Hunt Wins Backing of Bailey’s BOE, Leaving Truss Sidelined in UK

Chancellor of the Exchequer Jeremy Hunt won a crucial endorsement from the Bank of England for his plan to stabilize the UK’s strained public finances that leaves Prime Minister Liz Truss looking increasingly marginalized.

Article content

(Bloomberg) — Chancellor of the Exchequer Jeremy Hunt won a crucial endorsement from the Bank of England for his plan to stabilize the UK’s strained public finances that leaves Prime Minister Liz Truss looking increasingly marginalized.

Advertisement 2

Article content

Less than 24 hours after he was pulled from the backbenches to rescue Truss’s crumbling government, 55-year-old Hunt announced he was effectively ditching the premier’s dash-for-growth strategy and had spoken to BOE Governor Andrew Bailey to secure his backing.

Article content

“There is a very clear and immediate meeting of minds on the importance of sustainability,” Bailey told a panel on the sidelines of the International Monetary Fund’s annual meetings in Washington, where Hunt’s predecessor Kwasi Kwarteng was the target of running jokes before he left the US to be fired.

Bailey also made clear that Hunt will most likely have to contend with tighter monetary policy than he might previously have expected.

“We will not hesitate to raise interest rates to meet the inflation target,” he said. “My best guess is that inflationary pressures will require a stronger response than we perhaps thought in August.”

Advertisement 3

Article content

The renewed alliance between the Treasury and the central bank draws a line under months of bad blood which saw Truss and her outriders sniping at Bailey over surging prices only to then be rescued by the BOE when their tax-cutting plans triggered collapses in the pound and bonds.

It also demonstrates a united front to investors ahead of a critical trading session on Monday, the first since Bailey withdrew the BOE’s safety net for long-dated gilts.

UK assets tumbled on Friday after a shaky press conference by Truss in which she followed the sacking of Kwarteng by dumping plans to freeze corporation tax and promising spending cuts in a desperate bid to restore credibility.

A person familiar with the prime minister’s thinking said later on Friday that she had struck an agreement with the new chancellor that he wouldn’t abandon any more of her agenda.

Advertisement 4

Article content

But there was little sign of that commitment when Hunt made his first public statements on Saturday morning.

“We won’t have the speed of tax cuts we’re hoping for and some taxes will have to go up — that’s the reality of the very challenging situation we face,” he told Sky News. “Spending will not go up as much as people want and there’ll be more efficiencies to find.”

Hunt plans to delay by a year a plan to cut the basic rate of income tax, saving £5 billion ($6 billion), according to a report in the Sunday Times. The newspaper said the Office for Budget Responsibility forecast a shortfall of as much as £72 billion in the public finances by 2027.

The UK has been in the grip of a deep political crisis and financial turmoil since the government promised £45 billion of unfunded tax giveaways. Bloomberg Economics puts the hit to the economy at as much as 2% of gross domestic product.

Advertisement 5

Article content

Truss has now reversed £20 billion of the cuts. But her performance since taking office on Sept. 6 has provoked widespread mockery. One British tabloid has set up a live webcam showing a lettuce, asking whether it will last longer than the prime minister.

Hunt, a highly experienced minister, ran against Truss for the Tory leadership and then backed former Chancellor Rishi Sunak.

Truss now faces a mutinous party calling for her head. The Observer newspaper reported senior MPs will meet on Monday to discuss her future with some wanting her to resign within days.

The new chancellor made clear that while he agrees with Truss’s argument about the need for growth, he disagrees with how she and Kwarteng went about it.

Using borrowing to fund tax cuts “doesn’t work,” he told BBC Radio. Other “mistakes” included trying to cut taxes for the UK’s highest earners, he told Sky News, a plan they abandoned amid a ferocious political backlash.

Advertisement 6

Article content

“The thing that people want, the markets want, the country needs now is stability,” Hunt said. “No chancellor can control the markets. But what I can do is show that we can pay for our tax and spending plans.”

He said all government departments would have to tighten their belts, though he denied there would be a return to austerity of the level imposed by the Conservative-led coalition government in the early 2010s.

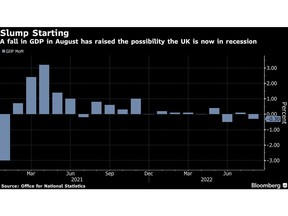

Truss and Kwarteng had staked their political reputations on an all-out push for growth through the biggest set of tax cuts in half a century. What they achieved instead was a collapse in UK credibility and a market sell-off that drove borrowing costs up for millions of households and businesses raising the risk of a recession.

Advertisement 7

Article content

The squeeze on spending may yet get worse, with the BOE expected to raise rates by as much as a 1 percentage point, the biggest move since 1989, at its next meeting on Nov. 3. By then, the Bank will have the new chancellor’s fully-costed budget to inform its decision.

The dramatic u-turn in policy is a victory for the institutions like the BOE, the Treasury’s civil service, and the IMF which try to ensure politicians implement realistic economic policy. Truss won office criticizing orthodoxy.

The IMF chastened the UK ahead of its meetings in Washington and officials from several countries present at the talks described Britain as a laughing stock.

At Saturday’s seminar, Bailey was introduced as “the central banker of the moment” to sympathetic laughter from the room, and he went on to reveal that he had privately warned Kwarteng of the need to demonstrate fiscal sustainability.

On the same panel, the Dutch central banker Klaas Knot explained that he tries not to worry too much, despite a daunting set of policy challenges in the euro-area, including soaring inflation, energy shortages and the war in Ukraine.

“Nothing keeps me awake at night — there’s nothing to be gained,” he said. “Unless, of course, we were to have a crisis like in the UK. Then probably I would also have to make a few all nighters.”

Advertisement

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.