Prashant Jain, MF industry’s poster boy, quits HDFC AMC after 19-year stint

Prashant Jain, the poster boy for the Rs 38-trillion domestic mutual fund (MF) industry, has quit HDFC Asset Management Company (AMC) after 19 years. He was serving as chief investment officer (CIO) at the country’s third-largest fund house, overseeing assets of more than Rs 4 trillion.

Jain has “decided to move on and has tendered his resignation”, HDFC AMC said in a stock exchange disclosure on Friday.

Jain, an alumnus of IIT Kanpur and IIM Bangalore, has been replaced by Chirag Setalvad, who will be head of equities, and Shobhit Mehrotra, who will helm the fixed-income segment. Both will report to Navneet Munot, managing director and chief executive officer of the company. Munot joined HDFC AMC 18 months ago following the retirement of Milind Barve, the fund house’s long-serving chief.

Rumours of Jain’s exit had been doing the rounds for the past two years, which he had always played down. The resignation comes at a time when Abrdn-backed HDFC AMC is struggling to increase its market share and assets under management (AUM), weighing on the performance of its stock.

In the past one year, HDFC AMC shares are down 34 per cent even as the benchmark Nifty50 index has gained 6 per cent. For the quarter-ended June 2022, HDFC AMC’s average AUM stood at Rs 4.15 trillion, down 0.2 per cent compared to the same period last year.

The fund house ceded its second position to ICICI Prudential MF, which saw its assets jump nearly 12 per cent to Rs 4.65 trillion for the period under consideration. The average AUM growth for the industry was 13.8 per cent.

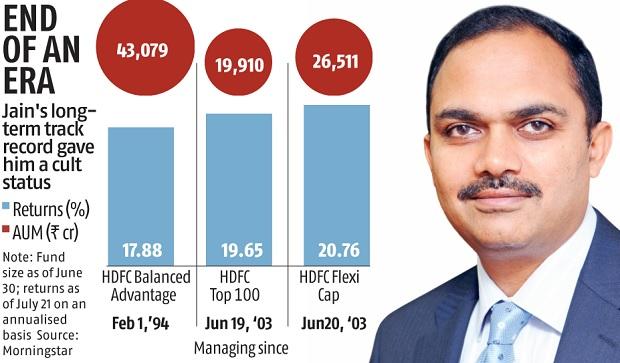

Jain’s legacy has helped his investors generate outsized returns over a long-term horizon. His largest fund HDFC Balanced Advantage (with a corpus of Rs 43,079 crore) has delivered annualised returns of 17.9 per cent since its inception in 1994. Meanwhile, HDFC Top 100 (Rs 19,910 crore) and HDFC Flexi Cap (Rs 26,511 crore) have given annualised returns of 18.8 per cent and 18.3 per cent since their inception in 1996 and 1995, respectively.

Jain’s ability to deliver sustainable growth over a longer period gave him a cult status among investors and helped propel the growth of HDFC AMC. However, his value-oriented approach has weighed on his scheme’s performance over the last few years as the market preference shifted to high-growth stocks.

His preference for public sector undertakings (PSUs), mainly banks, weighed on his schemes’ performance, often drawing investors’ ire. Over a 3-year and 5-year period, both HDFC Balanced Advantage and HDFC Top 100 have underperformed their benchmarks.

Jain, with over three decades of fund management experience under his belt, joins a series of high-profile fund managers to quit the MF industry. Many of them have forayed into the alternative investment fund (AIF) and portfolio management service, which are largely targeted at ultra-rich investors.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.