Markets end on flat note in highly choppy trade

In a highly volatile trade, equity benchmarks ended on a flat note on Wednesday amid unabated foreign fund outflows and a weak trend in index heavyweight Reliance Industries.

Continuing its previous day decline, the 30-share BSE Sensex dipped 9.98 points or 0.02% to settle at 60,105.50. During the day, it declined 309.7 points or 0.51% to 59,805.78.

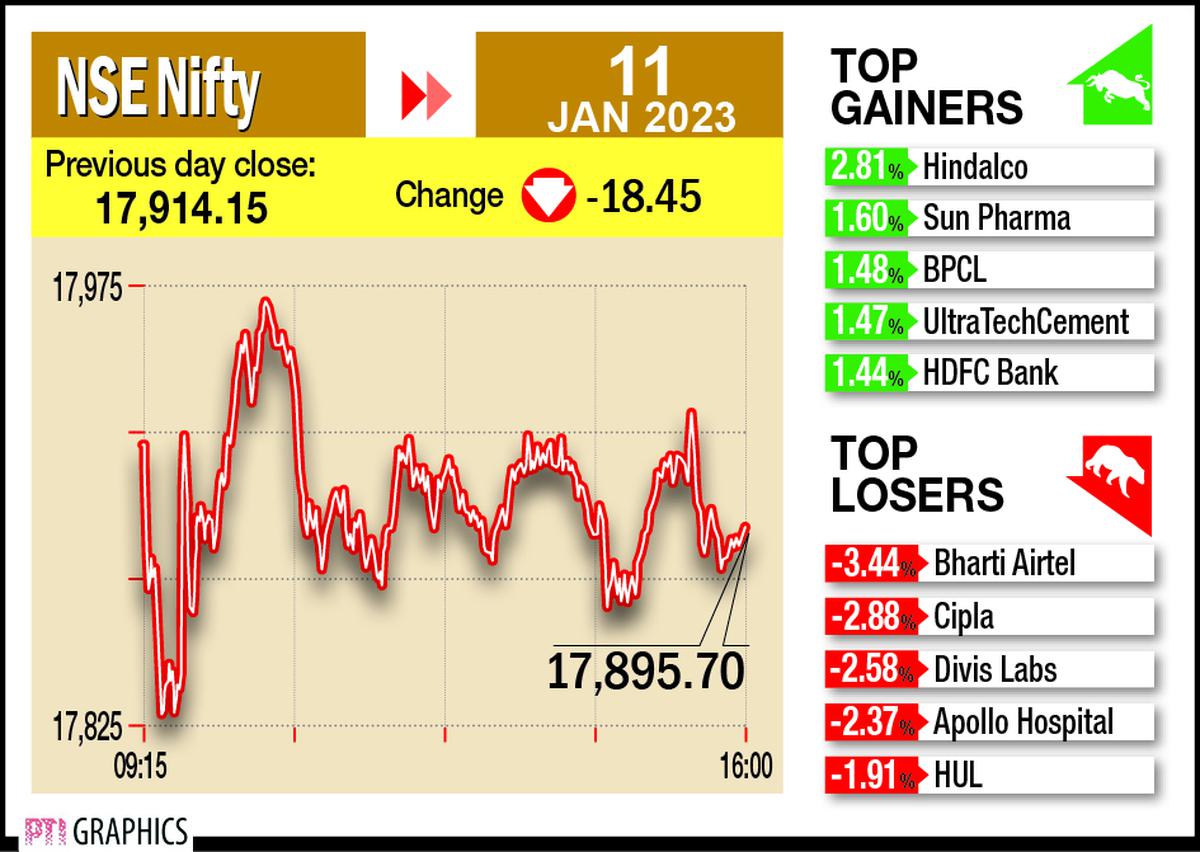

The broader NSE Nifty skidded 18.45 points or 0.10% to end at 17,895.70.

From the Sensex pack, Bharti Airtel, Hindustan Unilever, Titan, Reliance Industries, Nestle, IndusInd Bank, Bajaj Finserv and NTPC were the major laggards.

Sun Pharma, UltraTech Cement, Tata Motors, Larsen & Toubro, Tata Consultancy Services, HDFC Bank and Tata Motors were among the winners.

“The biggest drag on the market in the near-term is the sustained selling by FIIs for 13 continuous sessions, which has taken the cumulative cash market selling to ₹16,587 crore,” said V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Foreign Institutional Investors (FIIs) offloaded shares worth ₹2,109.34 crore on Tuesday, according to exchange data.

Elsewhere in Asia, equity markets in Seoul, Tokyo and Hong Kong ended in the green, while Shanghai settled lower.

Equity exchanges in Europe were trading in the positive territory in mid-session deals. Markets in the U.S. had ended in positive territory on Tuesday.

International oil benchmark Brent crude climbed 0.65% to $80.62 per barrel.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.