Knit Payroll Review (2023): Features, Pros & Cons

Knit, also called Knit People, is a Canada-only payroll service and HR software that boasts over 1,000 small business subscribers. In this guide, we’ll break down the pros and cons of Knit to help you figure out if Knit is the right choice for your business.

Jump to:

1

Paychex

Paychex is a cloud-based payroll management system offering payroll, HR, and benefits management systems for small to large businesses. Paychex covers payroll and taxes, employee 401(k) retirement services, benefits, insurance, HR, accounting, finance and Professional Employer Organization (PEO).

Learn more

2

Paycor

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

Learn more

Pricing

Knit offers three pricing plans:

Knit also offers a 30-day free trial of the Complete plan so you can try out the software for yourself before committing to a paid subscription.

Lite

The Lite pricing plan costs $39 per month plus $6 per employee per month. Features include direct deposit, payroll calculations, year-end T-4s, new hire onboarding, document management and more.

Complete

The Complete pricing plan costs $39 per month plus $8 per employee per month. It includes all the features included in the Lite pricing plan, plus mass payroll imports, WCB and WSIB remittance reporting, document e-signatures and time-off adjustments and approvals.

Concierge

The Concierge pricing plan costs $299 per month plus $25 per employee per month. With this plan, businesses outsource their payroll and HR management to Knit, so they don’t need to hire someone in-house.

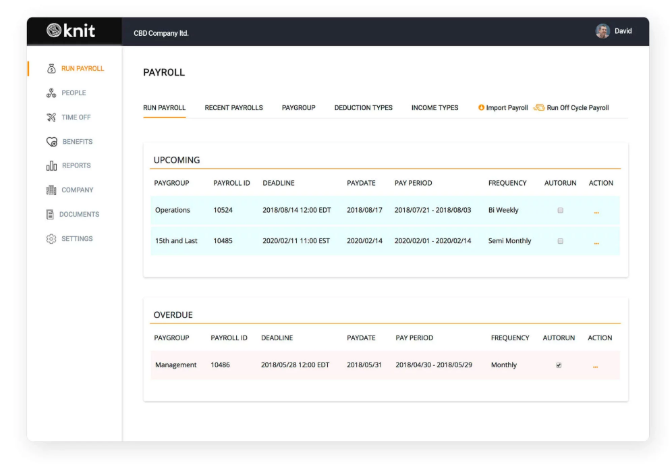

Figure A

Key features

Payroll

Knit payroll offers all the standard features, including payroll calculations, online pay stubs, direct deposit, and payroll tax payments. The Knit app also allows you to generate and file year-end T-4s, automate the creation of record of employment (ROE) documents and automate your WCB and EHT calculations and remittances. Each employee gets access to the self-service portal so they can access their documents on their own.

HR features

In addition to payroll, Knit also offers multiple HR features. Choose from multiple benefit packages from top Canadian insurers, track and approve time off, find people in the employee database, and speed up onboarding for new employees. The HR team can securely store documents in the Knit app and set up email alerts and reminders so they never miss important dates.

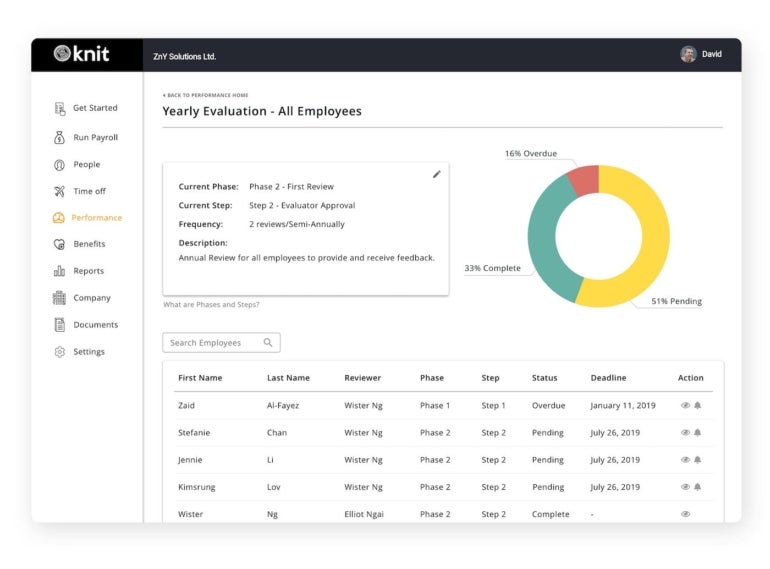

Performance management

Knit includes a performance management module to help your company set up a continuous review system. Managers and employees can work together to set up objectives, log them in Knit, and track progress over time. The Knit app also allows you to customize the performance review form, and the system will automatically remind you when it’s time for a review.

Figure B

Knit pros

Easy setup process

When you first create a Knit payroll account and login, you’ll be taken to a page that outlines the nine setup steps you need to complete, from adding your company address to verifying your bank account. Once you complete these steps, Knit will verify your account and you’ll be ready for your first payroll run.

Unlimited payroll runs

Some payroll software companies charge a fee each time you run payroll, and these extra costs can add up quickly for small businesses that need to run payroll weekly or have off-cycle payroll runs. Knit’s unlimited payroll runs mean that small businesses don’t have to worry about these added fees no matter how many times they run payroll.

Time-off module

Managing time off in the same platform allows data to flow seamlessly into the payroll software. While you do need to update to the Complete plan to access time-off features, it’s nice that Knit offers this capability so you don’t need separate software.

Figure C

Knit cons

Limited geography

Knit payroll is not currently available in Quebec or outside Canada. Canadian companies that need to pay employees in Quebec or other countries will need to seek out an alternative payroll software that isn’t bound by these geographic limitations. Check out our list of the best Canadian payroll software for some recommendations.

No mobile app

Knit does not offer a dedicated mobile app yet, which can make it clunky to run payroll on a smartphone or tablet as opposed to a desktop computer. If you frequently need to run payroll on the go, you might want a different payroll service that offers a dedicated mobile app or a mobile-focused web experience.

Cost of plans

While Knit’s pricing plans are reasonable for the number of features offered, it may be too expensive for some small businesses. If Knit payroll is out of your budget, then look for lower cost or even free payroll alternatives that will save you some cash.

Who is Knit best for?

Knit payroll is designed for small and medium-sized businesses in Canada (excluding Quebec province) that need to run payroll. If that describes your company, then Knit is worth checking out.

The unlimited payroll runs are especially beneficial for companies that run payroll frequently or have to run off-cycle payroll often. Knit also offers some HR tools, making it an excellent choice for small businesses that want HR tech but don’t want to invest in a second software platform.

Alternatives to Knit

That being said, Knit payroll isn’t the right choice for everyone. If you are located outside Canada or in Quebec, you will need to seek out alternative payroll software that supports your geographic region. Knit’s features may also not be advanced enough for very large businesses that need sophisticated payroll and HR support.

ADP

ADP is one of the most popular HR and payroll services in the world. While it does offer more affordable plans targeted to small businesses, ADP also scales with larger companies that have hundreds or even thousands of employees. If Knit payroll isn’t sophisticated enough for your company’s complex needs, then check out ADP.

BambooHR

BambooHR is one of the best-in-class HR software options for small and medium size businesses and offers pretty much every core HR feature you could want. However, some features — payroll, benefits administration, time tracking, and performance management — are only available as add-ons, which increases the price. BambooHR offers an applicant tracking system, while Knit does not, making this a good alternative for growing companies that are hiring a lot.

Rippling

Rippling starts as a payroll platform but has since expanded into HR and workforce management. Rippling is now available in 50 different countries, so it’s a good option for international companies that need a payroll service that works outside Canada. Rippling also offers cloud-based software for managing both IT and finance, a unique combination that sets it apart from many other competitors.

Need more suggestions? Check out our best payroll software recommendations for 2023.

Methodology

To evaluate Knit payroll, we signed up for the free trial and watched demo videos. We also consulted user reviews, product documentation, and the Knit website for more information. We weighed multiple parameters in our assessment, including cost, ease of use, feature offers, geographic availability and more.

1

Paychex

Visit website

Paychex is a cloud-based payroll management system offering payroll, HR, and benefits management systems for small to large businesses. Paychex covers payroll and taxes, employee 401(k) retirement services, benefits, insurance, HR, accounting, finance and Professional Employer Organization (PEO).

Learn more about Paychex

2

Paycor

Visit website

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

Learn more about Paycor

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.