US-China Tech Rivalry Adds to Headaches for Stock Investors

China’s heated rivalry with the US over tech supremacy is adding fresh pain points to the world’s second-largest stock market, as the Biden administration steps up efforts to reduce economic reliance on the Asian nation.

Article content

(Bloomberg) — China’s heated rivalry with the US over tech supremacy is adding fresh pain points to the world’s second-largest stock market, as the Biden administration steps up efforts to reduce economic reliance on the Asian nation.

Advertisement 2

Article content

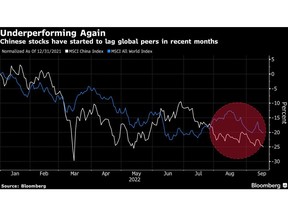

From biotech to electric vehicles, shares of China’s key manufacturers have seen heavy selling recently as US initiatives to secure domestic supply chains and solidify its industrial superiority raised uncertainties for Chinese firms. The MSCI China Index has fallen more than 7% this month, versus a 2.5% drop in the global gauge.

Article content

Investors also worry that rising tension over Beijing’s stance toward Russia and Taiwan may accelerate the economic decoupling. President Xi Jinping’s meeting with his Russian counterpart last week has been closely watched by traders for any gesture that may provide basis for US sanctions.

“China’s relationship with the US will remain challenging in 2022 and beyond with geopolitical risks remaining high as both economies increasing see each other as competitors,” said Zhikai Chen, head of Asian and global emerging market equities at BNP Paribas Asset Management. “We are focused on the defensive and policy beneficiary names and avoid those subject to higher geopolitical risk.”

Advertisement 3

Article content

The latest developments are further dampening sentiment in a market reeling from stringent Covid restrictions, a weakening economy and a property market slump. Chinese stock gauges are among the worst-performing major benchmarks this year.

Additional flash points may emerge as President Joe Biden and Xi face key political tests in coming months — the US midterm elections and the Communist Party Congress. Nicholas Yeo, head of China equities at abrdn plc, said market volatility may increase with the risk of “noise around China” in the US campaign.

Just last week, biotech bellwether Wuxi Biologics Cayman Inc. slumped nearly 20% in a day following Biden’s executive order to bolster domestic bio-manufacturing. EV makers also fell as China’s ambassador to the US warned against the risk of trying to cut the country off the vehicle supply chains.

Advertisement 4

Article content

Investors will have to brace for further swings. Biden looks set to sign an executive order in the following days that intensifies national security reviews on foreign investments, with new criteria applied to sectors including semiconductors, artificial intelligence, biotech and clean energy technologies.

Tech Battlefield

On the flip side, some see investment opportunities as China’s self-sufficiency drive gathers pace.

“Any homegrown semiconductor company will be supported by Chinese government,” said Alicia Garcia Herrero, chief economist for Asia-Pacific at Natixis Corporate & Investment Banking, adding that questions remain on how successful these companies can be with the pressure from the US.

Advertisement 5

Article content

China’s largest chipmaker Semiconductor Manufacturing International Corp.’s second-quarter profit beat estimates and its Hong Kong-listed shares rose 3.2% in September, versus a 6% drop in the Hang Seng Index.

Earlier this month, Xi has renewed calls to step up tech development. That came after he prioritized the role of state institutions in recent years over private giants such as Alibaba Group Holding Ltd. or Tencent Holdings Ltd. in spurring technological advancement.

But the unpredictable nature of geopolitical tensions means China stocks are a market to be shunned for some investors.

“I see decoupling as on the rise, and my China equity allocation remains zero,” said Brock Silvers, chief investment officer at private equity firm Kaiyuan Capital. The weakness in China’s economy “has significantly reduced its appeal relative to its associated risks,” he added.

Advertisement

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.