Inflation cools more than expected in Canada

Second month in a row inflation has slowed

Article content

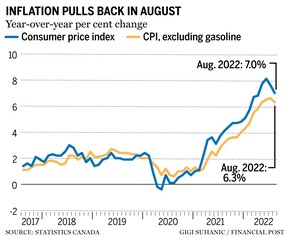

Canada’s headline inflation rate cooled for the second month in a row in August, running at an annualized pace of 7.0 per cent, lower than economist expectations of 7.3 per cent and down from July’s reading of 7.6 per cent.

Advertisement 2

Article content

The decline in the consumer price index was the largest since early in the COVID-19 pandemic, Statistics Canada said Tuesday.

Article content

The drop largely stemmed from lower gasoline prices, which fell 9.6 per cent from the month before, the largest monthly decline since April 2020. Gasoline prices fell the furthest in Saskatchewan and Alberta. The price of gasoline, however, remains 22.1 per cent higher than last year.

Excluding gasoline, prices rose 6.3 per cent year-over-year, down from a 6.6 per cent increase in July.

Travel and accommodation costs are also rising at a slower pace.

The price of groceries, however, surged 10.8 per cent from the year before, the fastest pace since 1981, driven higher by extreme weather, higher input costs and the disruption of supply chains caused by Russia’s invasion of Ukraine.

Advertisement 3

Article content

Meat prices are up 6.5 per cent from last year, dairy, 7 per cent, baked goods, 15.4 per cent and fresh fruit is up 13.2 per cent.

-

![None]()

‘All but set in stone’: More economists join chorus predicting a Canadian recession

-

![Grocery giants Empire and Loblaw say food inflation appears to be stabilizing.]()

Food inflation may have peaked, says head of Canadian grocery giant

All three core measures of inflation, which the Bank of Canada watches closely, eased slightly, but are still a long way from the Bank’s 2 per cent target.

“Even after today’s deceleration, the annual rate of inflation remains well above the Bank of Canada’s target and as such further interest rate hikes are still in the cards,” Andrew Grantham, senior economist at CIBC Capital Markets, wrote in a note after the data.

“However, a clearer gap appears to be opening up between Canadian and U.S. inflation trends, which should bring a lower peak from the Bank of Canada than the Federal Reserve.”

Advertisement 4

Article content

Leading up to the inflation figures released Tuesday, economists had been opining that price pressures in Canada could fall faster than in the U.S. CIBC’s chief economist Avery Shenfeld said the difference in the treatment of shelter costs in Canadian inflation figures could cause cost pressures excluding food and energy to tumble at a quicker pace.

While the second monthly dip in inflation readings may have policymakers resting somewhat easier, Royce Mendes, managing director and head of macro strategy at Desjardins, wondered in his note following the data whether the figures were “too good to be true.”

“We’ve seen head fakes in the numbers before, with recent data on U.S. inflation a prime example,” Mendes said in a Sept. 20 note. “However, it could be true that easing supply chain pressures, falling commodity prices and a highly interestrate sensitive economy are all conspiring to see price growth cool in Canada ahead of other jurisdictions.”

Mendes added that the numbers Tuesday reinforce the Desjardins economics team’s stance that the Bank of Canada holds one more 50-basis point hike up its sleeve.

Overall, economists expect that the central bank will err on the side of caution and will deliver another rate hike on Oct. 26.

• Email: [email protected] | Twitter: StephHughes95

Advertisement

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.