Is it possible for an investment to offer a profit of 3% per week?

No, it is not possible!

If it was possible, all investment managers across the globe will be investing in such a structure or product and the world would be a happy place. Be careful, be very careful …

Let us first spend some time explaining what the ‘risk-free rate’ is and how a guarantee is enforced. The risk-free rate is the rate that a country’s reserve bank, also referred to as the central bank, lends money to commercial banks. The central bank/reserve bank is therefore the bank of commercial banks, and the interest rate of the central bank is referred to as the repo rate which in SA currently sits at 6.25%.

Commercial banks are allowed to add some margin to the repo rate which determines commercial banks’ prime lending rate, currently at 9.75%.

Commercial banks will provide funding to individuals and corporates at a rate above or below their prime rate based on the creditworthiness of their borrowers.

Commercial banks raise funding by onward lending the funds they receive from the central bank. They also raise funding by borrowing money from individual and corporate investors/savers which they in turn lend onward again to clients of the bank by way of loans and asset financing.

In order to attract funding from individuals and corporates, commercial banks need to offer attractive interest rates that vary according to terms and the respective institutions. Generally, longer-term fixed deposits offer higher interest rates than shorter deposits.

Considering the current upward trend of interest rates, we see different banks offering interest rates that vary from around 4.5% per year on call accounts to around 12% per year on fixed deposits.

Day-to-day bank accounts attract much lower interest rates. These rates are reviewed regularly as the repo rate changes. In order for the banks to make money and be profitable from the fixed deposits that they accept from investors, they either need to onward loan the funds to people who will pay more than the interest the bank is paying its depositors, or the bank has to ‘churn’ the funds and lend them out more than once during the time that they hold the deposits.

Risk

If we now go and delve into the ‘risk’ involved in investments and guarantees offered by institutions, we must consider the risk-free rate as that of the repo rate currently sitting at 6.25%.

For any institution to offer a higher return than 6.25% they have to incur risk. The higher the return ‘promise’, the higher the risk. It is as simple as that.

For a bank to offer 8% interest, they have to either earn 10% or as I mentioned, have to churn their funding to earn multiple earnings from it. If you consider that, then even banks carry risk. Ask yourself the question why and how some banks can offer substantially higher interest rates on deposits than others.

Remember African Bank? They offered the best interest rates on deposits of all banks. Why did they fail? Because they lent their investors’ money to individuals within the micro-lending space and charged them enormous interest rates and they kept on churning those loans to the same individuals until they could no longer afford to repay their loans.

All returns are not equal in risk and security!

If the risk-free rate is 6.25% per year and someone offers you more than 150% per year does that make sense at all? There was absolutely no investment that could do that in the past or that will do that in future, no matter how smart the ‘tools’ they offer you are. I state again, why would no fund managers, who are incredibly smart people, not use these tools?

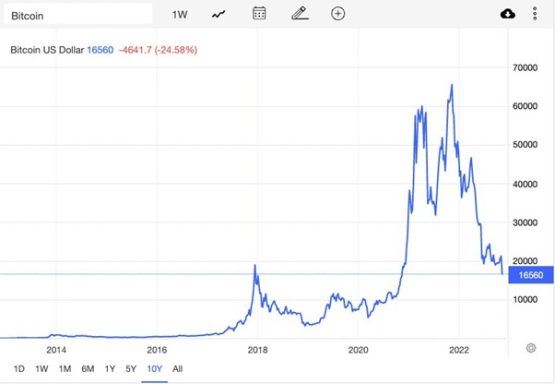

Even the mighty Bitcoin that is the darling of many has spectacularly crashed on numerous occasions and lost millions of people billions of dollars, as the graph below shows.

Cryptocurrencies in their current form cannot be the base of secure reliable returns.

I understand that the company you are referring to offers a crypto and forex trading platform. I don’t know the company, but I did a Google search on it and came across many questions and comments ranging from ‘Ponzi scheme?’ to ‘trusted’ or ‘scam’.

Unfortunately, the crypto space is still widely unregulated and there have been numerous scams costing investors globally tons of money.

In SA we are currently sitting with the Mirror Trading International (MTI) scam where South African investors are going to lose around R8 billion.

The Cajee brothers also scammed South African investors with another crypto platform scam (Africrypt) where they disappeared with $3.6 billion (R63 billion) worth of Bitcoins.

Forex scams started in South Africa in early 2000 with Leaderguard being the first major ‘blow up’ where they offered investors returns of 5% per month (much less than 3% per week), guaranteed with stop-loss systems in place – SCAM!

These weren’t the first scams and they are bound not to be the last …

I am not saying that the company that you are referring to are ‘skelms’, but I caution you to enter any forex or crypto trading platform with extreme caution.

Where trading platforms are used and ‘tools’ guide you in the trades, the only benefactors are the platforms. Platforms raise fees per trade. The more you trade the more they earn – fact.

If I understand you correctly the company does not offer guarantees? I just want to make one general comment on guarantees.

A guarantee is only as strong as its backer. Jo Blogs can offer you a guaranteed return of 50% and guarantee your capital. If he does not have the financial backing or financial structure to back it up, the guarantee means absolutely nothing! Any product of any sort that carries a guarantee and that includes South African structured products that are very popular, must carry a guarantee from one of the major banks or an internationally recognised financial institution. If they don’t, walk away.

In summary, any return above the risk-free rate carries risk. The bigger the variance the bigger the risk.

Use common sense. If the risk-free rate is say 7% and the average stock market return over 20 years is 14%, does it make any sense at all that a 130% return is possible? Without risk?

Would I place my clients’ or my own money with them? Absolutely not. Don’t let the misguided enthusiasm of others be the destroyer of your wealth …

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.