Stocks may extend a rally Monday but questions abound about how long the bear market can be kept at bay amid high inflation, monetary tightening and the risk of a recession.

Article content

(Bloomberg) — Stocks may extend a rally Monday but questions abound about how long the bear market can be kept at bay amid high inflation, monetary tightening and the risk of a recession.

Advertisement 2

Article content

Futures rose for Japan, Australia and Hong Kong after a near-5% jump in global shares last week, the best such performance in a month, as investors snapped up beaten-down shares in defensive sectors like healthcare and technology.

Contracts for the S&P 500 and Nasdaq 100 fluctuated in early Asian trading, while the dollar was mixed against major peers.

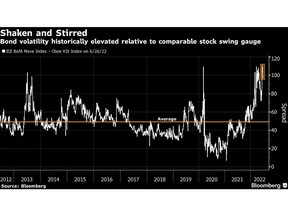

Treasury yields have retreated as worries about economic growth take center stage, leaving the US 10-year yield at 3.13%. Whether that marks the end of the worst Treasury bear market of the modern era is another live debate.

Oil dropped to about $106 a barrel. The Group of Seven nations is evaluating a potential price cap on Russia crude over its invasion of Ukraine.

Advertisement 3

Article content

Investors are parsing incoming data to work out whether the highest inflation in a generation is close to peaking, and whether that means central bankers can in time ease up on aggressive interest-rate hikes.

“Although inflation is probably close to its peak, it is likely to remain sticky at elevated levels for the balance of the year, contributing to an uncomfortable growth-inflation trade-off for central banks,” Silvia Dall’Angelo, senior economist at Federated Hermes Ltd., wrote in a note.

Federal Reserve Bank of San Francisco President Mary Daly said Friday she favors another 75 basis-point rate increase in July. Meanwhile, Fed Bank of St. Louis President James Bullard said fears of a US recession are overblown.

Advertisement 4

Article content

Elsewhere, Russia is on the brink of a foreign bond default. A grace period on about $100 million of missed bond payments — blocked because of wide-ranging sanctions — ends on Sunday night.

The US, UK, Japan and Canada also plan to announce a ban on new gold imports from Russia during a summit of Group of Seven leaders, who plan to commit to providing indefinite support to Ukraine for its defense against Russia’s invasion.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 7:12 a.m. in Tokyo. The S&P 500 rose 3.1%

- Nasdaq 100 futures fell 0.1%. The Nasdaq 100 rose 3.5%

- Nikkei 225 futures rose 1.5%

- Australia’s S&P/ASX 200 Index futures added 1.6%

- Hang Seng Index futures rose 0.9% earlier

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro was at $1.0557

- The Japanese yen was at 135.14 per dollar

- The offshore yuan was at 6.6892 per dollar

Bonds

- The yield on 10-year Treasuries advanced four basis points to 3.13%

Commodities

- West Texas Intermediate crude fell 1.3% to $106.27 a barrel

- Gold was at $1,834.03 an ounce, up 0.4%

Advertisement

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.