The Jumabhoy legacy expands: How utu is maximising tax-free shopping refunds for travellers

When a certain spice trader, Rajabali Jumabhoy, migrated from western India to Singapore in 1916, little did he know that he was not just crossing geographical boundaries, but also marking the beginning of a legacy that would shape the Jumabhoy’s family prominence in Singapore’s business landscape.

The Jumabhoys once used to own Scotts Holdings, which had assets of over S$600 million and a presence in the United Kingdom and Australia, apart from Southeast Asia, at its peak.

Unfortunately, due to a family feud that began in the early 1990s, where Rajabali took his son Ameerali Jumabhoy to court for allegedly racking up losses of S$50 million in the family business, the family ultimately lost management control of Scotts.

Although Ameerali was cleared of any mismanagement of the business, Scotts Holdings was eventually acquired by real estate firm CapitaLand.

After years of feuding, the members of the Jumabhoy family have charted their own courses — each venturing into diverse sectors, from investments and hospitality to real estate. For Rajabali’s grandson, Asad Jumabhoy and his son Ameer, it’s the tax-free returns sector.

A trip to Thailand sparked the business idea

During a trip to Thailand a couple of years back, Asad — who currently serves as Scotts’ CEO — and Ameer, discovered that they could not utilise their Starbucks reward points (Stars) which they had earned in Singapore at an outlet in Bangkok.

This sparked a thought — in an increasingly globalised world, why should loyalty be confined by geographical boundaries?

We came to the realisation that everyone is a local somewhere, but sometimes a tourist. And no matter whether you’re home or away, you should be rewarded for your loyalty and receive value from your shopping purchases.

– Ameer Jumabhoy, co-founder and VP of Consumer Technology, utu

The father-son duo recognised that “rewards was a broad and overarching concept”, so they decided to channel their efforts into underserved markets, like cross-border tourism, where they could deliver maximum value to shoppers.

With that, utu was incepted — a travel tech company that aims to help travellers get more out of their tax-free shopping.

COVID-19 impacted the business severely

utu was first established in 2016, and it released its initial suite of products in the cross-border rewards space in 2018. Later that year, the company pivoted into the tax-free shopping space, launching its first product at the end of 2019.

When asked about the inspiration behind the business’ name, Ameer said that he was looking for something that could be “abstractly connected to the work [utu] does”.

I’ve always aesthetically liked palindromes and as we were ideating a name for the company, we looked for something that could be abstractly connected to the work we do.

I came across the word ‘utu’ meaning ‘reward’ in Maori, and was also recently told it meant ‘humanity’ in Swahili. I think it encapsulates perfectly what we want to achieve: rewarding humanity when they travel.

– Ameer Jumabhoy, co-founder and VP of Consumer Technology, utu

However, Ameer candidly shared that utu’s pivot into the tax-free shopping space was far from smooth — COVID-19 quickly shut the rollout of its first product and severely disrupted the business in 2019.

Nevertheless, the company managed to raise a small round of funding right before the pandemic in November that year, which “turned out to be a blessing” as it gave utu the liquidity to keep all of its staff employed during the pandemic.

During the pandemic, Ameer and Asad also used the time wisely to forge strategic partnerships and refine their business model. They successfully established collaborations with renowned global partners in the airline and hospitality industry, such as Etihad, Emirates, Qatar Airways, Singapore Airlines and Accor.

Personally, I was thankful that we were able to strike significant deals with major partners who took a long-term view on travel and saw value in what we were building. This was a time in history where the world had turned their back on the travel industry.

– Ameer Jumabhoy, co-founder and VP of Consumer Technology, utu

Get VAT refund of up to 30 per cent more with utu

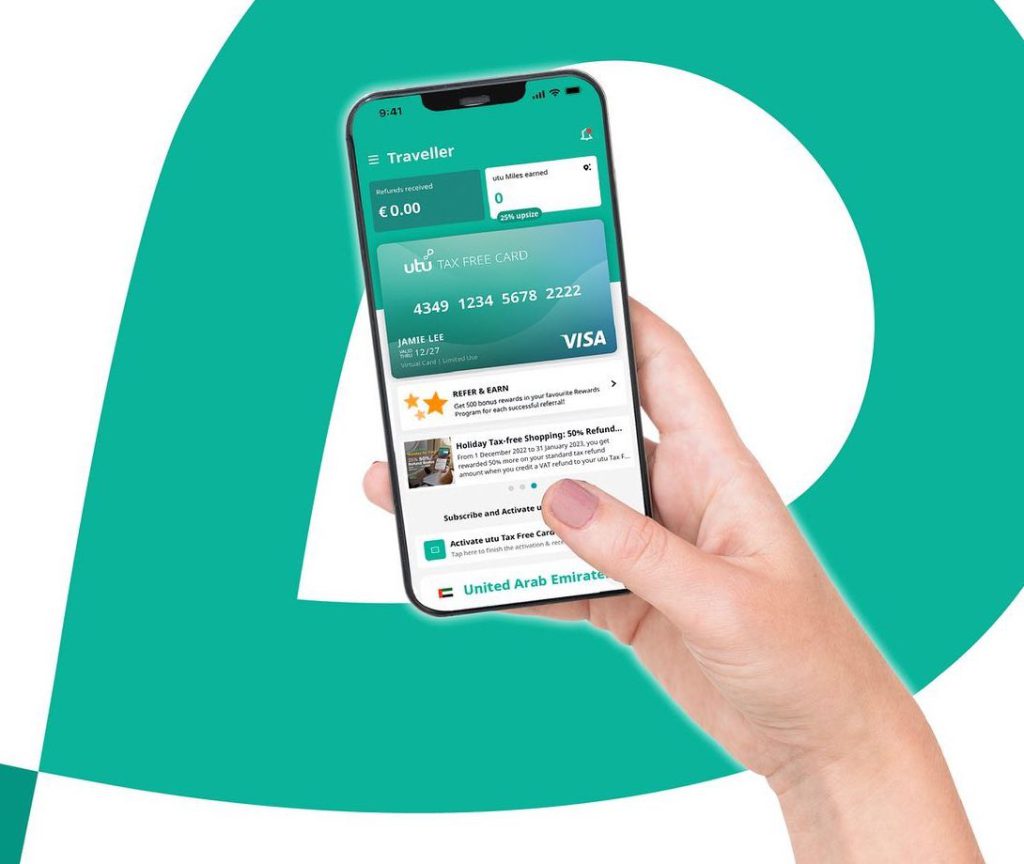

In November 2021, utu released a virtual tax-free card called the utu Tax Free Card, which allows international travellers to upsize their VAT (value-added-tax) refunds.

Users can receive their upsized VAT refunds in the form of air miles or hotel points, or obtain an immediate store voucher that is equal to 120 per cent of the VAT tax they have paid while shopping.

The utu Tax Free Card also comes in four tiers (one of which is a free membership), with the highest tier offering the biggest upsize in VAT refunds.

The virtual card addresses a major pain point that travellers face with the traditional VAT-return system.

Although the tax was introduced to boost tourism revenues in local economies, the conventional system has gradually lost favour among travellers, as they typically receive only a fraction of the total value of the VAT refund they are owed by the time their refunds are processes by VAT Refund Operators.

In fact, most travellers receive an average of between 45 and 65 per cent of their entitled refund amount.

We often hear tourists say they receive such a little amount of their refund, and that’s where utu can provide up to 30 per cent more in refund amount, if [our users] choose to receive their refund in the form of air miles or hotel points.

– Ameer Jumabhoy, co-founder and VP of Consumer Technology, utu

The best and not-so-great parts of working together

When asked about his experience working alongside his father, Ameer openly shared that they initially faced several challenges.

One one hand, he’s my dad, which means that there is the boundary of respect that I’ve grown up with. On the other hand, he’s my co-founder, which means at some level he’s a peer. Navigating that initially was challenging.

– Ameer Jumabhoy, co-founder and VP of Consumer Technology, utu

However, the father-son duo have now settled into a great rhythm at work. Asad is very much open to learning and is constantly curious about new innovations.

Ameer also gets to leverage and glean into Asad’s vast experience in the tax-free shopping space. In fact, Asad founded Global Blue, a pioneer in the tax refund industry when it started out over 25 years ago.

The only current issue they encounter is their shared intensity in the workplace, which occasionally spills over into their personal lives, much to the dismay of both Ameer’s wife and mother. Nevertheless, they have made significant progress in managing this aspect more effectively.

Introducing the concept of ‘refunds-as-a-reward’

Personal challenges aside, one of the biggest challenges the company faces today is introducing the concept of VAT refunds as a type of reward — after all, it was started as an incentive to encourage tourists to spend more.

As a pioneer in this space, Ameer admits that new concepts, such as utu’s Tax Free Card, are hard to implement. In fact, they have introduced the ‘refund-as-a-reward’ concept to the market since the pandemic.

That said, the company is now in “a good space” today to overcome this with the strength of its partnerships across the travel ecosystem, with more partnerships down the line across the retail industry.

Aside from introducing its product to the market, the company also faced difficulties due to the refinancing it had to take on during the pandemic, which did not allow the startup to get its nascent products to market “in the way [they] would have liked”.

You then face chicken-and-egg scenarios from potential investors such as “revenge travel is back, you guys must be making good money”. No, we were hamstrung in terms of what we could do from COVID-19’s impact.

Less sophisticated investors asked us why we did not have revenues between 2020 and 2021. Well, planes weren’t flying, so this became a common theme.

– Ameer Jumabhoy, co-founder and VP of Consumer Technology, utu

utu raised S$33 million in a Series B funding round

In June 2023, the travel tech startup managed to successfully raise US$33 million in a Series B funding round, from investors including SC Ventures.

We were lucky to meet SC Ventures who took a more nuanced look at the space, understood the macro environment’s impact on our work, saw a clear strategy in what we are trying to do, and decided to back us.

– Ameer Jumabhoy, co-founder and VP of Consumer Technology, utu

With the funding, utu will introduce a revamped utu Miles program, that is currently in production which will include more features such as a miles booster to complement an even higher miles-for-refund upsize.

While utu is currently not at the breakeven point, Ameer expects the business to start generating increasing revenues from September onwards.

In the next month, it will also be introducing utu Privileges, a programme that will reward tourists with up to double the VAT refund, which can be utilised within the same store to purchase a second item. utu Privileges will first launch in Thailand, followed by the UAE, Italy and Singapore.

Alongside the funding, the travel tech startup also acquired CardsPal, a one-stop lifestyle app that offers deals including event tickets and entertainment offerings.

The CardsPal acquisition will give utu a digital marketplace, a promotions engine and self-service merchant registration portal. It will also expedite utu’s rollout in markets like France and Italy, as well as 50 other countries that offer VAT and GST refunds.

All in all, the ultimate goal for utu is to build an ecosystem of rewards, both home and away, ensuring that everyone participating in cross-border transactions receives significantly more value than they get today.

Featured Image Credit: utu

Also Read: NannyStreet: This duo invested S$65,000 to build S’pore’s first confinement nanny marketplace

For all the latest Life Style News Click Here

For the latest news and updates, follow us on Google News.