Quickbooks Payroll vs. OnPay (2023): Payroll Software Comparison

Jump to:

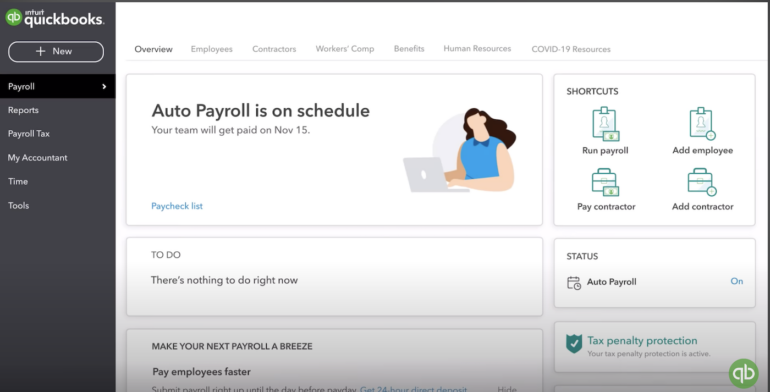

Intuit QuickBooks Payroll has carved a niche for itself among small and medium-sized businesses with its diversified and scalable payroll plans. Its wide-ranging plans cater to growing businesses that want more HR features as they grow.

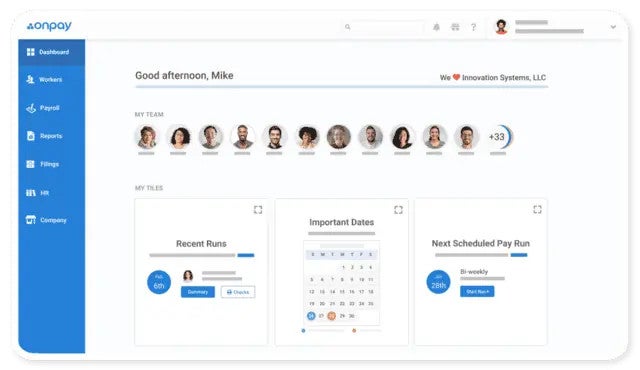

Similarly, OnPay has swiftly gained a reputation for its streamlined focus on core payroll needs, coupled with robust HR functionality. Its strength lies in its capacity to simplify payroll processing while helping small businesses manage HR tasks and find fully integrated employee benefits.

Since OnPay and QuickBooks Payroll are two of the best payroll solutions for small and midsize businesses, it can be hard to determine which one is right for you. Below, we dive into each payroll software solution’s strengths, weaknesses, features and pricing to help you decide.

QuickBooks Payroll vs. OnPay: Comparison table

The table below illustrates the key features and pricing structure of both products.

| QuickBooks Payroll | OnPay | |

|---|---|---|

| Pricing | Starts at $45/mo. + $5/employee/mo. | Starts at $40/mo. + $6/person/mo. |

| Benefits management | Yes | Yes |

| Mobile app for employers | No | No (mobile-friendly site) |

| Automated tax filing | Yes | Yes |

| Third-party integrations | 700+ | 12+ |

| Built-in time tracking | Yes (additional cost) | Third-party integrations |

| HR compliance tools | Yes | Yes |

| Same-day direct deposit | Yes (Premium and Elite plans only) | No |

Pricing and plan details up to date as of 6/12/2023.

1

OnPay

Payroll and HR that move you in the right direction. We give you everything you need to navigate payroll, HR, and benefits — so you can keep running your business smoothly.

Get your first month free, or join a demo to see everything we can do!

Learn more

2

Paychex

Paychex is a cloud-based payroll management system offering payroll, HR, and benefits management systems for small to large businesses. Paychex covers payroll and taxes, employee 401(k) retirement services, benefits, insurance, HR, accounting, finance and Professional Employer Organization (PEO).

Learn more

3

Paycor

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

Learn more

QuickBooks Payroll vs. OnPay: Pricing

QuickBooks Payroll pricing

Pricing is a critical factor when choosing a payroll system. QuickBooks Payroll follows a tiered model:

- Core: Starts at $45 per month + $5 per employee per month

- Premium: Starts at $75 per month + $8 per employee per month

- Elite: Starts at $125 per month + $10 per employee per month

QuickBooks Online Payroll’s Core plan has a notably low per-employee fee that ensures small businesses save money as they add employees. Each tier increases in functionality and features, with an additional fixed amount per employee per month, catering to growing businesses.

In contrast to some of its top rivals, like Gusto Payroll, Intuit QuickBooks Payroll offers a 30-day free trial, so you can take the software for a spin before committing. QuickBooks Payroll also offers a 50% discount for the first three months, but you have to waive the free trial to get the discount.

OnPay pricing

OnPay offers one flat rate:

- $40 per month + $6 per person

The first month is free and includes white-glove setup and migration (at no additional cost). Your monthly payment only changes when you add more employees — a transparent model well-suited for small businesses.

Naturally, all of OnPay’s features are included in its single plan. And while OnPay has a few extra charges, it lists those fees upfront, and none of them are outside the industry norm. For instance, you’ll be charged a fee if you have insufficient funds to cover a payroll run, which is true for all payroll software systems. OnPay is simply one of the only providers to explain its fees transparently instead of hiding them in the fine print.

QuickBooks Payroll vs. OnPay: Feature comparison

Payroll processing and tax filing

Winner: Tie

Both QuickBooks Payroll and OnPay excel at payroll processing and tax filing. Both providers offer full-service payroll plans only, meaning they will calculate, deduct and file your federal and state payroll taxes on your behalf. Both also draw up 1099 and W-2 end-of-year tax forms, though both providers charge an extra fee if you want to print and mail these tax forms to your employees. (Employees can access their tax forms for free using each provider’s self-service portals.)

Since they file taxes on your behalf, QuickBooks Payroll and OnPay issue a tax-filing guarantee: If they make a mistake with your taxes, they’ll pay the resulting penalties and fines and deal directly with the IRS on your behalf. QuickBooks Payroll Elite users get additional coverage of up to $25,000 for any payroll fines incurred, including those incurred not by QuickBooks’ errors but your own.

Note that neither QuickBooks nor OnPay offers international payroll services. If you pay employees and contractors internationally, look into a global payroll provider like Rippling, Gusto (which supports contractor payments only) or Papaya.

Employee and benefits management

Winner: OnPay

Both platforms offer solid employee and benefits management. However, OnPay goes the extra mile by offering a slew of HR tools, integrated benefits management and options for health and dental benefits in all 50 states, making it a more comprehensive option for businesses with employees scattered across the country. Since OnPay uses an in-house brokerage, you won’t pay an additional fee to integrate healthcare benefits with OnPay’s payroll software. The only fee you incur is the insurance premium.

QuickBooks Payroll offers health, dental and vision insurance through SimplyInsured. Unlike OnPay’s health benefits, which are available in all 50 states, SimplyInsured works in every state except Hawaii, Vermont and Washington, D.C.

Additionally, while all plan users can find workers’ compensation insurance through QuickBooks, QuickBooks Payroll Core users will pay an extra fee of $5 per month to access workers’ comp (which isn’t available in Ohio, North Dakota, Washington or Wyoming).

Third-party software integrations

Winner: QuickBooks Payroll

When it comes to integrations, OnPay offers extensive integration with other accounting, time tracking, 401(k), HR systems and other business tools. For example, OnPay integrates with the QuickBooks Accounting software so users can synchronize payroll data with their accounting system.

However, since Intuit QuickBooks is one of the biggest players in the business software field, it’s able to offer hundreds of integrations compared to the few dozen OnPay can offer. It integrates with more than 750 business apps that run the gamut from shopping stores like Amazon and Shopify to construction management apps like BuilderTrend.

Time tracking and project tracking

Winner: QuickBooks Payroll

With QuickBooks Payroll, businesses can efficiently manage employee time tracking and project tracking without working through a third-party provider. This integrated feature provides more control over projects, resource allocation and accurate billing. Note that QuickBooks Payroll charges an extra fee for customers who want to add its time-tracking feature, QuickBooks Time, to their payroll plan.

In contrast, OnPay syncs with time-tracking and project-tracking software, but it doesn’t offer any native solutions.

Reporting

Winner: QuickBooks Payroll

QuickBooks Payroll offers comprehensive reporting features. Businesses can easily generate and customize reports, providing critical insights into payroll, tax and employee data.

OnPay’s Report Designer, although providing good reporting features, does not offer the same level of customization and detail found in QuickBooks Payroll.

Mobile capabilities

Winner: OnPay

QuickBooks Payroll recently got rid of its employer-facing payroll app (though there is still one for QuickBooks Online Accounting), and there’s no word on how that will change its mobile capabilities.

On the other hand, OnPay offers only an iOS employee-facing app, not an app for employers — but only because OnPay has optimized its browser version for both desktop and mobile. The employee-facing app doesn’t have great reviews, but the good news is that employees can access OnPay just fine in their mobile browser. Others have said that using OnPay’s browser version on a mobile device is actually a pretty clean experience.

QuickBooks Payroll pros and cons

Pros of QuickBooks Payroll

- Centralized and easy-to-use interface for quick data access.

- Comprehensive and streamlined administration of benefits, payments, time tracking and compliance.

- Workers’ compensation insurance and health benefits add-ons.

Cons of QuickBooks Payroll

- While the tiered pricing model offers scalability, the additional cost per employee might be a concern for businesses with a larger workforce.

- Users incur more add-on fees with QuickBooks Payroll compared to OnPay, which has relatively few extra fees.

OnPay pros and cons

Pros of OnPay

- More than a dozen software integrations to enhance the efficiency of HR operations.

- Nationwide coverage for health and dental benefits.

- Above-average customer service ratings.

- Free white-glove setup and account migration.

Cons of OnPay

- The fact that OnPay has just one plan could make it less scalable for growing businesses.

Methodology

Our comparative analysis is built on a deep dive into each product’s specifications and an examination of user reviews, with a focus on features of importance to our audience of human resources and business professionals.

Should your organization use QuickBooks Payroll or OnPay?

Choosing between QuickBooks Payroll and OnPay should be primarily dictated by the specific requirements of your organization, such as its size, industry and growth projections.

Choose QuickBooks Payroll if:

- Your organization values a streamlined, centralized system that simplifies payroll and tax processing while saving time and money.

- You need integrated time and project tracking with resource allocation.

- You already use QuickBooks Online to manage accounting and prefer a software solution that integrates with no time or effort on your part.

Choose OnPay if:

- You prefer a simple, transparent pricing model and require comprehensive benefits management (like health and dental benefits in all 50 states).

- You need to integrate payroll with your current HR system.

- You’d like an optimized mobile browser experience to handle your payroll in the office and on the go.

- You want payroll software that includes a variety of HR features and tools so you don’t have to pay for multiple business software providers.

As a final piece of advice, it is essential to consider not only your current needs but also your future. As your business grows and evolves, your payroll needs may change, and having a scalable solution will prevent future hurdles.

Before deciding, take advantage of discounts, free trials or demos offered by the vendors to ensure the chosen solution meets your business needs and expectations.

Read next: Choosing a payroll service: A guide for business leaders (TechRepublic Premium)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.