QuickBooks Payroll vs. Paychex (2023): In-Depth Comparison

With so many great payroll software options available, it can be tough to choose one that fits your needs and budget. Today, we’ll be comparing two of the most popular online payroll services, QuickBooks Payroll and Paychex, to help you figure out which one is right for your business.

Jump to:

What is QuickBooks Payroll?

While Intuit QuickBooks is most well known for its bookkeeping and accounting software, it also offers other solutions, including the cloud-based payroll software we’re reviewing here. Note that the payroll software syncs with QuickBooks Online but not QuickBooks Desktop — so if you currently use the desktop version, bear this in mind when weighing these two payroll options.

See our full QuickBooks Online Payroll review for more details.

What is Paychex?

Paychex is another very popular payroll and HR solutions provider. We’ll be focusing on its cloud-based payroll service, Paychex Flex, in this review because of its popularity. However, Paychex does offer a couple of other payroll options, such as Paychex PEO. Like many other major payroll providers, Paychex syncs with QuickBooks Online thanks to a pre-built integration.

See our full Paychex review for more details.

QuickBooks Payroll vs. Paychex: Comparison table

| Unlimited payroll runs | ||

| Automatic payroll | ||

| Time tracking | ||

| Benefits administration | ||

| Free trial | ||

| Pricing | ||

|

|

Pricing and details are up to date as of 6/22/2023.

QuickBooks Payroll vs. Paychex: Pricing

Both QuickBooks Payroll and Paychex offer multiple pricing tiers. QuickBooks is more transparent, disclosing the prices of three plans and offering a free trial option. Meanwhile, Paychex only discloses the price of one plan (the others require custom quotes) and does not offer a free trial option.

QuickBooks Payroll pricing

- Payroll Core: Costs $45 per month plus $5 per employee per month.

- Payroll Premium: Costs $75 per month plus $8 per employee per month.

- Payroll Elite: Costs $125 per month plus $10 per employee per month.

New QuickBooks customers can choose between a 30-day free trial or a 50% discount for three months of service (but not both).

SEE: The 5 Best QuickBooks Payroll Alternatives

Paychex pricing

- Flex Essentials: Costs $39 per month plus $5 per employee per month.

- Flex Select and Pro: Contact for a custom quote.

Paychex does not offer a free trial option, so you must decide whether you wish to subscribe based on the demo alone.

SEE: Gusto vs. Paychex: Which Payroll Software is Better for Your Business?

Feature comparison: QuickBooks Payroll vs. Paychex

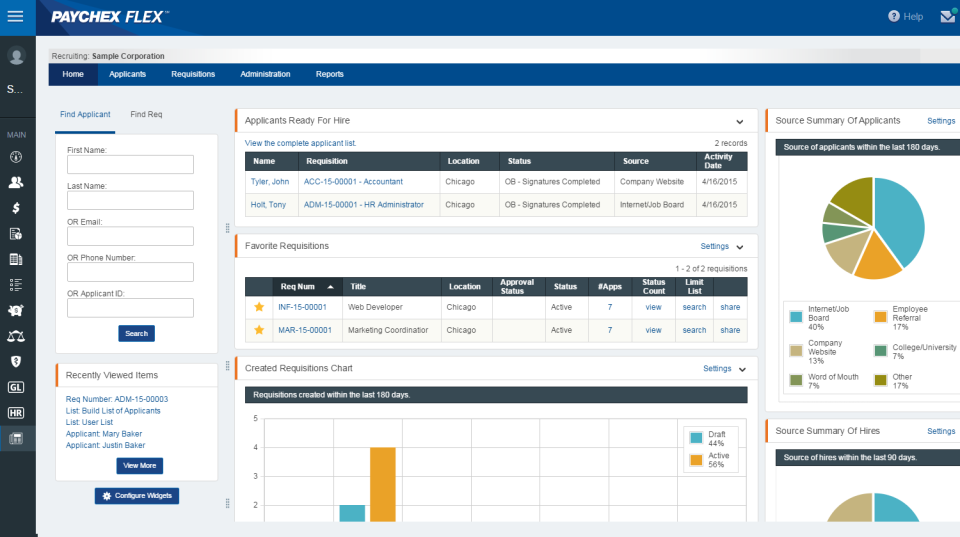

Figure A

Payroll functionality

Both QuickBooks Payroll and Paychex offer all the standard payroll features, though not all features are available to all plans. Both services will automatically calculate paychecks, deduct payroll taxes and remit those taxes for you.

Depending on what plan you have, QuickBooks Payroll offers same-day and next-day payroll. It also offers the option to set up Auto Payroll, which will run without manual initiation. Meanwhile, Paychex gives employees the option to review their scheduled payments beforehand to reduce payroll errors.

SEE: The Best Payroll Software for Accountants in 2023

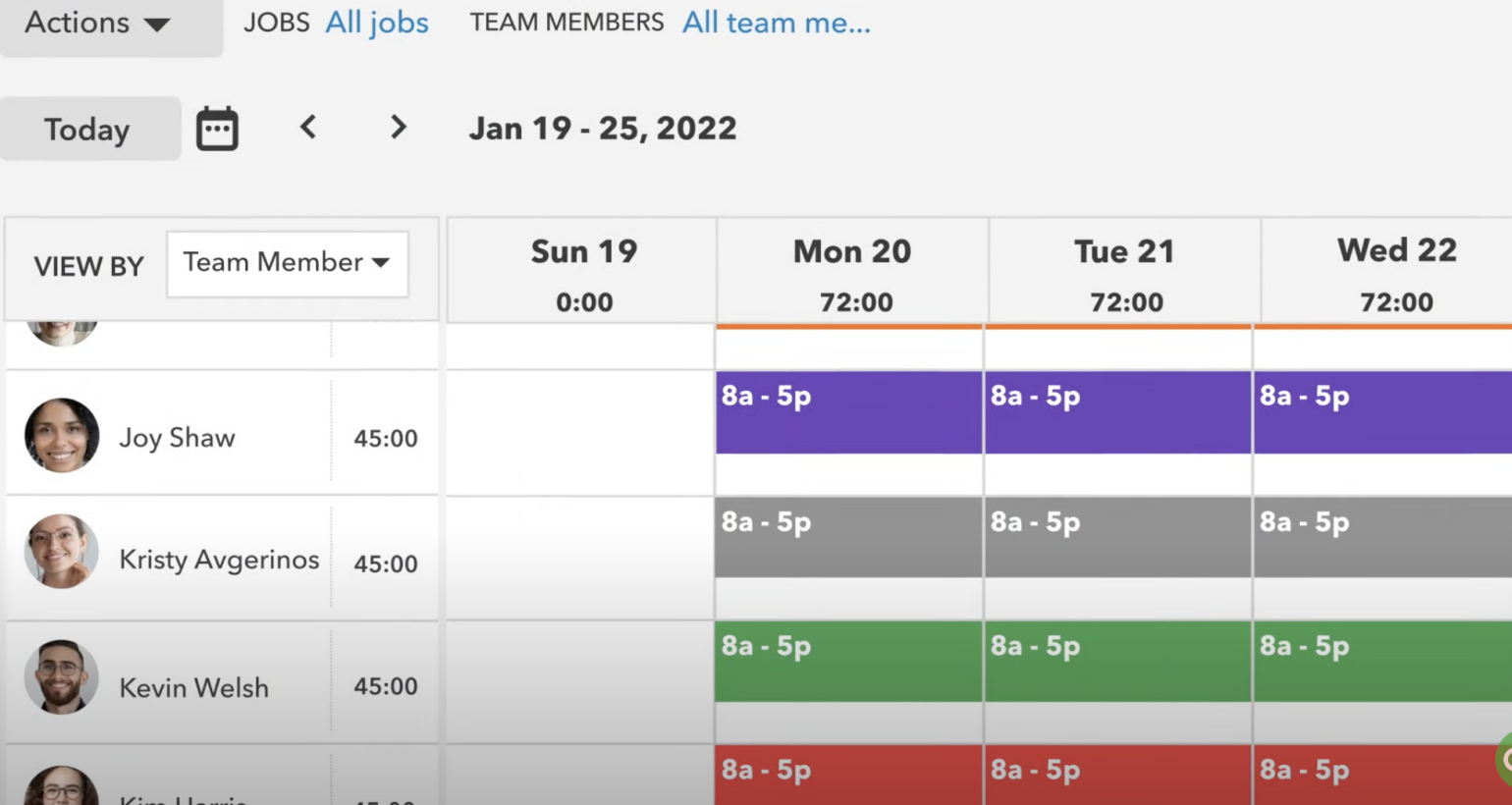

Figure B

Time tracking

Time tracking is one of the most helpful extra features for payroll software to have, since data on hours worked can flow right into the payroll tool. Both QuickBooks Payroll and Paychex offer the option for time tracking — but not on the base plans.

Time tracking is available on the Premium and Elite QuickBooks plans, while the Paychex Flex time feature is a paid add-on. Employees can clock in and out online, via a mobile app or on a time kiosk tablet.

SEE: ADP vs Paychex: 2023 Payroll Software Comparison

Figure C

HR features

QuickBooks Payroll and Paychex also include some HR features, though QuickBooks’ capabilities are more limited. QuickBooks offers both 401(k) and health insurance benefits administration, as well as workers’ compensation administration and an HR support center, run in collaboration with Mineral Inc.

Paychex offers benefits administration for both health insurance and retirement plans, as well as HR services for employee onboarding, HR consulting and hiring new employees. It also provides business insurance management for workers’ compensation, general liability, cyber liability, commercial property and umbrella.

SEE: FreshBooks vs QuickBooks Online: Which Accounting Solution is Best for Your Business?

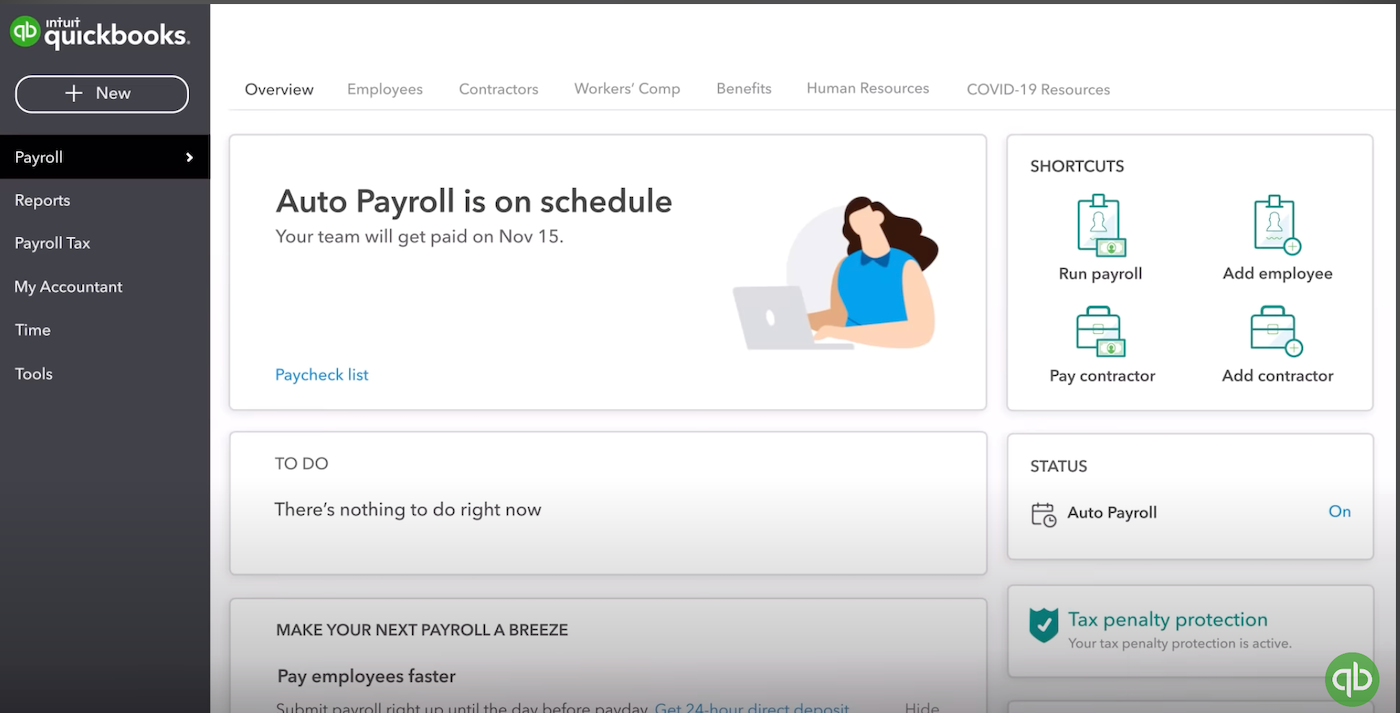

Figure D

Ease of use

QuickBooks Payroll’s layout and signature green color palette will be familiar to anyone who has used its other accounting and bookkeeping software. Even if you haven’t used a QuickBooks product before, the approachable layout is easy to navigate thanks to the left-hand menu.

Paychex follows a similar design, with a left-hand menu and a dashboard composed of modules. However, due to the greater number of features offered, some users do report that its learning curve is a bit steeper and that it can sometimes take a moment to find the function they’re looking for.

SEE: Gusto vs QuickBooks Payroll: Which Software is Better for 2023?

Customer support

QuickBooks consistently wins praise for its customer support and helpful resources. Chat support in the U.S. is offered 24/7, while phone support is available 9 a.m. to 8 p.m. EST, Monday through Friday. The company offers a robust online resources center full of videos, tutorials and webinars to help users get up to speed.

Paychex offers 24/7 customer support — phone, chat and email options are all available, as well as a knowledge base that you must register to access. However, users report that Paychex’s customer support isn’t as available or helpful as it could be, and many reviews complain that this could be improved.

SEE: The Best Payroll Software for Nonprofits in 2023

Paychex pros and cons

Pros

- Easy-to-use payroll functionality.

- Comprehensive HR features included.

- Analytics and reporting for payroll insights.

- Option to add on business insurance.

Cons

- No free trial.

- Pricing is not transparent.

- Additional fees for essential services like time tracking.

- Customer support can be lacking.

SEE: Rippling vs Paychex: 2023 Payroll Software Comparison

QuickBooks Payroll pros and cons

Pros

- User-friendly interface.

- Robust payroll features.

- QuickBooks Online integration.

- Excellent customer service.

Cons

- High monthly base price compared to competitors.

- Must choose between free trial and three-month discount.

- Certain key features are restricted to more expensive plans.

- HR features are limited.

SEE: ADP vs QuickBooks: 2023 Payroll Software Comparison

Should your organization use QuickBooks Payroll or Paychex?

Both QuickBooks Payroll and Paychex are promising payroll options. QuickBooks Payroll combines QuickBooks’ excellent customer support with solid payroll features. However, you will need to upgrade to the more expensive plans to make the most of QuickBooks Payroll, which might be too expensive for some small businesses. That being said, it does offer a free trial option, so you can try before you buy.

While Paychex may be lacking on the customer service front, it combines HR tools and support with payroll, which may be enticing to small businesses who don’t want to pay for separate HR software. However, the lack of a free trial or transparent pricing plans may give some companies pause.

If neither of these options sound right for your needs, there are plenty of other payroll options out there, including many that integrate seamlessly with QuickBooks’ accounting and bookkeeping software. Check out our list of the best payroll software of 2023 to expand your search right now.

Review methodology

To compare QuickBooks Payroll and Paychex, we consulted product documentation, user reviews, videos, product demos and more. We considered factors such as payroll and HR capabilities, pricing, ease of use and navigation, as well as customer support options.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.