The world of professional employment organization software is abundantly rich. Companies have a wide range of options to run payroll and manage employees and human resources. But for small companies looking for simple, easy-to-use solutions, the top software options may be overcomplicated.

Neither Square Payroll nor Hourly is technically a professional employer organization solution because they don’t manage day-to-day HR tasks. However, they’re both cost-efficient solid options for small and medium companies who want to run payroll, handle taxes, meet compliance and offer benefits.

What is Square Payroll?

Square Payroll is designed for small and medium-sized businesses. The platform simplifies payroll, tax, compliance and benefits. The company was founded in 2009 and expanded from commerce to omnichannel solutions where businesses can sell, manage inventory, engage with buyers and pay staff. Square has international customers from Australia and Ireland to Canada and Japan and works across all 50 U.S. states.

Read the full Square Payroll review for more information.

What is Hourly?

Hourly is an emerging platform also designed for small and medium companies. Founded in 2018, Hourly focuses on workers’ compensation, insurance integration and payroll. The company provides features for business owners, insurance agents and insurers. The main downside of the platform is that, at the time, it’s only available for companies operating in California. The company has plans to expand to all 50 U.S. states in the future.

Read the full Hourly review for more information.

Jump to:

Square Payroll vs Hourly: Comparison table

| Features | Square Payroll | Hourly |

|---|---|---|

| Payroll | Yes. U.S. and international. | Yes. Only for California based businesses. |

| Benefits | Yes. | No. |

| Tax and compliance | Yes. All 50 U.S. states. | Yes. Only California. |

| Time tracking and attendance | Yes. | Yes. |

| Workers’ comp | Yes. | Yes. |

| HR lifecycle features | No. Integration with Bambee available. | No. |

| Availability | International and all 50 U.S. states. | Only California-based businesses. |

| Support | Premium plan 24-7. Other plans Monday to Friday support. | Only Monday through Friday support during business hours. |

| Free trial | No. | No. |

| Pricing starts at | $6 per month per contractor. | $40/month + $6 per person. |

Square Payroll and Hourly Pricing

Square Payroll offers two plans for small businesses. The first, starting at $35 per month plus $6 per month per person, is designed for companies to pay employees and contractors. The second plan, for just $6 per month per contractor and no monthly fixed fee, supports payroll for contractors only. Both plans include unlimited pay runs. Square Payroll doesn’t have a demo or offer free trials.

Hourly also has two plans. The Gold plan costs $6 per month per person plus a fixed fee of $40 per month. In contrast, the Platinum plan costs $10 per month per person and has a fixed monthly payment of $60 per month. Both plans have tax, compliance and unlimited pay runs. Hourly does not offer a free trial but offers its customers a 90-day money-back guarantee.

Feature comparison: Square Payroll vs Hourly

Payroll

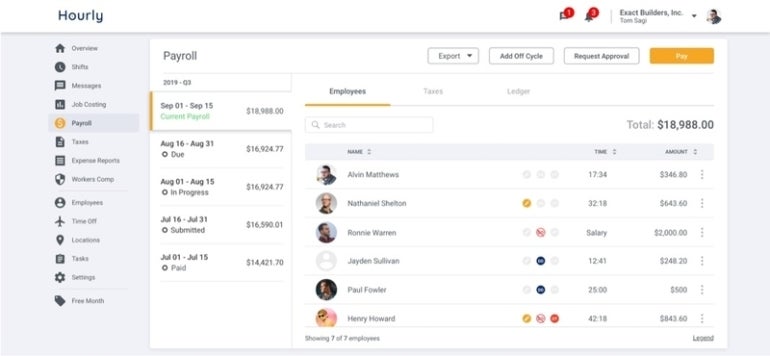

Square Payroll and Hourly are known for their simple automated payroll runs. Both offer time and attendance tracking to pay employees and contractors.

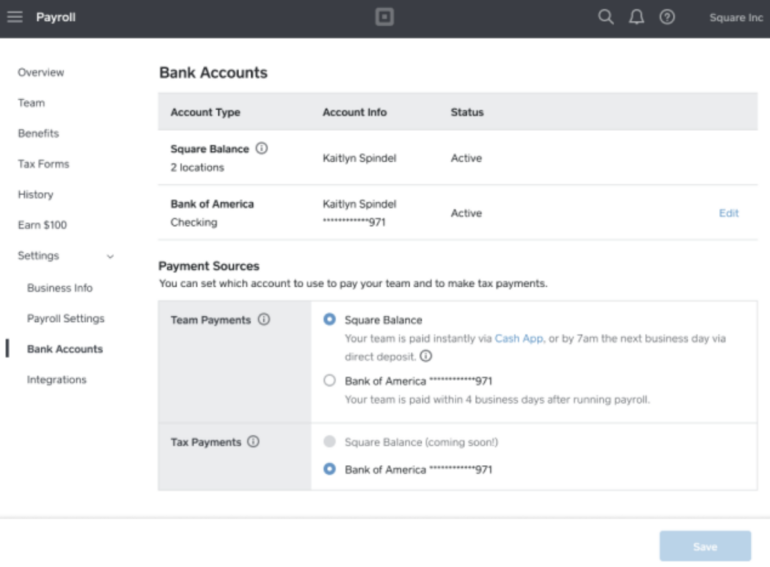

Square lets customers pay W-2 employees and 1099 contractors and does direct deposits or manual checks. Pay runs can be customized and off-cycle runs come at no charge. The platform also provides support via chat, phone or email during business hours and automatic federal, state and local payroll tax filings. Premium plans have 24/7 customer support.

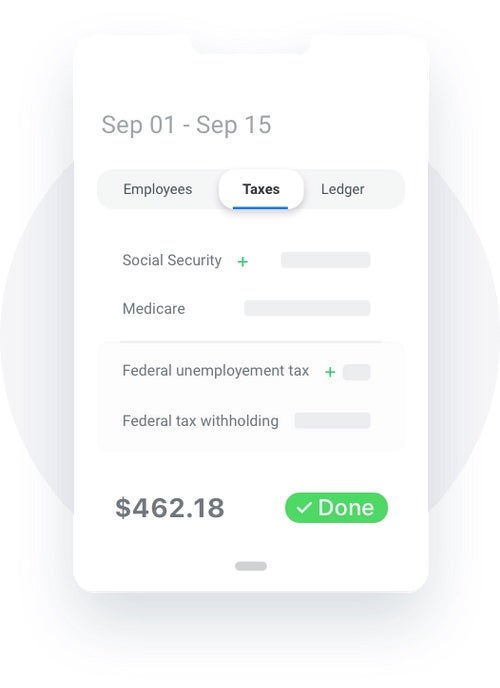

Hourly offers a more minimalistic payroll dashboard designed to simplify the experience. The company and its workers can access the web or mobile app. The platform provides tax support, automatically files taxes, tracks time and attendance and offers direct deposits and paper checks. A significant difference between both solutions is that Hourly includes workers’ compensation insurance in the payroll dashboard.

HR features

It’s important to note that Square Payroll and Hourly don’t offer advanced or basic built-in HR features. If your company is looking for technologies to modernize HR operations, from onboarding to hiring, skilling and training, and retaining workers or termination, you should definitely consider other alternatives. Leading PEO solutions that offer comprehensive HR tools include Gusto, Rippling, Papaya Global, ADP and Paychex.

SEE: Learn more about PEO platforms with HR tools in a review of the best PEO companies of 2023.

Square Payroll allows users to integrate with Bambee to leverage HR tech and offers a platform called Square Team Management that helps companies organize scheduling, timecards and more. Hourly doesn’t provide HR partner integration.

Tax and compliance

Square Payroll helps businesses stay on top of taxes and meets compliance in all 50 U.S. states.

With Square Payroll, users can:

- Run automated federal and state tax filings.

- Perform automatic quarterly and annual tax filings.

- Manage tax withholdings and payments.

- Run multistate payroll and tax and pay employees who work from home.

- Generate yearly filings and forms, including W-2 and 1099-NEC forms, for employees and contractors at no extra cost.

- Ensure ongoing compliance with updates on tax law changes.

- Manage IRS forms 940, 941, 944 and 1099-NEC.

- Manage Social Security Administration forms W-2 and W-3.

SEE: Discover the top Square Payroll competitors and alternatives for 2023

Hourly tax and compliance are limited to the only state in which it currently operates, California.

With Hourly, businesses in California can:

- Get tax and compliance support.

- File payroll taxes with the right government agencies automatically.

- Manage forms, including W-2s and 1099s.

- Stay updated on tax law changes.

- Calculate tax.

- Meet compliance with hourly workers.

- Provide employees with transparent access via web or mobile app.

Time tracking, benefits and workers’ compensation

Square Payroll provides automatic and synchronized time tracking, attendance, workers’ compensation and benefits. While its workers’ compensation insurance features aren’t as elaborated as those offered by Hourly, it can provide employees with pay-as-you-go workers’ compensation insurance that automatically syncs with your payroll.

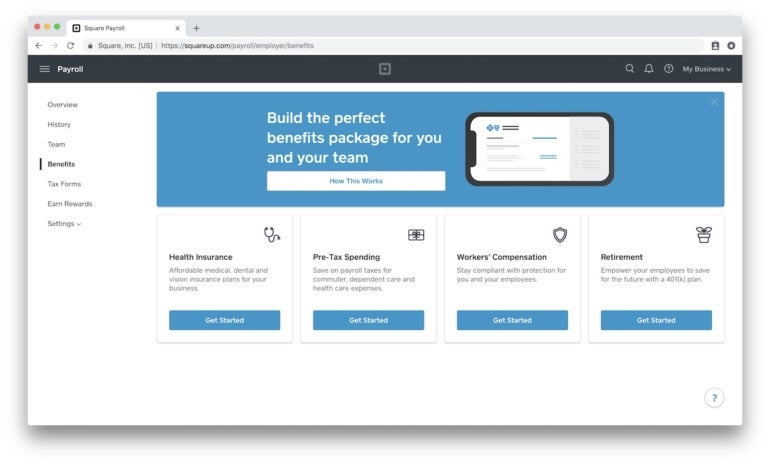

Regarding benefits, Square enables companies to access healthcare (medical, dental and vision plans) and retirement benefits, which also automatically sync with the payroll dashboard.

The company has partnered with leading benefits providers, insurance and retirement 401(k) plans. The platform handles everything, from employee enrollment to calculating deductions and contributions for each pay run.

Hourly’s main strengths are its time tracking and attendance technology and its workers’ compensation insurance management tools. However, the platform cannot connect businesses with workers’ benefits such as medical, dental and vision insurance or 401(k) retirement plans.

Support

Square Payroll has a dedicated customer team available Monday through Friday during working hours to assist companies. Support queries can be done via phone, email or live chat. Square Payroll premium plans offer 24/7 phone support in English.

Hourly provides support during working hours from Monday to Friday. Customers can contact support via phone or email.

Square Payroll pros and cons

Pros

- Easy-to-use interface.

- Cost-effective solution.

- Ideal for small companies that need to run payroll.

- Provides payroll, compliance, tax and benefits in all 50 U.S. states.

- Easy to learn.

- Designed for small businesses.

- Can perform international pay runs.

Cons

- Doesn’t have a free trial.

- Doesn’t offer built-in HR features.

- Only premium plans get 24-7 support.

Hourly pros and cons

Pros

- An excellent option for companies in California that need simple payroll combined with workers’ compensation and time tracking.

- Manages tax, compliance and payroll in the state of California.

- Integrates advanced workers’ compensation features with payroll.

Cons

- Only available for businesses located in California.

- Doesn’t offer a free trial.

- Doesn’t offer health benefits or retirement solutions.

- Doesn’t have built-in HR tools.

Methodology

To write this software comparison report, we evaluated Square Payroll and Hourly and examined their official sites, resources and documentation. We also test-drove the software when possible.

Should your organization use Square Payroll or Hourly?

Comparing two software options can be daunting when they’re both designed to perform similar tasks, but this isn’t the case with Square Payroll and Hourly. While they both focus on payroll solutions, only companies that operate in California should consider Hourly, as the company provides its services and solutions only in that state.

SEE: Discover how Hourly compares to ADP.

In contrast, Square Payroll offers payroll, benefits, tax and compliance in all 50 U.S. states and can handle international pay runs. Both solutions are easy to use and have competitive prices, but availability gives Square Payroll a significant advantage over Hourly.

Hourly strengths are undoubtedly its workers’ compensation tools and time-tracking technology. But Square Payroll also competes in that area, as it offers both to some level. Overall, Square Payroll would seem like a more solid alternative, but for companies in California, Hourly is definitely a cloud platform to consider.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.