Intuit Mint review: Personal finance made simple

Intuit Mint provides a robust set of automated tools for tracking your personal finances. Among those tools is the one that makes this one of the best budgeting apps we tested: The ability to create multiple budgets to view your spending across different categories.

Part of Intuit’s stable of financial products — which includes TurboTax and QuickBooks — Mint has been around since 2006. Mint’s services are free, but at least one feature (bill negotiation) has an extra fee, and you’ll have to endure a steady diet of financial offers.

Mint tracks your spending, provides financial alerts, and includes free credit monitoring from TransUnion. Once you link your financial accounts, you can set up a budget that draws on that information and track your transactions and financial health from a single dashboard. (For this Intuit Mint review, we are focusing on the overall usability and budgeting capabilities.)

Intuit Mint review: Cost

Intuit Mint is free to use, but in exchange for its services, Intuit serves up a barrage of financial offers the services matched to you. These offers range from ads for other Intuit products (like TurboTax) to credit cards, loans, and more. On mobile, those ads can be eliminated if you pay $0.99 per month; and on iOS you can subscribe to Mint Premium for additional features for $4.99 per month. Ad-free or Premium subscribers will see no ads beyond the Mint Marketplace via the web-based service (but bizarrely you can’t initiate the ad-free experience from the web).

Mint is the only service we reviewed that has an individualized financial coaching package available at an extra cost. Mint suggests paying $125 for those two sessions, but it also claims you pay “what you believe it’s worth” when you schedule the second session.

Intuit Mint review: Features

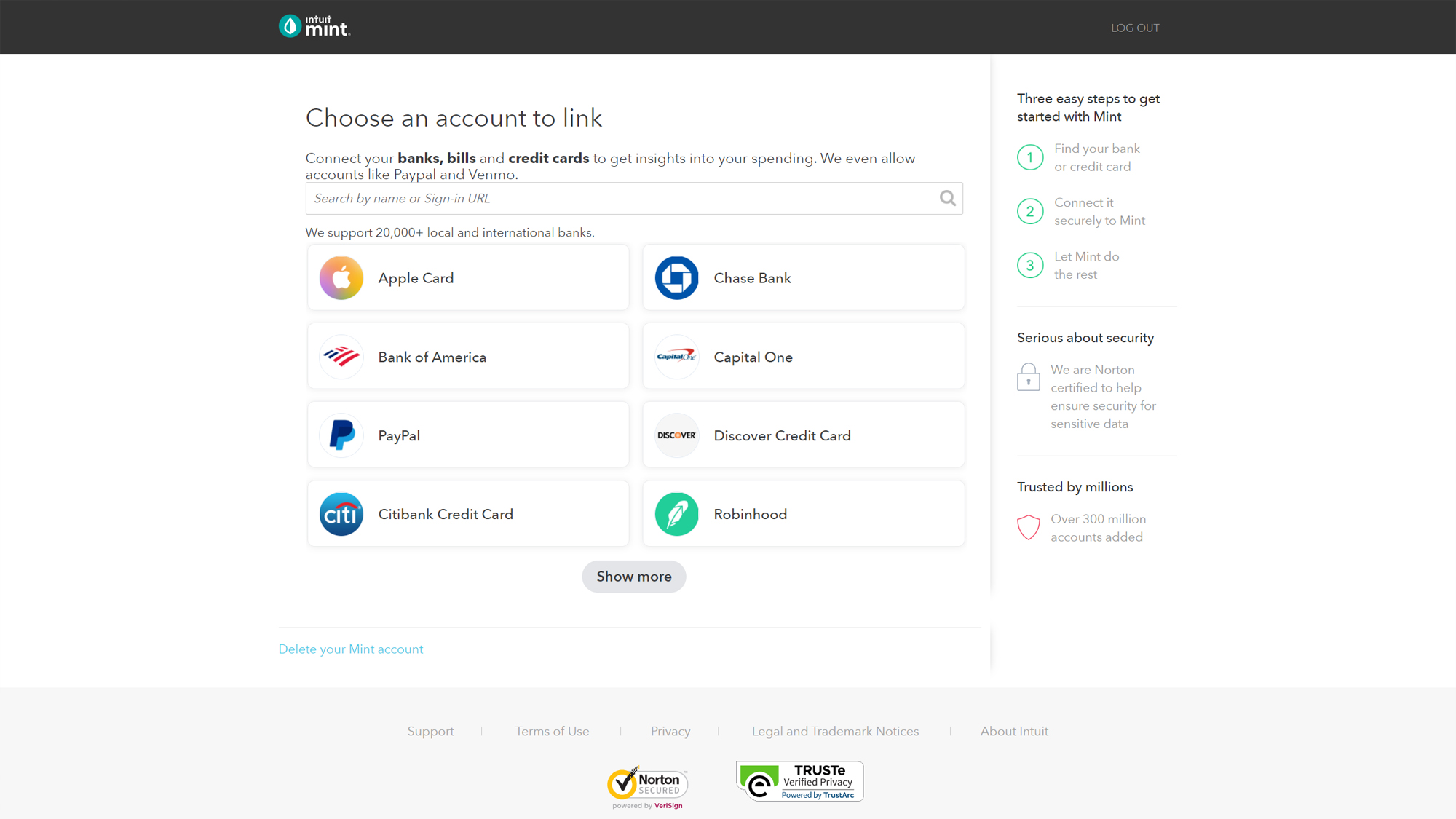

Mint is a full-spectrum personal finance app that uses machine learning to make financial recommendations. Supply Mint with data either manually or by linking banking, credit card, and investment accounts, and the service provides a running view of your financial health and habits. As with Intuit’s TurboTax service, Mint connects to more than 20,000 local and international financial institutions.

The service parses the data you’ve supplied into actionable and useful categories, providing a picture of your bills, transactions, credit score, budgets, goals, trends, and investments all under one-roof. It can also track your subscriptions and bulk edit transactions. And it provides handy visuals for viewing and parsing trends for spending, income, assets, debts, and net worth. Mint also supports tracking cryptocurrency investments.

Intuit Mint review: Available help

From within Mint, you’ll get very little in the way of guidance or financial education. The Mint life blog online has lots of articles and information, but you need to seek that out separately, outside of the service itself. The mobile app has links to Mint life, and a how-to-use tile that links out to Mint life, but that’s about it. Intuit offers Mint Financial Coaching for speaking with an accredited financial expert about your financial health, spending habits, and more. The first 15-minute session is free; after that, the service has a two-session coaching package (each session up to one hour), and additional sessions may be added as needed.

Intuit Mint review: Ease of use

After setting up an Intuit account (if you already have one from using one of Intuit’s other services, including TurboTax and QuickBooks — you’ll use that log-in). Mint gets straight to business by prompting you to connect your financial accounts. Connecting accounts is a key part of how to use the service, but we ran into stumbles and interface oddities from the start. The linking process depends upon the institution — some will have you enter the account information within the Mint interface, and others will require you to authorize account access at the financial institution first.

The interface for connecting accounts lacks clarity and finesse (even in the beta version discussed later). For example, to connect a Citibank credit card, Mint first sends you to a pop-up to sign into your Citibank account and choose the accounts to connect, and then it will return you to Mint to import transactions. If you have multiple accounts, all boxes are checked by default, but you can uncheck boxes if you’d like to import specific accounts only.

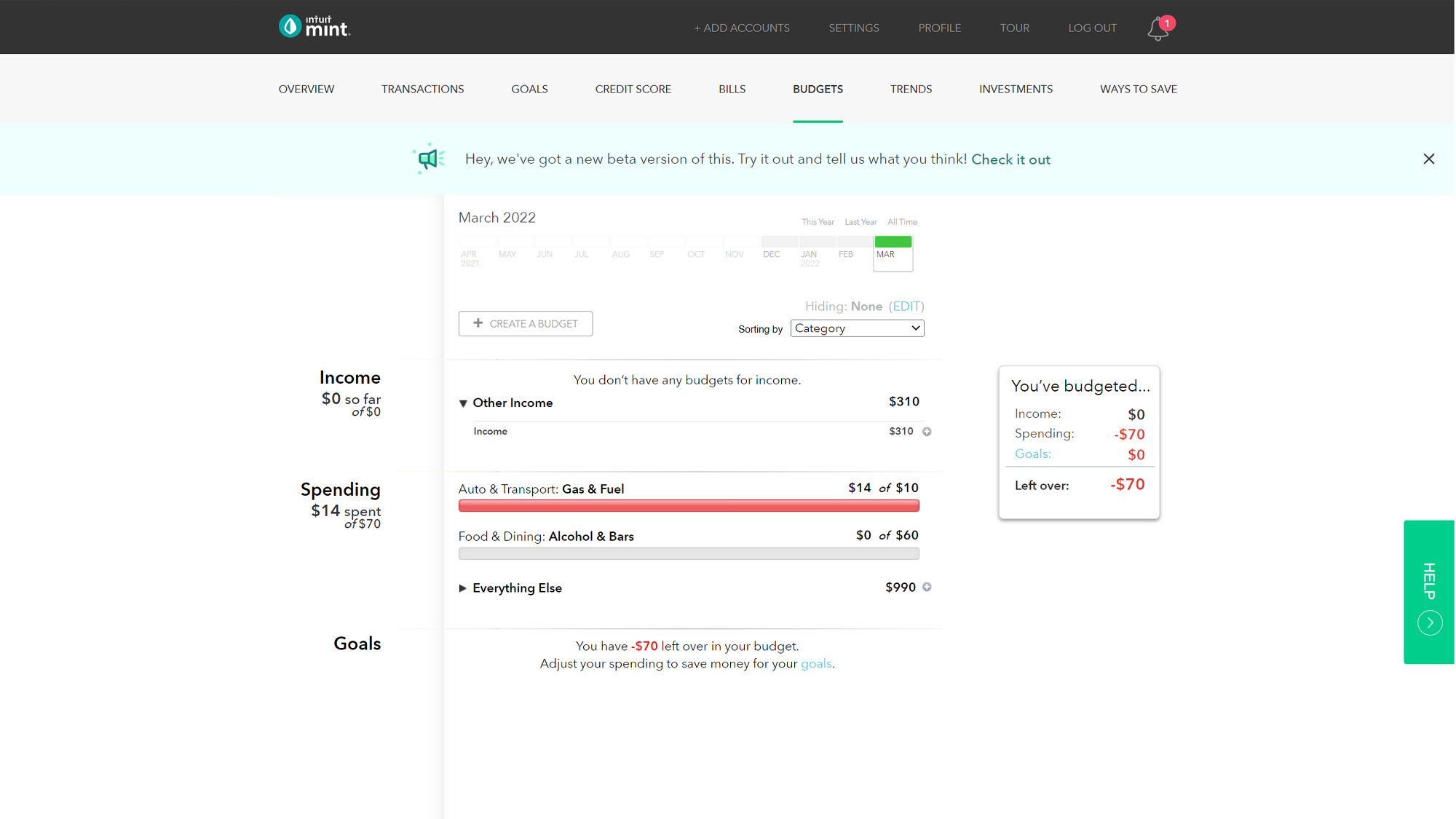

The overview screen is the focal point of Mint’s data presentation. And to be blunt, the first interface we were dropped into looked dated with its small, hard-to-read text and inconsistent visual design.

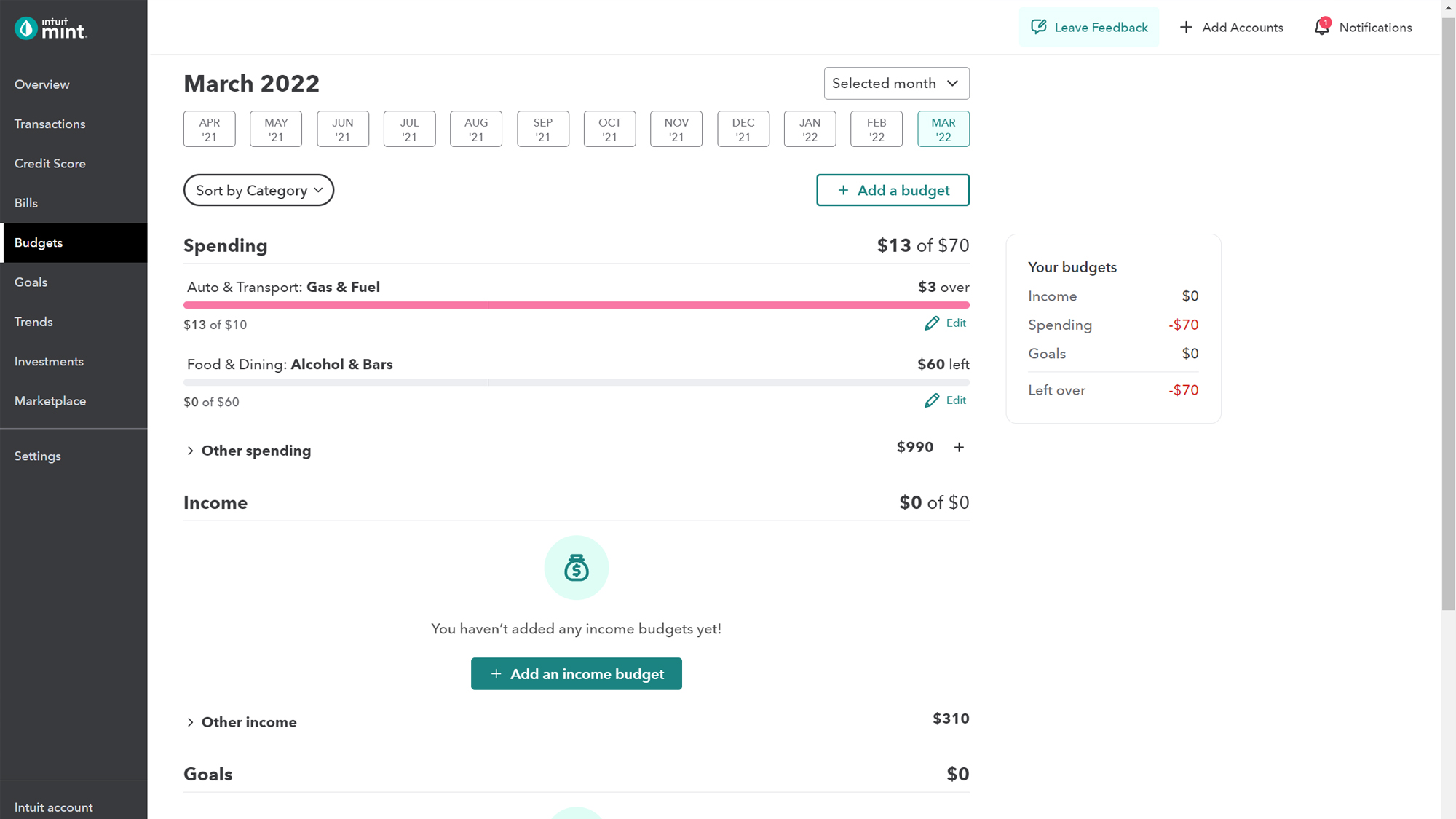

Then we noticed that a beta version of most views was available, and we selected that option. The Mint beta dramatically transformed the service’s usability and visual aesthetic.

According to Intuit, the redesign was rolled out temporarily to a “small percentage” of users, then was paused to make additional changes based on user feedback. Once those issues are resolved at an unspecified time, Intuit says “the rollout will commence.” Since the redesign is so significant, we’ll revisit this review when the rollout begins anew to see if anything about our experience changed.

The redesigned web interface represents a much-needed refresh, and the updated look and feel mimics the current interface of TurboTax. The service uses larger-size fonts fonts and heavier weight for the text, two changes that together boost readability. Even the graphics are larger and easier to read. Curiously, the options here don’t reflect the organization and presentation of the recently updated mobile app (more on that later) — but perhaps that’s part of the beta that remains a work-in-progress.

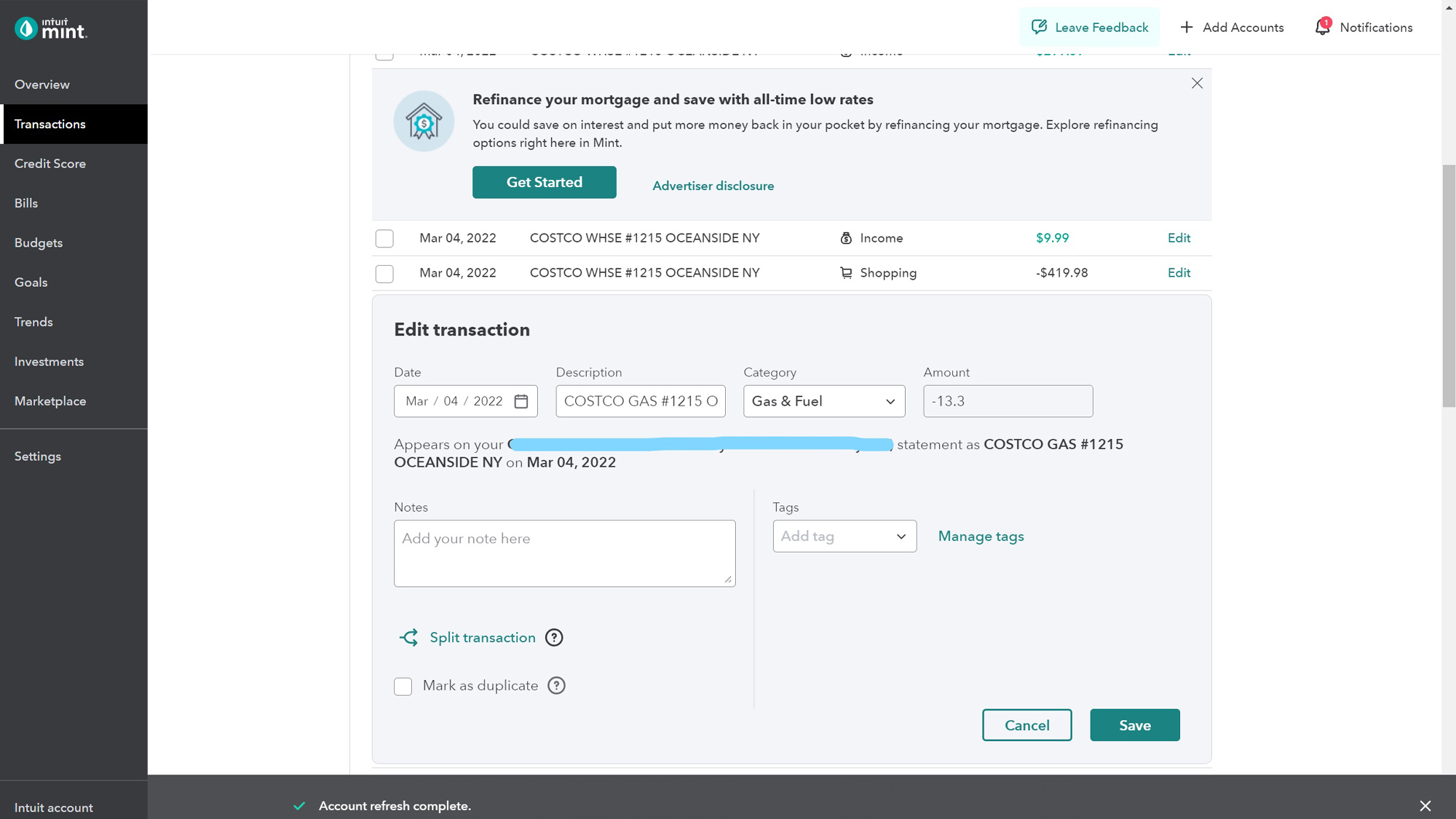

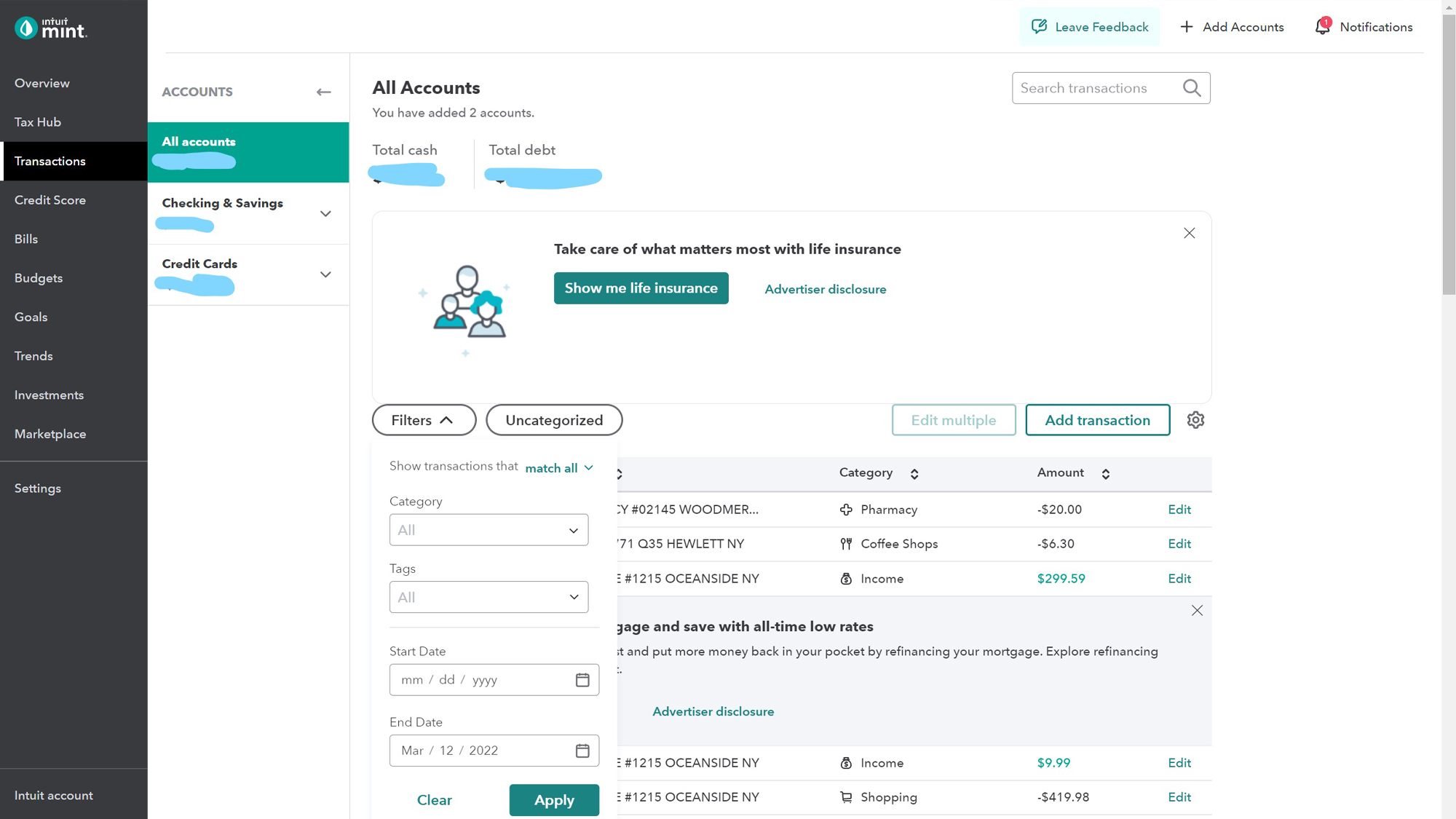

We noticed a smoother experience when we reviewed our credit card transactions. The data was presented clearly, and it was simpler to sort by category using a drop down filter (before it was a hypertext link off on the side of the page, in tiny text).

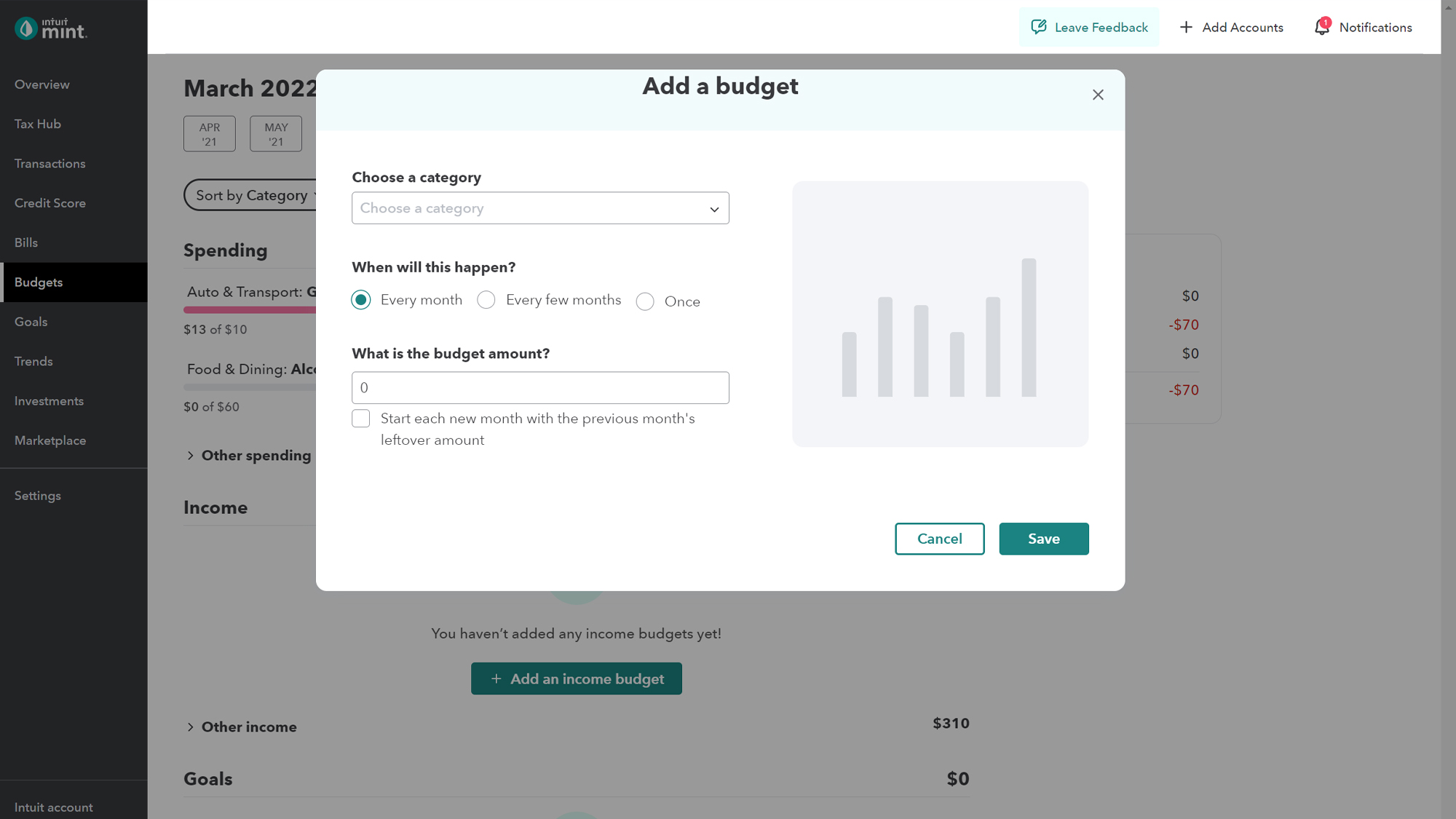

As with the prior version of Mint, the beta Mint site lacks any specific guidance on how to budget. But setting budgets for specific categories is easy, and the service works well to show you your income, spending, and goals all in one place so you can see if you’re on track at any given time.

When adding a budget category, you can choose the frequency, set the budget amount, and choose to start a new month with the leftover amount from the previous month – effectively rolling over any overages or savings. The categories will auto-populate with matching expenses found in your linked accounts. We liked how we could sort by which categories are over or under budget, which is useful for eyeballing areas to cut back on. Your goals appear at the bottom of the page.

Intuit Mint review: Mobile

Intuit offers dedicated iOS and Android apps. We tried the early March update on Android that rolled out a minty green visual redesign that is big on using the data you’ve connected to produce attractive graphics. Only the mobile versions give the option to remove ads, for $0.99 per month or $4.99 for Mint Premium on iOS. Security appears strong — we had two verifications before logging in.

Each section of the service has a button along the top of the screen. Beneath that is a visualization of your habits, a context-sensitive graph that changes depending on which section you’re in. Spending is the first one you’ll see upon opening the app, useful if you’re trying to track how much you’ve spent at a particular time.

For further detail, you’ll scroll down to select from among the buttons below. The main navigation — home, monthly, marketplace, and notifications — is a dock at the bottom of the screen, and only visible when you’re at the top of a page.

Budgets are no longer broken out on mobile as a separate label. Instead, you can access your budget info under the aforementioned new monthly tab — along with your spending, bills and subscriptions, goals, and bill negotiation. The latter aims to reduce your costs and looks like a feature, but it’s an extra-cost service powered by BillShark (you only pay if they succeed). You’re on your own to click around to set a budget — the app lacks guidance on how to get started, and arbitrarily sets the budget for you when you add a category (it chose $100 as the budget, but we could change by adjusting a slider).

You can also manually add a transaction as a budget line item, and select whether it is income or expense and the payment type. On the whole, setting a budget via mobile lacks clarity (for example, you’re adding a transaction to a month, not to every month — as you can clearly do via web browser) and less detailed than we’d have expected. We did like the visuals for monthly cash flow and spending categories, though.

At the time of our review, Mint Premium was only available for iOS (the Android version will come, but Intuit didn’t provide a target release date). Mint Premium adds monitoring and cancellation; spending projections based on your data and trends; a growth estimator for visualizing the impact of a decision today on your monetary future tomorrow; and money spotlights that provide visualizations based on your spending habits and trends as compared with those of your fellow Minters.

Intuit Mint review: Verdict

Mint is a well-rounded and free personal finance service for getting a picture of your fiscal health. The beta interface is light years ahead of where the service has been, but for now Mint still has room to improve clarity and guidance inside the service.

Still, Mint stands alone in offering a 15-minute live consultation with a coach and the option to expand to several sessions (Simplifi by Quicken offers 15-minutes that targets personalized app navigation vs. than financial coaching). The closest any other service came was YNAB, which has free live Zoom education sessions which teach you how to use the service, and provide an opportunity to ask the instructor questions.

We felt that Simplifi by Quicken does a better job helping you think through your cash flow in the context of your greater financial picture, and it handles budgets in a more intuitive way, with better documentation. However, it costs $5.99 per month, making it $4 more than the ad-free version of Mint. Mint’s mix of features and functionality makes it stand out for both monitoring your net worth and setting budgets, but we really hope Mint rolls out its new interface soon.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.