Susan Knudsen, the mayor of Ridgewood, New Jersey, stood before a giant mound of road salt earlier this year to protest what she viewed as one of America’s great tax injustices.

For nearly a century, residents of towns such as Ridgewood were able to deduct their hefty state and local tax payments, or ‘Salt’, from their federal tax bill. After Donald Trump’s 2017 tax reform, the deduction was capped at $10,000.

In a place such as Ridgewood, where local property taxes average more than $18,500 per household and help to fund the town’s highly-regarded schools, the cap hit some residents hard.

So Knudsen’s spirits brightened last week as US President Joe Biden and House Democrats pushed ahead with a $1.75tn legislative package that would — in addition to satisfying the party’s larger goals of strengthening the nation’s social safety net and boosting its response to climate change — also raise the Salt cap to $80,000 until 2025.

“This will come as a relief to many,” Knudsen said, heaping praise on Josh Gottheimer, the Democratic member of Congress whose district includes Ridgewood and other high-tax northern New Jersey towns, and who has drawn a line in the sand over Salt.

But what feels like relief in Ridgewood feels like injustice elsewhere — even to many Democrats. From Maine to Montana, party members are balking at what they regard as a subsidy for the rich that would cost $275bn, according to the Congressional Budget Office, making it the second-largest component of Biden’s signature Build Back Better bill.

The debate is aggravating the fissures in a party increasingly riven between progressive and moderate factions, while also posing a further complication to the Build Back Better bill as it heads to the Senate after a rocky journey.

“If you’d told me a year ago that the second-biggest piece of a signature bill of this Congress was $280bn in tax giveaways to millionaires, I’d have told you the Republicans were in charge,” said Jared Golden, a Democrat from Maine who was the party’s lone House member to vote against Build Back Better.

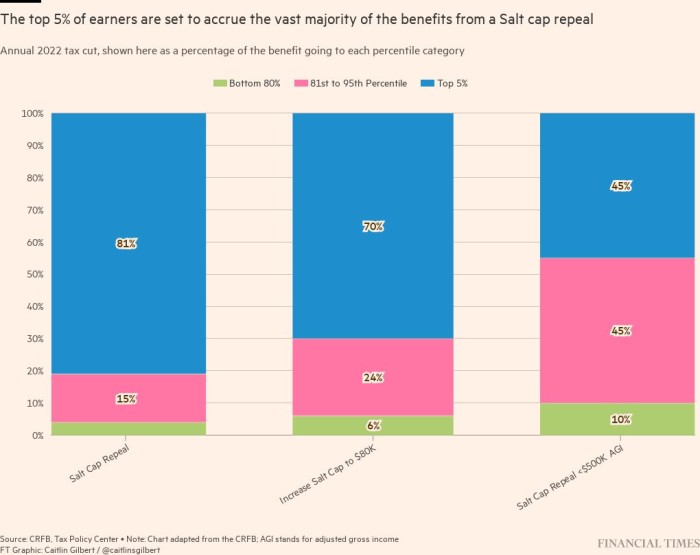

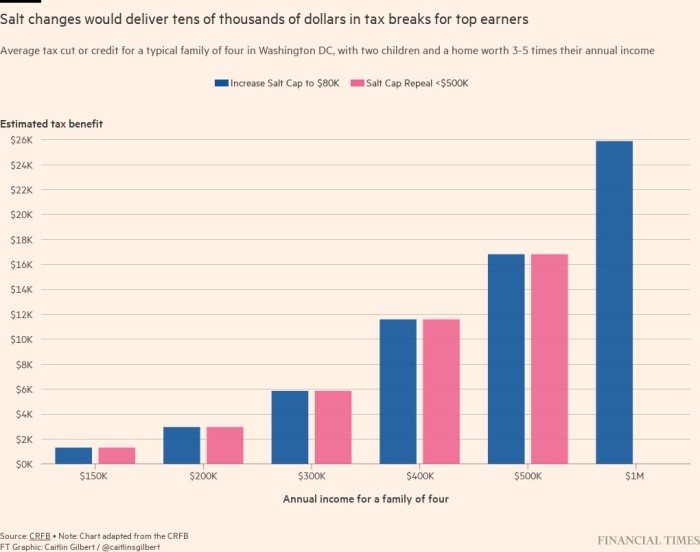

According to analysis by both the non-partisan Tax Policy Center and the fiscally hawkish Center for a Responsible Federal Budget think-tanks, 94 per cent of the benefits of increasing the Salt cap to $80,000 would go to the top quintile of earners nationwide — who make at least $175,000 a year — with 70 per cent going to the top five per cent.

Vermont Senator Bernie Sanders called raising the Salt cap “bad politics” and “bad policy”, telling reporters on Capitol Hill: “We have got to demand that the wealthy start paying their fair share of taxes, not give them more tax breaks.”

Jason Furman, former economic adviser to then president Barack Obama, criticised an earlier push to do away with the cap altogether as “obscene”.

Meanwhile, Republicans, having absorbed ample criticism for pushing through tax cuts that favoured the wealthy, are delighting at the opportunity to deride the bill as a concession for wealthy Democratic campaign donors in high-tax states such as New York and California.

Mitch McConnell, the Senate’s top Republican, called it a “bonanza for blue-state millionaires and billionaires”.

“They are just basically pointing out Democratic hypocrisy,” said Republican strategist Doug Heye.

The Biden administration has appeared sheepish in response. Jen Psaki, White House press secretary, told reporters that the president’s excitement for the package “is not about the Salt deduction; it’s about the other key components”.

But Howard Gleckman of the non-partisan Tax Policy Center noted that appeasing voters in high-tax suburban districts could be critical to Democrats’ chances in next year’s midterm elections.

“[House members from high-income areas] very well could lose their elections if they can’t deliver on providing some sort of relief,” he said, “and if they lose their seats, it increases the chances of Democrats losing control of the House.”

The provision’s ultimate fate is uncertain because it would require the support of all 50 Democrats in the Senate. One possible fix being worked on by Sanders and New Jersey Senator Robert Menendez would limit the deductions based on income, with a potential cut-off for people earning more than $500,000 a year.

“The messaging is that the Salt will be a tax cut for the wealthy — and that’s not necessarily wrong,” said Michael Hayes, a public policy professor at Rutgers University.

Still, Hayes argued, the Salt cap was also more complicated than that, in part because of its wider economic impact on areas such as home prices and the construction industry.

While Salt may seem awkward to some Democrats, in a place such as New Jersey it can feel practically existential. The state boasts the nation’s highest property tax bills, at an average of $9,112 in 2020. By contrast, in states including Louisiana and Alabama the average was less than a thousand dollars.

Fury over the Salt cap helped New Jersey Democrats such as Mikie Sherrill and Tom Malinowski sweep into Congress in what had been Republican districts in the 2018 midterms. Meanwhile, this month’s governor’s election served as a jarring reminder of voters’ frustration over high taxes when a little-known Republican candidate nearly upset incumbent Phil Murphy partly by hammering on the issue.

A visceral fear provoked by the Salt cap was that the heavier tax burden would not only squeeze residents but also dent the area’s lofty home prices. So far, that has not happened. One reason may be that the pandemic prompted many city dwellers to rush to the suburbs.

“To be honest, I just haven’t had a buyer that’s brought it up,” said Claudia Inoa, an agent at Keller Williams in Ridgewood.

According to Knudsen, it has been difficult to assess the impact of the Salt cap in the midst of a historic pandemic and economic crisis. When people moved to Ridgewood, where the quaint village centre was being readied earlier this week for Christmas, they understood the town’s proposition, the mayor said: high property taxes in exchange for top public schools.

One reason the taxes are so high is because of its property values. As of October, the median asking price for a home was $872,000, according to Realtor.com, up 11.5 per cent from a year ago.

Still, Knudsen argued, it was mistaken to conclude that lifting the cap would only benefit the wealthy. “Not everyone here is rich,” she said. “There are many middle-income people this has impacted.”

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.