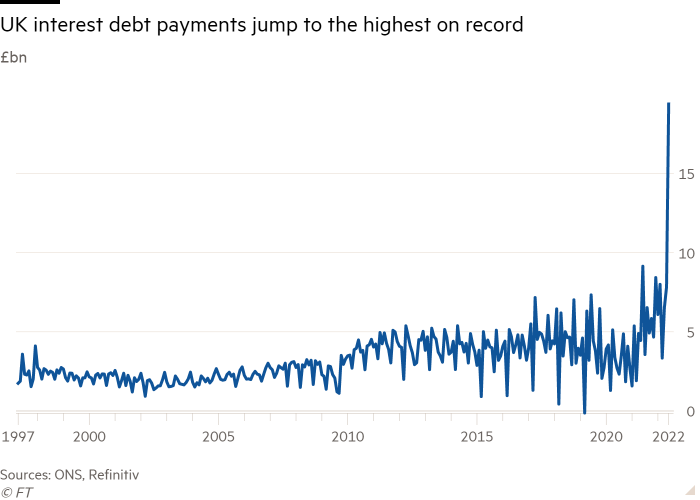

UK interest payments on government debt jumped to the highest level on record last month in a sign of the limited fiscal space available for tax cuts.

Debt interest payments rose to £19.4bn last month, £10.3bn more than in June last year and the highest since records began in 1997, the Office for National Statistics said on Thursday.

A quarter of the UK’s government debt is index-linked, so the cost of servicing it is pushed up by inflation, which is running at a 40-year high.

The interest payments were about double the previous record in June 2021, reflecting soaring prices over the past year as well as temporary factors including the ways debt payments are accounted for.

The data came the day after Tory MPs voted former chancellor Rishi Sunak and foreign secretary Liz Truss on to their shortlist of two candidates to become Britain’s next prime minister.

June’s figures “may well be a warning shot to the incoming prime minister, whoever they may be, that the space for fiscal giveaways may be constrained by servicing existing debt”, said Sandra Horsfield, economist at Investec.

Samuel Tombs, economist at Pantheon Macroeconomics, said Sunak would use the debt data to argue that tax cuts must wait until after inflation has fallen back. But Truss has proposed tax cuts, meaning “the outlook for public borrowing will rise further if [she] wins”, Tombs said.

The Office for Budget Responsibility, the UK fiscal watchdog, had forecast interest payments would rise to £19.7bn in June — slightly more than the actual figure — before dropping back to £3.9bn in July.

Interest payments are likely to remain high by historical standards beyond June. Last month the OBR noted that with the Bank of England expecting inflation to hit 11 per cent this year “debt interest can be expected to continue to overshoot our forecast”.

Public sector net borrowing was £22.9bn in June, £4.1bn more than in the same month last year. This is despite significant savings from the end of most coronavirus support schemes.

Borrowing was marginally higher than the £22.3bn forecast by the OBR in March.

High inflation and the economic rebound from the hit of the pandemic have boosted government income over the past year. However, soaring prices are pushing up public expenditures and limiting economic growth.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.