Interest payments on UK government debt hit one of the highest levels on record last month as rising inflation limited an expected fall in public sector borrowing.

Interest payments rose to £7.6bn in May, well above the figure for last year and higher than the OBR forecast of £5.1bn following a rapid rise in retail price inflation, to which many debt payments are linked.

The Office for National Statistics said the debt interest payments were the third highest made by the UK central government in any single month and the highest payment made in any May on record.

Inflation lifts government borrowing costs because index-linked gilts make up 25 per cent of UK government debt.

Official data released on Wednesday showed that the RPI rose at an annual rate of 11.7 per cent in May, the fastest pace since December 1981.

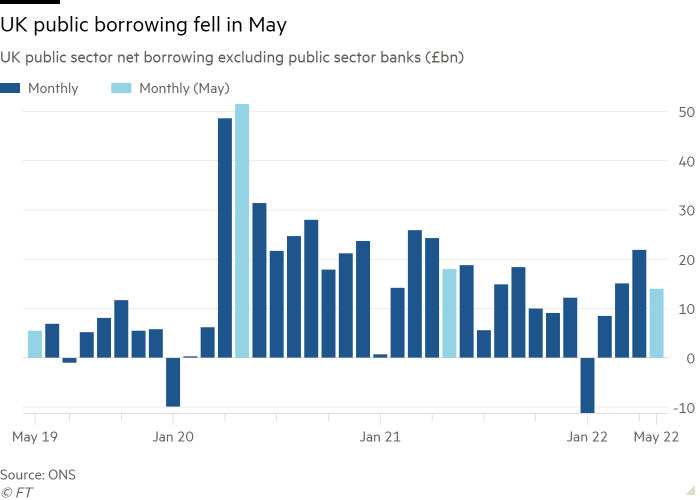

Public sector net borrowing nonetheless declined in May — but by less than expected — as inflation also helped government finances by bringing in higher tax revenues.

The strong labour market and reopening of the economy boosted government income as well.

Borrowing in May was £14bn, down £4bn from the same month last year, according to ONS data published on Thursday. But May’s borrowing was higher than the £12bn forecast by economists polled by Reuters and well above the £10.3bn expected by the Office for Budget Responsibility.

Chancellor Rishi Sunak said: “Rising inflation and increasing debt interest costs pose a challenge for the public finances, as they do for family budgets.”

He added that “being responsible with the public finances now will mean future generations aren’t burdened with even higher debt repayments, and we can secure our economy for the long term”.

The rising interest payments were also partly offset by the end of most Covid-19 government support schemes.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.