus crisis in 2020.

“Companies that miss always underperform, but the misses gave a signal that the floor wasn’t lowered far enough,” said Parag Thatte, US equities strategist at Deutsche Bank.

Ohsung Kwon, US equity strategist at BofA, echoed that sentiment, noting that earnings per share estimates had been slashed 7 per cent in the run-up to earnings season, compared with the norm of about 4 per cent.

Big technology companies have had a particularly bruising earnings season after several of the most high profile players issued downbeat outlooks as they contended with rising concerns over a potential economic slowdown, rapid inflation and soaring borrowing costs. Apple, Microsoft, Google parent Alphabet, Amazon and Facebook owner Meta have shed $770bn in market value collectively since earnings season began three weeks ago.

“Over the past couple of years, investors started to look at tech as the new defensive sector as they were relatively immune and even benefited from the Covid downturn” said Kwon. “This earnings season has shown that growth stocks are not immune from the downturn.”

In contrast, banking giants Goldman Sachs and BofA posted better than expected profits, and Netflix’s share price jumped 13 per cent after publishing positive results. But rewards for companies that beat expectations have been more muted than the punishments for companies that missed, outperforming the S&P 500 by 1.3 per cent, compared with the historical average of 1.5 per cent.

Overall, companies listed on the S&P 500 index have revealed year-on-year earnings per share growth of 2.1 per cent, according to FactSet data based on groups that have already reported and estimates for those that have not. That would mark the slowest pace of profit growth in two years, when companies were still reeling from the effects of pandemic-induced lockdowns.

FactSet senior earnings analyst John Butters said earnings have been “weaker than we typically see — 71 per cent of companies are beating estimates, and on face value that looks good, but it’s below the five and 10-year averages of 77 per cent and 73 per cent.”

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.