The soaring cost of gas has pushed up energy bills across Europe — and put the EU’s electricity market under the spotlight.

The way prices are set has come under fire not just from member states — with Spain and France leading calls for changes to protect consumers from surging costs — but from Russia, where President Vladimir Putin blames rising gas prices partly on the EU’s decision to phase out long-term contracts in favour of market-based prices.

The European Commission, however, has resisted pressure for major regulatory changes to the 30-year-old EU energy market. Brussels has published a “toolbox” of options to deal with the price surge, such as direct income support and tax breaks but is staying away from promising a radical overhaul of pricing rules.

Kadri Simson, EU energy commissioner, has defended the system for paving the way for market liberalisation and encouraging investment in green technologies.

Why is the price of electricity rising?

The average European household electricity bill is broken down into costs for taxes and VAT (about 35 per cent), network operator costs (30 per cent), and the unit cost of energy (about 35 per cent), according to figures from the EU’s Agency for the Cooperation of Energy Regulators (ACER).

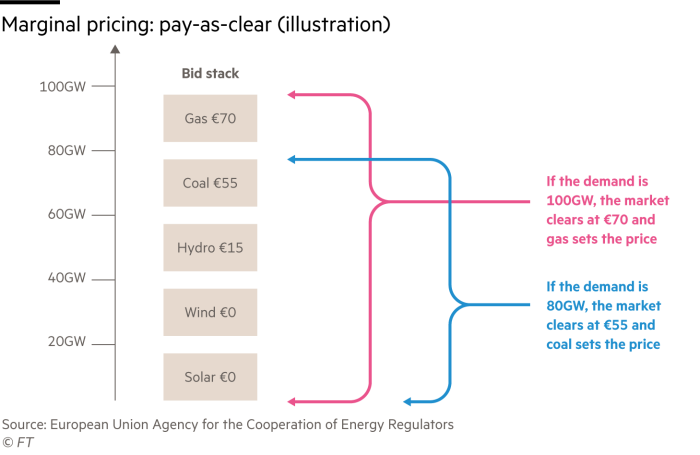

At the heart of complaints from some countries is the EU’s energy pricing system. It operates on a common “pay as you clear” model where wholesale electricity costs reflect the price of the last unit of energy bought via auctions held in member states.

Generally gas is the fuel that is needed to make sure enough energy is supplied to meet demand.

So even in countries such as France — where cheaper nuclear power provides about 70 per cent of electricity — gas is still driving the wholesale electric price. And as the gas price has soared, so has the price of electricity.

Who benefits from how the market works?

The EU’s energy market has helped to bring down prices across Europe since the late 1990s by accelerating a shift away from long-term contracts for fossil fuels such as oil to less carbon-intensive natural gas and renewables bought on spot markets.

Because prices are based on shifting supply and demand dynamics, Europe has even experienced negative prices — most notably during the start of the Covid-19 pandemic in 2020 — when supply massively outweighed falling demand. Between 2019 and 2020, Europe’s households experienced a 20 per cent fall in the cost of gas, according to figures from Eurostat.

Jan Cornillie, research associate at the European University Institute, said the EU’s energy market had “delivered very low prices for years” but a confluence of recent factors — largely outside the control of policymakers — mean that “this is among the first times it is not working in our favour”.

“The lesson is not to do away with the design altogether but to add insurance mechanisms in times of high prices,” said Cornillie.

Brussels is also fiercely protective of a model that it says is crucial to meeting its ambitious climate goals and speeding up the transition to renewable energy.

Marginal pricing means all suppliers in the market, including cheaper wind or solar installations, get the price paid for the most expensive offer accepted, providing a boon for capital intensive technologies such as renewable energy. “The market is not dominated by the big players and is open for smaller renewable installations,” Simson told the Financial Times.

Is there an alternative?

Finance ministers from France, Spain, Romania, Greece and the Czech Republic have called for sweeping changes to “better establish a link between the price paid by the consumers, and the average production cost of electricity in national production mixes”.

The commission has promised to assess how this possible “delinking” could be achieved.

But appetite for sweeping changes is low. Changing the marginal pricing rules would also require time-consuming EU legislation. Many member states including Germany, the Netherlands and the Nordics are likely to resist major legal changes in the face of a price surge that experts say is expected to fade by early 2022.

“To the extent that [the price surge] is a temporary phenomenon, then the response should be just as transitory,” Christian Zinglersen, director of ACER, told the FT.

Would better energy reserves make any difference?

One solution that Brussels is working on is to find ways to boost the EU’s capacity to procure and store natural gas so it would be available to smooth out swings in prices at times of high demand. “Volatility is likely here to stay and we need to work on accepting this,” said Zinglersen.

Only about a dozen member states have their own strategic gas reserves.

By contrast, the EU already has strict rules on emergency oil stocks: each member state must keep crude oil worth 61 days of consumption and continually report stock levels to Brussels.

But moves towards establishing joint EU gas purchasing and storage are likely to be beset by technical difficulties and high costs. Natural gas is stored in underground reservoirs and the market is dominated by commercial players, including Russia’s Gazprom.

“Only a few member states may be able to offer storage sites at sufficient scale, again raising the tricky question on how costs are divided between them,” noted Christian Egenhofer and Irina Kustova at the Centre for European Policy Studies.

Energy commissioner Simson on Wednesday said Brussels would propose a “voluntary” system for joint storage and procurement, encouraging countries who want to participate, but not creating obligatory rules.

Follow on Twitter: @mehreenkhn

Twice weekly newsletter

Energy is the world’s indispensable business and Energy Source is its newsletter. Every Tuesday and Thursday, direct to your inbox, Energy Source brings you essential news, forward-thinking analysis and insider intelligence. Sign up here.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.