IRCTC gains 3% on data monetisation plan; analysts see more upside

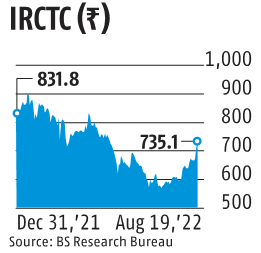

Shares of Indian Railway Catering and Tourism Corporation (IRCTC) jumped over 3 per cent on Friday on the BSE to end the day at Rs 735. This came a day after the company announced plans to monetise its passenger data bank. In the last two trading sessions alone, the stock surged nearly 9.5 per cent as compared to S&P BSE Sensex, which has lost 1 per cent in the last two days.

In a first of its kind move, IRCTC — ticket-booking arm of the Indian Railways — announced on Thursday that it is looking to monetise its bank of passenger data while conducting business with private and government companies.

The company aims to raise up to Rs 1,000 crore through this exercise.

IRCTC has a large bank of data related to every online railway ticket ever generated.

“The firm has just floated a tender to appoint a consultant to look for possible alternatives to monetise its data but the process shall be set into motion only after the appointment. Till then, we await for more clarity on this development,” said Devang Bhatt, lead analyst at IDBI Capital Markets & Securities.

For the quarter ended June for the 2022-23 financial year (Q1FY23), IRCTC reported a 196 per cent surge in net profit, at Rs 246 crore, when compared to Rs 82.50 crore in Q1FY22. Its total income grew 251 per cent year-on-year (YoY) to Rs 853 crore.

“Given the beat on revenue front, we increase our top-line estimates by 5.8 per cent/6.3 per cent for FY22 and FY24 as we re-align our assumptions for catering business. Ticketing volumes will be keenly eyed in near term as reversal in 2S class is applicable from July,” wrote Jinesh Joshi and Shweta Shekhawat of Prabhudas Lilladher recently.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.