London’s prime property market still reeling from mini-Budget

The market for London’s most expensive homes has been thrown into disarray and is unlikely to recover until next year after last month’s “mini”-Budget sparked expectations of a sharp fall in property prices, according to the latest data.

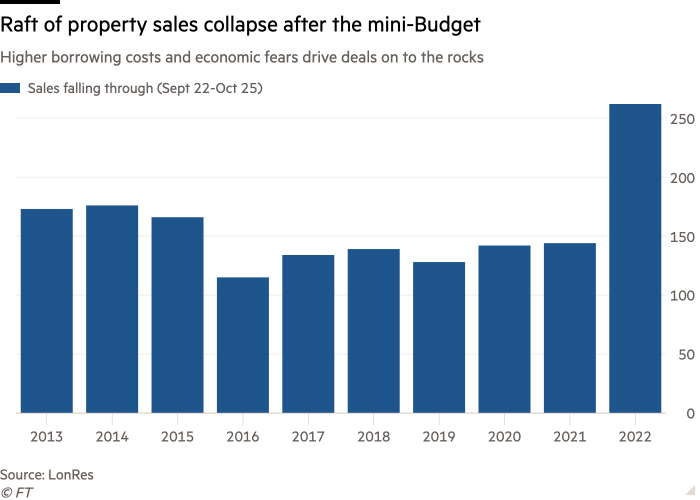

The number of property deals falling through in the capital’s most expensive postcodes, including parts of Mayfair and South Kensington, has leapt in the five weeks following the statement from former chancellor Kwasi Kwarteng on September 23, according to LonRes, which monitors London’s high-end property market.

Since the “mini”-Budget, 262 prime home sales have collapsed, an 82 per cent increase on the 144 that fell through in the same period of last year.

The number of properties being reduced in order to push through a deal has increased by 60 per cent and homes being withdrawn from the market is starting to tick up, LonRes figures show.

“There is a pause in the market which is a direct result of the “mini”-Budget, and which I suspect will lead to price reductions,” said Anthony Payne, managing director of LonRes.

Kwarteng’s promise of £45bn in tax cuts with few details of how they would be funded sparked an instant shock across the housing market. Borrowing costs spiked as markets priced in higher and faster interest rate rises, while gilt yields rose sharply.

That had a chilling effect on the mainstream housing market, with lenders raising mortgage rates and withdrawing products for first-time buyers, while prospective buyers lowered their offers because they think house prices will fall further.

The upper reaches of London’s housing market tend to be relatively insulated from those issues because many buyers are cash-rich and less reliant on borrowing. Overseas buyers also make up a big proportion so the weakness of sterling would usually help.

But the LonRes’ data shows that this time the expectations of a sharp price drop is hitting sentiment. “What has disappeared is the desire to [buy a home] overnight. It doesn’t matter if you’re spending £500,000 or £15mn, if you think the market is going to come off 10-15 per cent then you will wait. Why wouldn’t you?” said Payne.

Last week, Lloyds bank said it expected UK house prices to fall 8 per cent next year, and other analysts have been even more bearish. Payne predicts the pause in trade will last at least six months, until prices have fallen far enough to lure buyers back.

Jo Eccles, founder of high-end property buying and management company Eccord, agreed the mood among the usual cash-rich buyers had soured fast. With expectations of a crash mounting, “people are embarrassed to say to friends at a dinner party ‘I’m pushing ahead with the purchase’ . . . Sentiment is just very, very delicate,” she said.

She added that higher mortgage rates were also having a dampening effect. “There are many people sitting out on the sidelines or having to redo their numbers and finding they have a lot less to spend than they previously did,” she said.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.