In Vitro Diagnostics Market Size is projected to reach USD 149.4 Billion by 2032, Due to the rising incidence of chronic Diseases

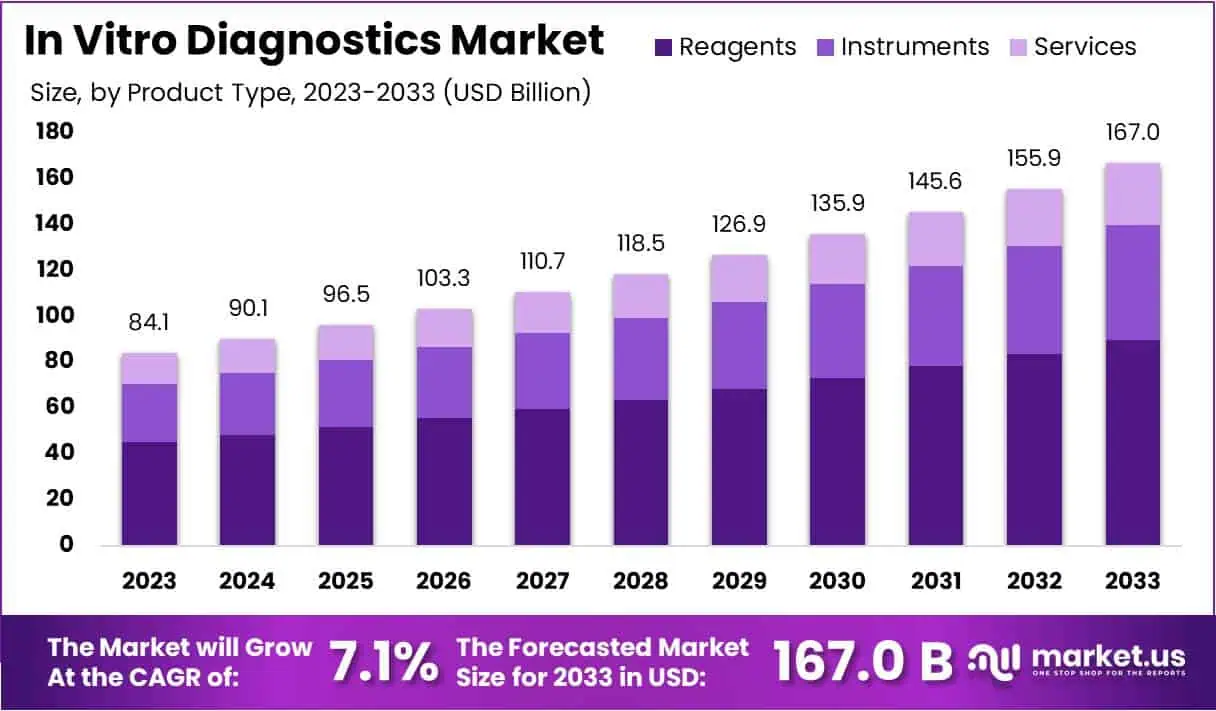

New York, March 21, 2023 (GLOBE NEWSWIRE) — The in vitro diagnostic market was valued at around USD 93.5 billion in 2022 and is estimated to be worth approximately USD 149.4 billion in 2032, growing at a CAGR of slightly above 4.7% between 2023 and 2032. Automated intravenous diagnostic (IVD) systems are used in hospitals and laboratories to provide an accurate, quick, and error-free diagnosis. The number of IVD (in-vitro diagnostics) products that are being introduced by leading players is also helping to boost the market’s growth. The efficient and precise results of Molecular Diagnostic IVD products are impressive.

To get additional highlights on major revenue-generating segments, Request a In Vitro Diagnostics Market sample report at https://market.us/report/ivd-in-vitro-diagnostic-market/request-sample/

Key Takeaway:

- By product and services, in 2022, the reagents segment had a market share of 55%.

- By technique, In 2022, the molecular diagnostics segment held 38.5% of the market.

- By application, the infectious disease segment dominated the market with a share of 60.5% in 2022.

- By end-user, the laboratory segment accounted for 40% of the total share in 2022.

- In 2022, North America dominated the market with the highest revenue share of 38%.

The University of California invented an ultrasensitive molecular test in May 2021. This test can differentiate between SARS-CoV-2 antigens and influenza A. The test is now a Point of Care (POC) test. The industry has changed. As a result, more players are now focusing on home-based testing. The FDA prioritized home-based molecular diagnostic testing in 2021. BATM Progressed Correspondences Ltd. reported that the sub-atomic diagnostics test pack was sent to the Coronavirus location in March 2021.

These tests also have a low chance of being replaced, allowing for early disease detection. Patients are expected to use their external reserves due to the high cost of these tests. The high rate of internal substitution to detect newer infections such as SARS-CoV-2 also increases competition. IVD products made by established companies aren’t widely used in APAC. Instead, local musicians sell instruments at a lower price. Technology portability, accuracy, and cost-effectiveness are the main drivers of this market.

Factors affecting the growth of in vitro diagnostics market?

There are several factors that can affect the growth of the in vitro diagnostics market. Some of these factors include:

- Increasing awareness about early disease diagnosis: The importance of timely and accurate diagnostic tools in the clinical setting is becoming increasingly acknowledged.

- Advances in technology: Technological advancements have enabled the development of more accurate and efficient testing methods, as well as providing novel ways of analyzing and interpreting test results. This has allowed IVD manufacturers to produce highly sensitive products that provide improved accuracy and faster results, making them extremely attractive to healthcare providers.

- Government support and funding: The in Vitro Diagnostics (IVD) Market is significantly impacted by the provision of government support and funding. Governmental agencies provide incentives in the form of financial contributions, subsidies, and grants which facilitate growth within this competitive market sector.

- Increasing demand from emerging countries: Emerging countries are experiencing rapid economic growth, resulting in increased disposable incomes among their citizens. Consequently, this has led to an increase in the number of individuals with access to medical care and diagnostic services.

To understand how our In Vitro Diagnostics Market report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/ivd-in-vitro-diagnostic-market/#inquiry

Top Trends in the Global in Vitro Diagnostics Market

In response to the rising incidence of diseases, medical device manufacturers continue to develop technologically advanced diagnostic tools. Hospitals and laboratories increasingly seek accurate, real-time information from point-of-care testing devices. As a result, in vitro diagnostics instruments are likely to be in high demand.

This significant increase also helps the market expand by introducing cutting-edge products.

- Hoffmann-La Roche Ltd. launched the Cobas pulse glucose testing instrument in March 2021. As a result, AccuChek Inform II will be replaced by the new product.

- According to the EUA, Abbott conducted a molecular test in March 2020 to detect COVID-19 in America using its IDNOW rapid point-of-care platform.

Market Growth

The In Vitro Diagnostics (IVD) Market is exhibiting a sustained upward trajectory in terms of growth. This can be attributed to the increased demand for cost-effective, accurate and timely diagnostic services globally across healthcare systems. Another contributing factor to this trend has been the emergence of technological advancements such as automated systems, which have revolutionized the IVD sector by making processes faster and more efficient.

Regional Analysis

Based on geography, the global market can be subdivided into North America, Europe, Asia Pacific, Latin America, and Middle East, and Africa. Among these, North America dominated the global market in 2022. It contributed more than 38% to the total revenue. Moreover, it is expected to continue its dominant market position during the forecast period. This market is driven by many factors, including rising rates of chronic diseases, a rapidly growing senior population, high healthcare costs, and government support.

The increasing demand for genetic testing will drive market expansion in North America to personalize health care, such as treatment for cancer and diabetes. However, Asia Pacific will be the fastest-growing region during the forecast period and will have a large revenue share in 2022. In vitro diagnostics tests can diagnose many conditions, including cancer, heart disease, and cardiovascular problems. The Asia-Pacific region market is expected to grow due to stabilizing economies, an expanding middle-class population, and favorable government policies.

Have Queries? Speak to an expert, or To Download/Request a Sample, Click here.

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 95.3 Billion |

| Market Size (2032) | USD 149.4 Billion |

| CAGR (from 2023 to 2032) | 4.7% |

| North America Revenue Share | 38% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

Many diseases, including genetic, neurological, and cardiovascular diseases, are rising. According to the World Health Organization, CVDs, which account for 17.9 million deaths yearly, are the leading cause of demise. This has helped expand the market by increasing public awareness about early and routine diagnoses. The introduction of cutting-edge IVD products also helped the market’s rapid growth. Many diseases such as diabetes, hypertension, liver, cardiovascular, kidney, and other diseases are expected to increase in the elderly population.

Market Restraints

In vitro diagnostics products have significantly advanced in adopting new products or making design modifications in the last ten years. However, the high upkeep costs and IVD instruments impeded the market’s growth. In-vitro diagnostics instruments require skilled professionals. Therefore, the market slows down as the price of maintaining the device increases. The cost of an RT-PCR system can range from USD 15,000 to more than USD 90,000. This is why in vitro diagnostics products are not widely used in many countries and regions.

Market Opportunities

Emerging economies such as Brazil, India, China, Brazil, South Africa, and Turkey will offer growth opportunities to major players in the IVD industry. The Asia Pacific region is known for being adaptable and friendly due to its data requirements and relatively relaxed regulations. China is one of the largest investors in R&D. Agilent Technologies (US), which is a manufacturer of spectrometer systems, has invested USD 20,000,000 in 2022 in order to meet China’s growing demand for advanced mass spectroscopy (MS), liquid Chromatography (LC) and other spectrometers.

Grow your profit margin with Market.us – Purchase This Premium In Vitro Diagnostics Market Report at https://market.us/purchase-report/?report_id=96594

Report Segmentation of the in Vitro Diagnostics Market

Product and Services Analysis

In 2022, the reagents segment had a market share of 55%. Blood, stool, and urine are all tested for infection using software and reagents for in vitro diagnosis (IVD). Many IVD devices also employ molecular, tissue, immunodiagnostics, and haematological diagnostics. For the IVD market’s management and application, technical proficiency is required. Specialist medical facilities use diagnostic devices as a result.

IVD products can be used in hospitals, laboratories, and point-of-care testing areas. In vitro testing requires multiple reagents as well as software to ensure smooth operation. In vitro diagnostics can also diagnose many HIV/AIDS-related conditions, such as infectious diseases, cancer, diabetes, cardiac diseases, nephrology autoimmune disorders, and medical disorders.

The IVD market’s expansion is largely due to increased chronic and other infectious diseases. In the current economic climate, chronic diseases such as diabetes, cancer, heart disease, and tuberculosis are rising. In addition, there is also a rise in patients suffering from infectious diseases such as STDs, respiratory, gastrointestinal, and STDs. These diseases are expected to increase the demand for diagnostic tools, which is driving the IVD market.

Technique Insight

In 2022, the molecular diagnostics segment held 38.5% of the market. This was due to new products and technological developments. Complex equipment is required for PCR. However, research has led to innovations such as postage stamp-sized plasmofluidic chips. According to ACS Nano Journal, plasmofluidic chips are extremely efficient and fast. They are expected to speed up diagnosis for current and future pandemics due to their ability to run a PCR test in eight minutes. In 2022, there were several new products in the immunoassay marketplace.

Diagnostic tools include plating patient samples and obtaining pure cultures. Antibiotic susceptibility testing is one of the most popular microbiology testing applications. As the number of infectious diseases increases, the microbiology industry will grow. In addition, the FDA’s January 2022 approval of advanced devices such as Colibri will likely encourage the development and using clinical microbiology analysers. This will make it easier to implement AI-based automated workflows.

Application Insight

With a market share in 2022 of 60.5%, the infectious disease segment dominated. IVDs makes it possible to detect contagious disease-causing microorganisms. The most serious infections that can lead to death are hepatitis, tuberculosis, pneumonia, hepatitis, and HIV/AIDS. Major market players have joined forces to make getting high-quality, cutting-edge laboratory services for patients and providers easier. For example, quest Diagnostics and Memorial Hermann Health System teamed up in January 2020 to provide improved, high-quality, and cost-effective diagnostic services to 21 hospitals located in the Huston area. Market growth will be boosted by such efforts by market players to expand.

End-User Insight

The market is divided into different end-user segments, such as hospitals, home care, laboratories, and other end-users. The laboratory market was the largest worldwide end-use market, accounting for 40% of the total revenue in 2022. The market for laboratory services is expected to grow due to several factors. These include increased awareness about personalized medicine, higher demand for affordable services, and technological advances. This market is also one of the main revenue-generating segments due to its large laboratory testing volume.

Laboratory-based tests are more reliable than PoC and home tests, giving them an edge over the other categories. Hospitals held a large share of the market in 2021 due to increased hospitalizations requiring faster diagnostics. The ongoing improvement in healthcare infrastructure will also lead to an increase in the number of existing hospitals. As a result, hospitals are increasingly required to perform IVD tests. Hospitals purchase the majority of IVD devices, and they are used frequently. IVD tests are more reliable and provide quicker results. This means that over 6,093 hospitals across the United States will need constant IVD assistance in order to make crucial decisions in 2022.

Recent Development of the in Vitro Diagnostics Market

- Thermo Fisher Scientific (US) introduced the rapid RTPCR Accula Flu A/Flu B Test in November 2022. It is designed to allow healthcare providers to differentiate and identify influenza A/B within 30 minutes quickly.

- Thermo Fisher Scientific (US) agreed to acquire The Binding Site Group, a leading company in specialty diagnostics. The Binding Site offers specialty instruments and diagnostic tests to help improve the diagnosis and management of immune system disorders as well as blood cancers.

- The UF-1500 Fully Automated Urine Particle Analyser (UF-1500) was launched by Sysmex Corporation, Japan (September 2022) for urine sediment testing.

- Abbott Laboratories in the US and AL-Futtaim Health in Dubai entered a strategic partnership to raise standards for advanced laboratory diagnostics in Dubai in August 2022.

For more insights on the historical and Forecast In Vitro Diagnostics Market data from 2016 to 2032 – download a sample report at https://market.us/report/ivd-in-vitro-diagnostic-market/request-sample/

Market Segmentation

Based on Product and Services

- Reagents

- Instruments

- Software and Services

Based on the Technique

- Immunodiagnostics

- Haematology

- Molecular Diagnostics

- Tissue Diagnostics

- Clinical Chemistry

- Other Techniques

Based on Application

- Infectious Diseases

- Cancer

- Cardiac Diseases

- Immune System Disorders

- Nephrological Diseases

- Gastrointestinal Diseases

- Other Applications

Based on End-User

- Hospitals

- Standalone Laboratories

- Academic and Medical Schools

- Point of Care

- Other End-Users

By Geography

- North America

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The competitive landscape of the market has also been examined in this report. Some of the major players include-

Related Reports

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn | Facebook | Twitter

Our Blog:

For all the latest Health News Click Here

For the latest news and updates, follow us on Google News.