TriNet Review (2023): Pricing, Features, Pros and Cons

Are you shopping for human resources and payroll software for your small or mid-sized business? We reviewed TriNet’s pricing, standout features, plus pros and cons to help you determine if it’s the best solution for your organization.

SEE: Use this guide from TechRepublic Premium to learn how to choose the best payroll software for your business.

TriNet’s fast factsPricing: TriNet doesn’t advertise its pricing plans on its website.

|

Jump to:

TriNet is a professional employer organization offering full-service HR functions to small or medium-sized businesses. The software can manage employees’ lifecycle from hire to onboarding to management and offboarding. It also provides additional capabilities like benefits management, expense management, performance management, risk mitigation, plus time and attendance tracking.

TriNet serves businesses in various industries, including:

- Technology.

- Consulting.

- Education.

- Nonprofits.

- Marketing and advertising.

- Media and entertainment.

- Financial services.

- Life sciences.

- Manufacturing.

- E-commerce.

- Retail and wholesale.

If TriNet doesn’t meet your needs, we also evaluated its top three alternatives. Keep in mind that the best payroll software for you depends on your needs and preferences.

TriNet’s pricing

TriNet’s pricing isn’t an open book due to its quote-based model. The company charges a flat monthly fee for each employee, and their prices vary by region, industry, company size and scope of services. Note that TriNet’s fees go down if an employee maxes out their Social Security deduction, reaches the max for unemployment taxes and elects a pre-tax medical deduction. To get your actual rate, you need to contact a TriNet sales representative by filling out a form on the pricing page.

TriNet’s standout features

As a full-service Professional Employer Organization and HR software, TriNet helps organizations manage their payroll and HR needs. Let’s analyze TriNet’s standout features.

Payroll and tax filing services

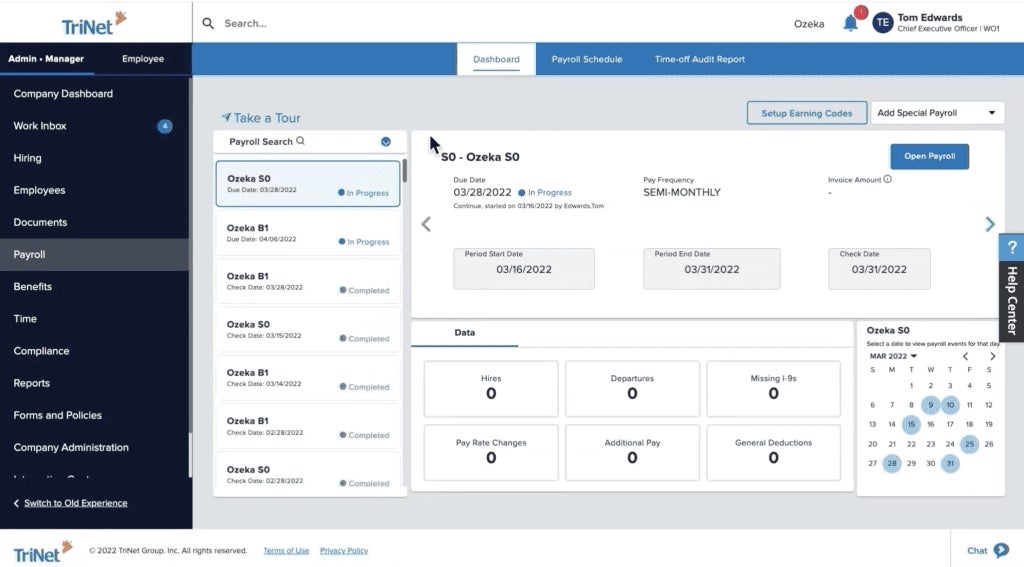

Figure A

TriNet helps small and mid-sized companies process their employee’s payroll throughout their life cycle at the company ― from hiring and onboarding to promotion and off-boarding (Figure A). Its direct deposit and debit make it easy for either the payer (employer) or the payee (employee) to initiate a push or pull transaction from the bank to the employee. TriNet makes it possible for companies to go digital with its paperless payslip, electronic tax computation and filing, and W-2 preparation and delivery.

They also automatically calculate federal, state and local payroll taxes paid through their platform and electronically submit the withholdings. With their self-service capability, employees can enroll in direct deposit, view and print W-2s, view pay stubs, manage/change their status and track paid time off. Businesses can integrate with accounting software like Intacct, Xero, QuickBooks Online, and NetSuite for additional payroll capability.

Time and attendance tracking

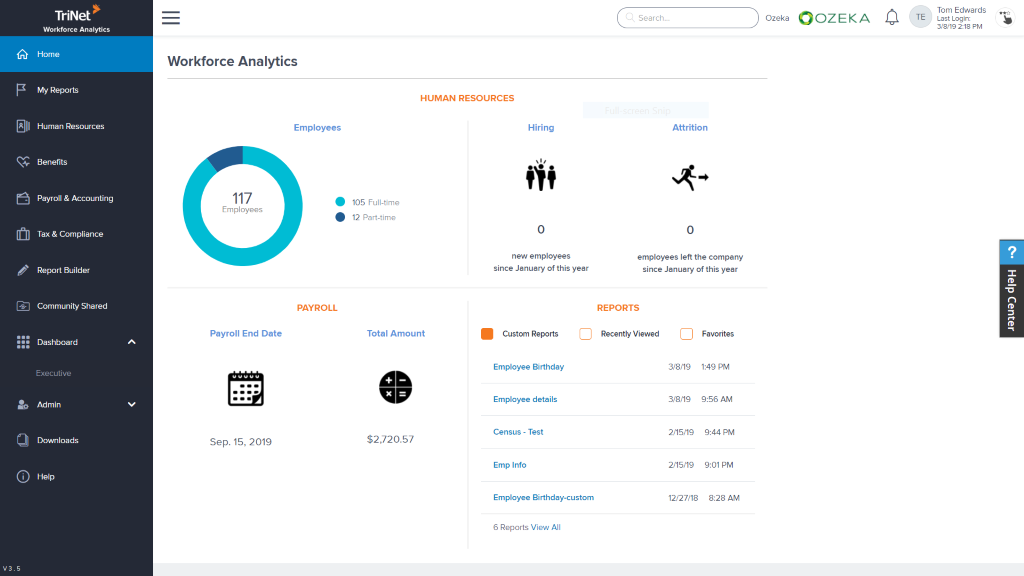

Figure B

To keep track of employees’ total hours, project hours and overtime accruals, businesses need software that has time and attendance tracking (Figure B). This is especially beneficial for companies that hire contractors, freelancers or distributed teams. With TriNet, employees can view their schedules, clock in and out, and request and manage time off. The software also features a time and attendance dashboard, allowing managers to view metrics, build reports, and export employee time and attendance data.

Reporting

TriNet’s payroll reporting capability provides managers with key insight and data they need to manage and control payroll costs (Figure C). Their customizable reports also offer insights into the company’s workforce analytics like HR, payroll and TriNet-sponsored benefits ― TriNet’s reports can be exported into various formats, including PDF, Excel and CSV. They can also be translated into graphs, scorecards, metrics and charts.

Figure C

Depending on their needs, users can gain workforce insights with various types of reports, including standard reports ― which contain commonly used KPIs, like turnover, headcount and earnings distribution ― flex reports, payroll registers and job costing reports, custom reports and visualizations, and multi-company reports.

Expense management

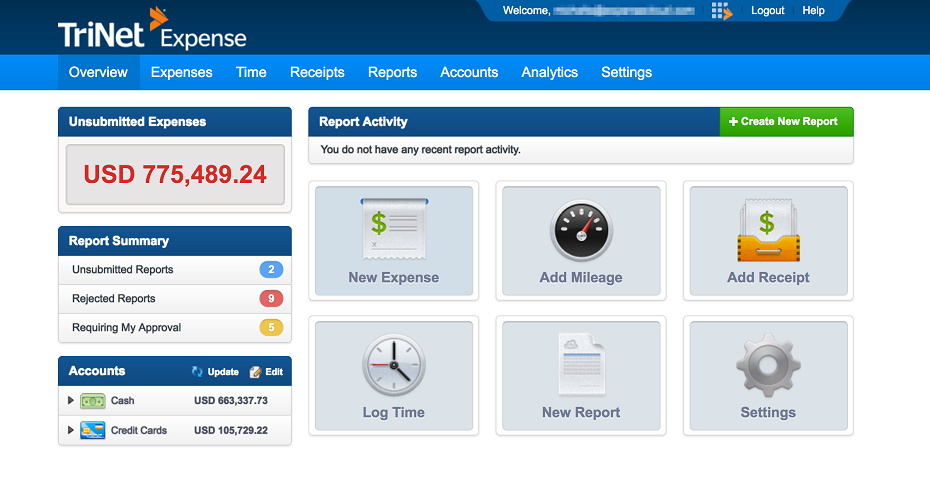

Figure D

TriNet allows users to automatically import expenses from a bank account, credit card, CSV or their mobile expense app (Figure D). These expenses can be computed in 160 foreign currencies and calculated using the user’s base currency. With TriNet, users can create, submit and approve paperless expense reports.

TriNet’s pros

- Intuitive user interface.

- Fast support response time.

- Industry-specific features.

- Efficient payroll and benefits process.

TriNet’s cons

- Lacks transparent pricing.

- TriNet doesn’t handle payments for 1099 contractors.

Alternatives to TriNet

If TriNet doesn’t serve your purpose, here are some noteworthy alternatives.

| Software | TriNet | Paylocity | ADP | Rippling |

|---|---|---|---|---|

| Starting price | Quote-based | Quote-based | Quote-based | $8 per user per month |

| Payroll and HR management | Yes | Yes | Yes | Yes |

| Time tracking | Yes | Yes | Yes | Yes |

| Tax filing | Yes | Yes | Yes | Yes |

| Mobile app | Yes | Yes | Yes | Yes |

| Expense management | Yes | Yes | No | Yes |

Paylocity

Paylocity is a full-service payroll and HR platform suitable for all business sizes, including one-employee businesses. Unlike TriNet, Paylocity provides and files 1099-MISC forms (employee and employer copies) for businesses, making it a suitable option for companies that hire contractors. Paylocity serves businesses in eight industries, including:

- Restaurant and hospitality.

- Manufacturing.

- Retail and wholesale.

- Nonprofit.

- Financial services.

- Healthcare.

- Tech and professional services.

- Education.

Like TriNet, Paylocity is a quote-based tool. Interested buyers must contact a Paylocity customer representative for custom pricing.

ADP

For organizations with complex payroll needs, ADP is worth considering. The company is one of the largest payroll and HR outsourcing companies in the world, and they offer payroll services for both small businesses (1-49 employees) and large businesses (over 1,000 employees). ADP doesn’t advertise its rates online; contact their sales team for custom quotes.

Read our comprehensive ADP review to learn more about its features, pricing, pros and cons.

Rippling

Aside from HR management and payroll service, Rippling also offers device management capability. Companies looking for an all-in-one tool to manage their finances, HR and IT will find Rippling beneficial. Rippling pricing starts at $8 per month per user. Your overall rate depends on the number of employees you have and the features you need.

Read our comprehensive Rippling review to learn more about its features, pricing, pros and cons.

How we reviewed TriNet

To review this solution, we gathered data from primary data sources, including TriNet’s website, documentation, and other resources from the software provider, and secondary, sources such as review websites such as Gartner as well as current and past product users.

1

Rippling

Rippling is the first way for businesses to manage all of their HR, IT, and Finance — payroll, benefits, computers, apps, corporate cards, expenses, and more — in one unified workforce platform. By connecting every business system to one source of truth for employee data, businesses can automate all of the manual work they normally need to do to make employee changes.

Learn more

2

Paycor

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

Learn more

3

OnPay

Payroll and HR that move you in the right direction. We give you everything you need to navigate payroll, HR, and benefits — so you can keep running your business smoothly.

Get your first month free, or join a demo to see everything we can do!

Learn more

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.