H&R Block Deluxe 2023 review (tax year 2022): Friendly, colorful, helpful tax preparation experience

H&R Block Deluxe: Specs

Mobile app: iOS, Android

Online support: Email, live chat, screen share and phone (with Online Assist, available weekdays 7 a.m. to 11 p.m., weekends 9 a.m. to 9 p.m. CST)

Phone support: None (tax pro calls you with Online Assist)

Tax pro assistance: Yes, Online Assist starts at $70 (price varies depending upon tax service); Online Assist + Tax Pro Review starts at $90

H&R Block consistently delivers one the best tax software services, and its H&R Block Deluxe 2023 service continues this tradition. Moreover, the service has several useful updates for tax year 2022, with clear guidance on complex tax topics (including crypto) and a colorful, visual interface whose efficient design keeps tax prep from feeling overwhelming. Plus, the service integrates cogent explanations that break down tax lingo in a digestible way. H&R Block still has the cleanest and most friendly user experience we’ve seen. But what it still lacks is a seamless, all-virtual way of having a tax pro handle your taxes from start to finish.

For this H&R Block Deluxe 2023 review (which covers the 2022 tax year), we started out using the first paid tier of H&R Block’s do-it-yourself online tax prep product, and noted the upgrade paths and differentiators. Read the rest of our review to find out if this is the best tax software for you.

H&R Block Deluxe 2023 review: Pricing

H&R Block’s federal online tax service encompasses four tiers (opens in new tab), each with a stacking list of added features and form support. New this year is seeing H&R Block refer to the service as eFile Tax Preparation; alternately, the company’s site refers to it as its do-it-yourself product. Minor details, but details nonetheless.

The free tier includes unemployment income, an uncommon feature for this tier among its competitors. The other tiers have simplified names from last year, and all went up slightly – but not as much as with other competitors: Deluxe ($55), Premium ($75) and Self-Employed ($110). The Deluxe version adds real estate taxes and self-employed income; Premium adds support for investments, including cryptocurrency; and Self-Employed adds Schedule C deductions and asset depreciation.

The company has a $220 small business product (up from $145) under its Block Advisors banner. This service integrates with other small business services, and includes tax pro assistance at a lower price than if you buy the Self-Employed product and add it on later. A DIY-version of business taxes starts at $85. A separate product for expat U.S. citizens starts at $99 (or $199 with a tax advisor).

This year, Online Assist is broken out as its own product line, such that you can sign up for H&R Block’s tax expert help (opens in new tab) from the get-go. Online Assist adds unlimited screen share and on-demand chat and video assistance. Pricing starts at $70 for the Basic version, and scales from there (but that’s not published). You can start with Online Assist, or add it as an upgrade from within the product.

If you choose to file with a tax pro, that path leads you to a different product page and onboarding process, one that’s tied to making an appointment with an H&R Block tax pro. Pricing starts at $85, but beyond that tagline, you don’t see detail up front about how much the service may cost you given your specific tax situation.

If you prefer to keep your data locally and out of the cloud, H&R Block has four Mac/PC downloads (opens in new tab) as well, starting at $29.95 for the Basic version and scaling up to $79.95 for Premium & Business (appropriate for small business owners).

H&R Block Deluxe 2023 review: State filing

Except for H&R Block’s Free Online version, which includes a state tax return at no cost, other H&R Block online versions require an additional $37 per state. State e-filing is included in all online versions. As always, you move onto the state return only after completing a federal return; the service will auto-populate relevant information accordingly.

The Deluxe+State, Premium, and Premium & Business download versions all include the software for one state form, but bizarrely charge $19.95 to e-file (except in N.Y.). Additional state programs cost $39.95 each. For Basic, it costs $39.95 for the state return, or $19.95 to e-file. (Note: This is the only place on H&R Block’s tax site that shows dollars and cents; all prices are otherwise already rounded off, a welcome change).

H&R Block Deluxe 2023 review: Features

H&R Block’s Free Online (and Basic download) versions are meant only for simple federal tax returns. As soon as you have a deduction to declare (beyond the Child Tax Credit or student loan interest), you need to step up to a higher tier with more features that let you deduct things like donations, real estate taxes and mortgage interest. The free version handles unemployment income, an uncommon find at this tier as compared with the competition.

If you’re self-employed with no expense deductions, you can use the Deluxe tier. At the Premium level, you gain support for rental income and deductions, Health Savings Accounts tracking, and investment and cryptocurrency transactions.

The Self-Employed version offers more complete support for independents and freelancers, full Schedule C business expense deductions and support for filing for home-office deductions, depreciation and vehicle expenses. If you start at a lower tier you can upgrade along the way.

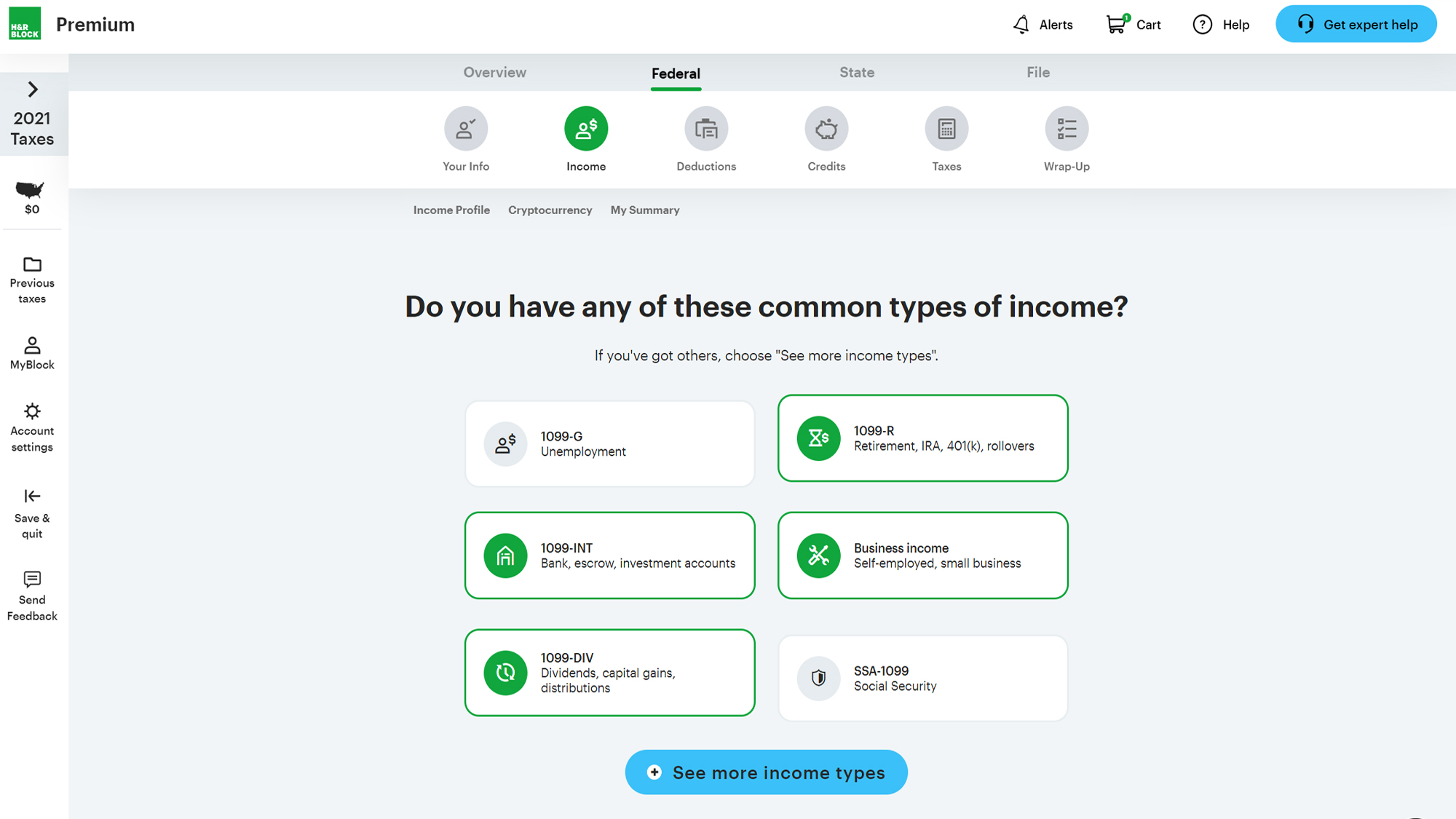

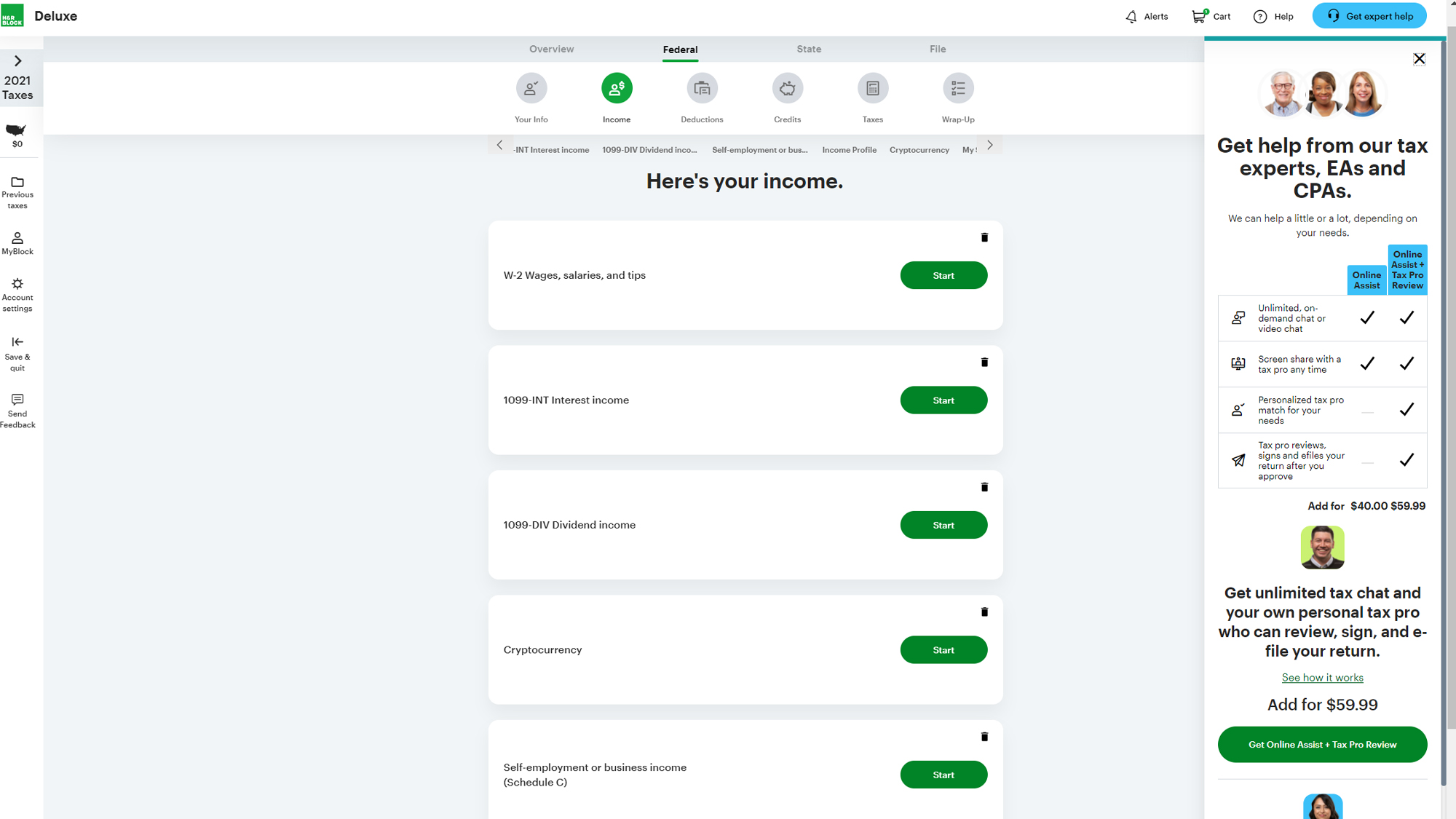

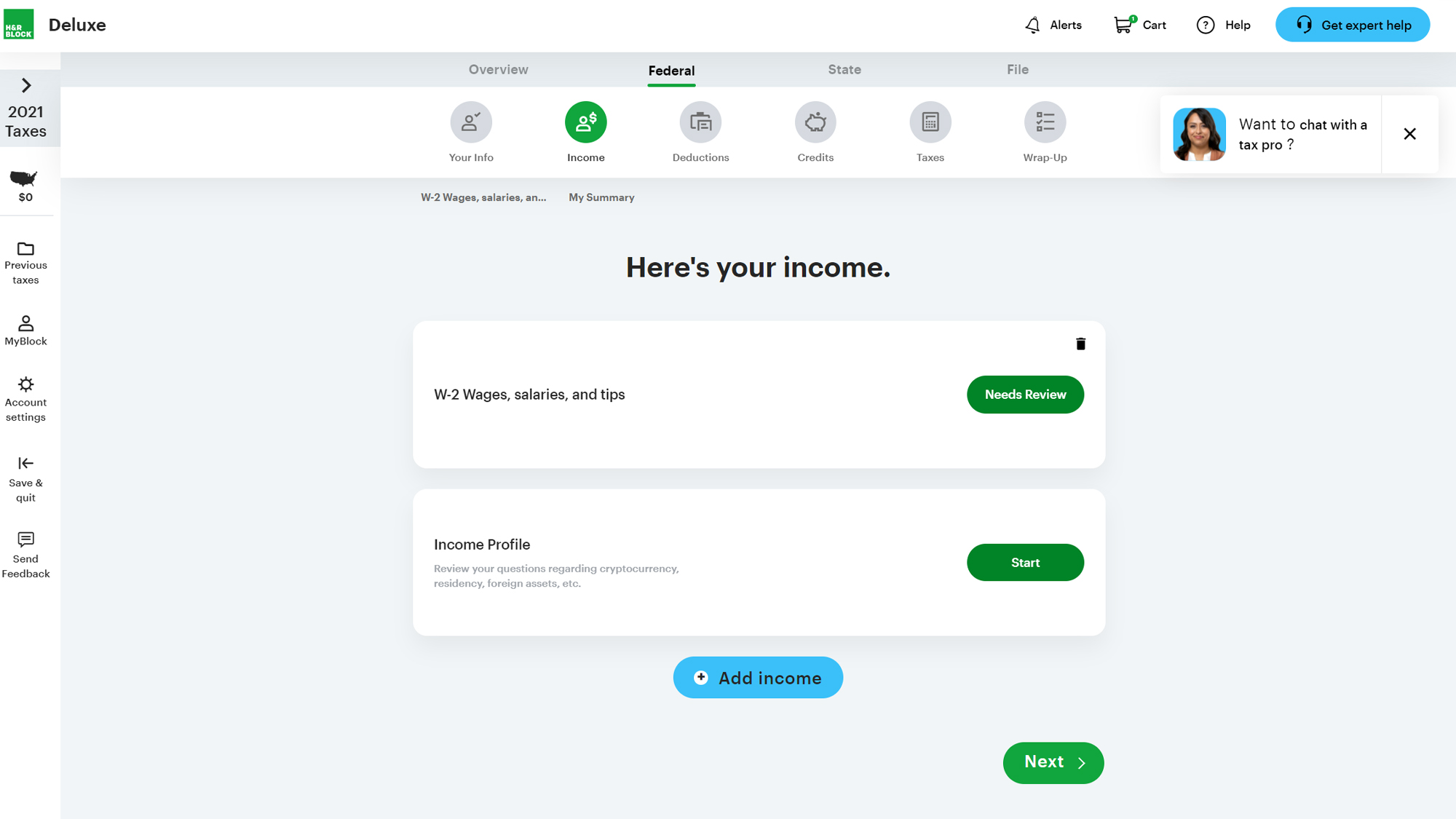

The service has revamped its income hub to reflect societal changes since the start of the pandemic. The tweaks bring trends like more self-employed, multiple W-2 forms and cryptocurrency investment gains to the forefront, so you can consider them earlier and more naturally in the process.

H&R Block Deluxe 2023 review: Available help

As a baseline, all H&R Block products include the online help pane and text-chat technical support offering free, 24/7 guidance on using the product.

Additional tax expert help has gotten significantly less costly. Online Assist connects you with a tax pro over video, phone, screen share or chat (hours available are 7 a.m. to 11 p.m. CT weekdays, and 9 a.m. to 9 p.m. CT weekends). If you didn’t choose expert help at the outset, you can add it anytime from the nav bar, or from the pop-ads that occasionally appear reminding you of this upsell.

Tax Pro Review (opens in new tab) is an upgrade, and you can’t find pricing on the site. Instead, this feature now says your tax complexity determines the cost, for example, with Deluxe costing $60 and Premium costing $90. The lack of transparency is a disappointment, considering last year it was clearer how much you were paying to step up, with the price scaling up based on your tier of service.

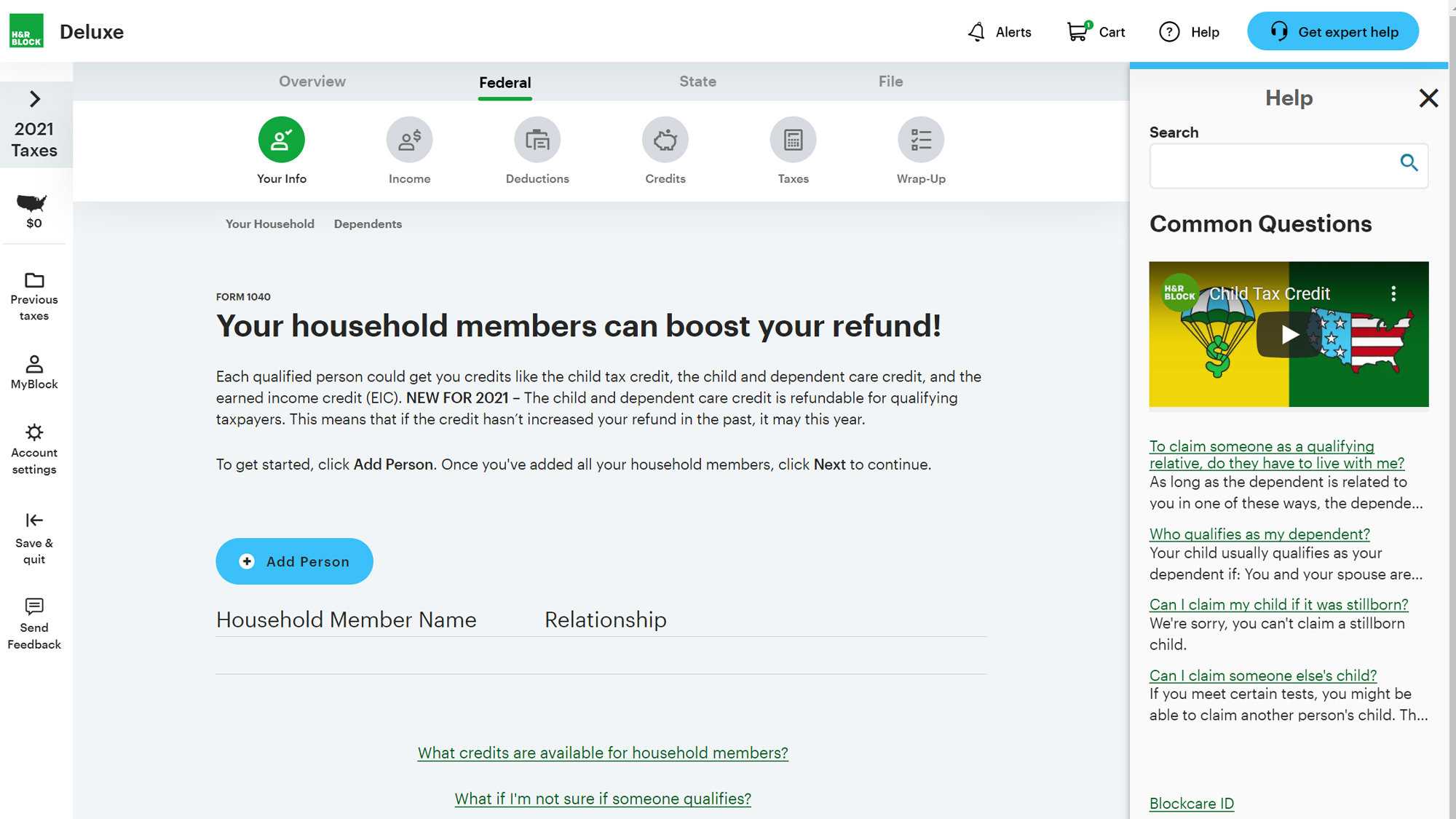

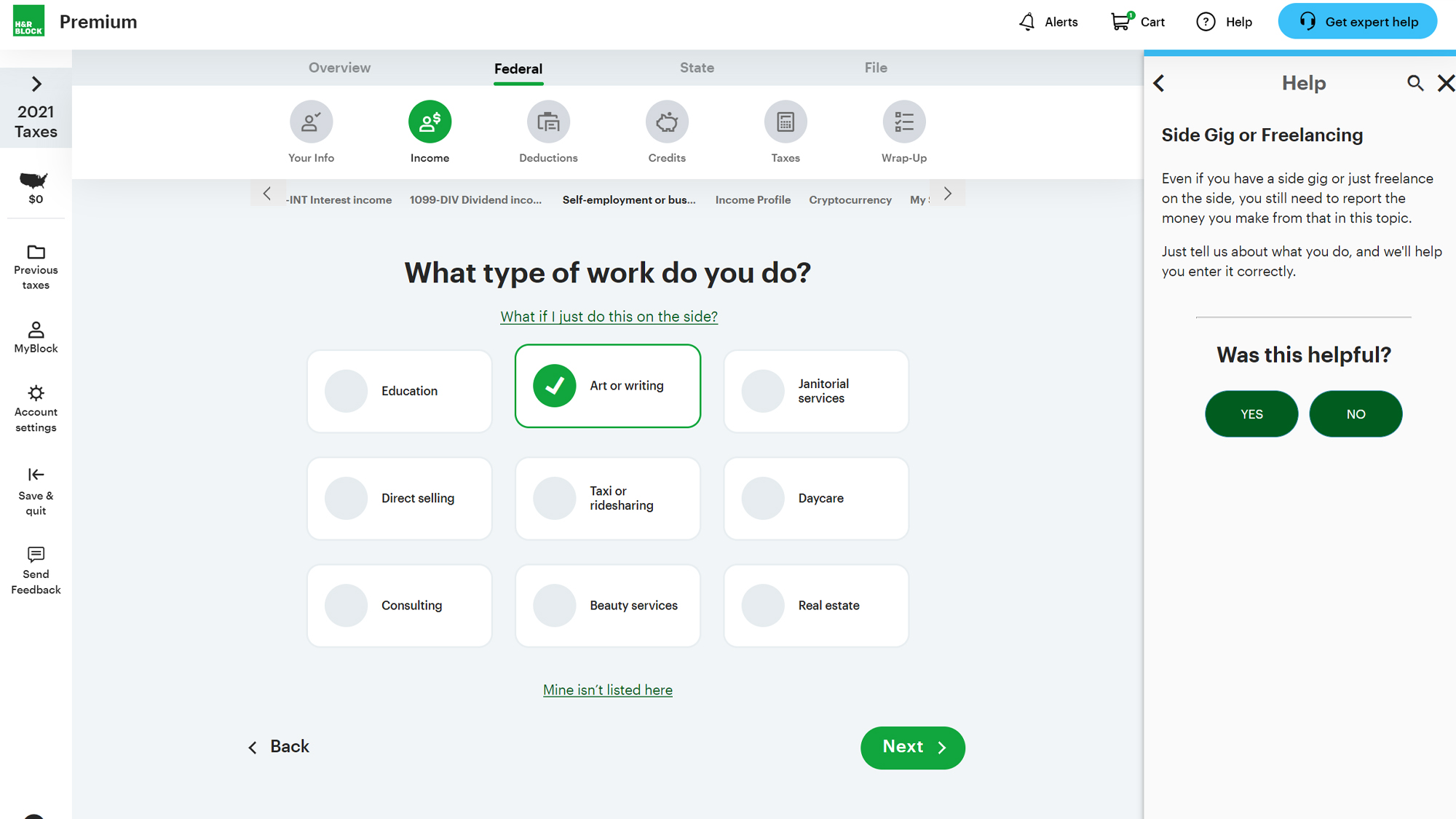

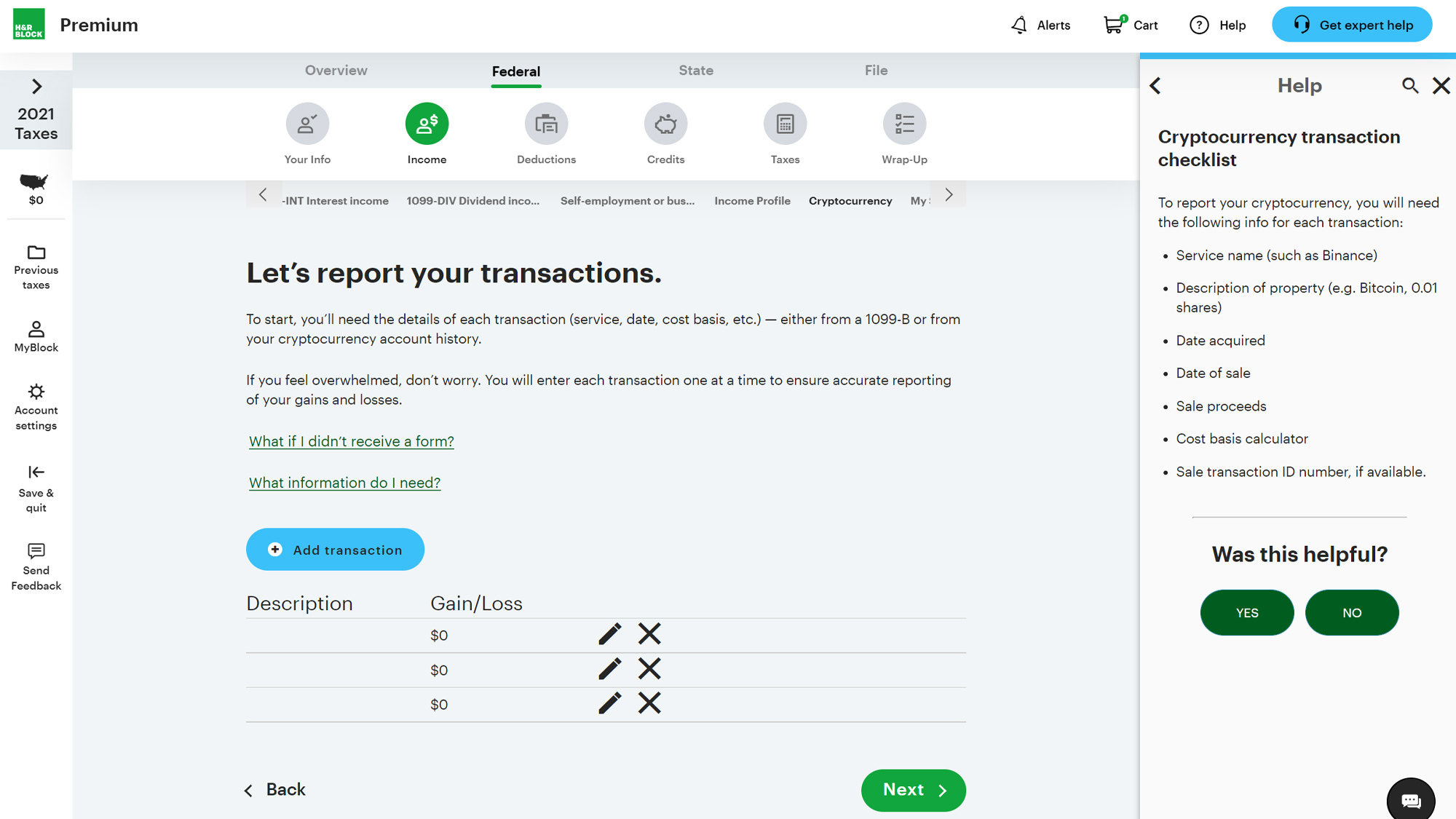

We were pleased to see H&R Block continues to evolve its help content, both with original writing and videos. The key-art style of blog posts on current tax topics — as found on the My Block page accessible through the left nav pane — makes learning more approachable. And as you move through your online return, you get context-sensitive help at the ready, always visible in a right-hand pane that can be accessed by the question-mark icon on the top navigation bar, or by clicking on a link in the main interface.

The help pane conveniently auto-populates to show relevant deeper explanations of terms. This pane’s time-saving design minimizes how much you fumble around the interface — making it a pleasure to use. Help includes answers to common questions, a search bar and related additional information. H&R Block says it has some new pop-ups to dig into more challenging topics.

Unlike TurboTax’s Live Full Service option, H&R Block’s do-it-all virtual tax pro service is still marketed outside of the do-it-yourself online services reviewed here. This more hybrid approach can have all-virtual communication, or you can go into a local H&R Block office and see a live tax pro.

Unfortunately, to set this up online, you have to enter your zip code and choose a local tax pro online to start the process, extra steps the fully virtual TurboTax Live Full Service on-boarding lacks. H&R Block says they use your zip code to match you with a tax pro with expertise on your state’s taxes, but that still doesn’t account for why we had to pick a tax pro from a local office before we could move forward.

H&R Block Deluxe 2023 review: Ease of use

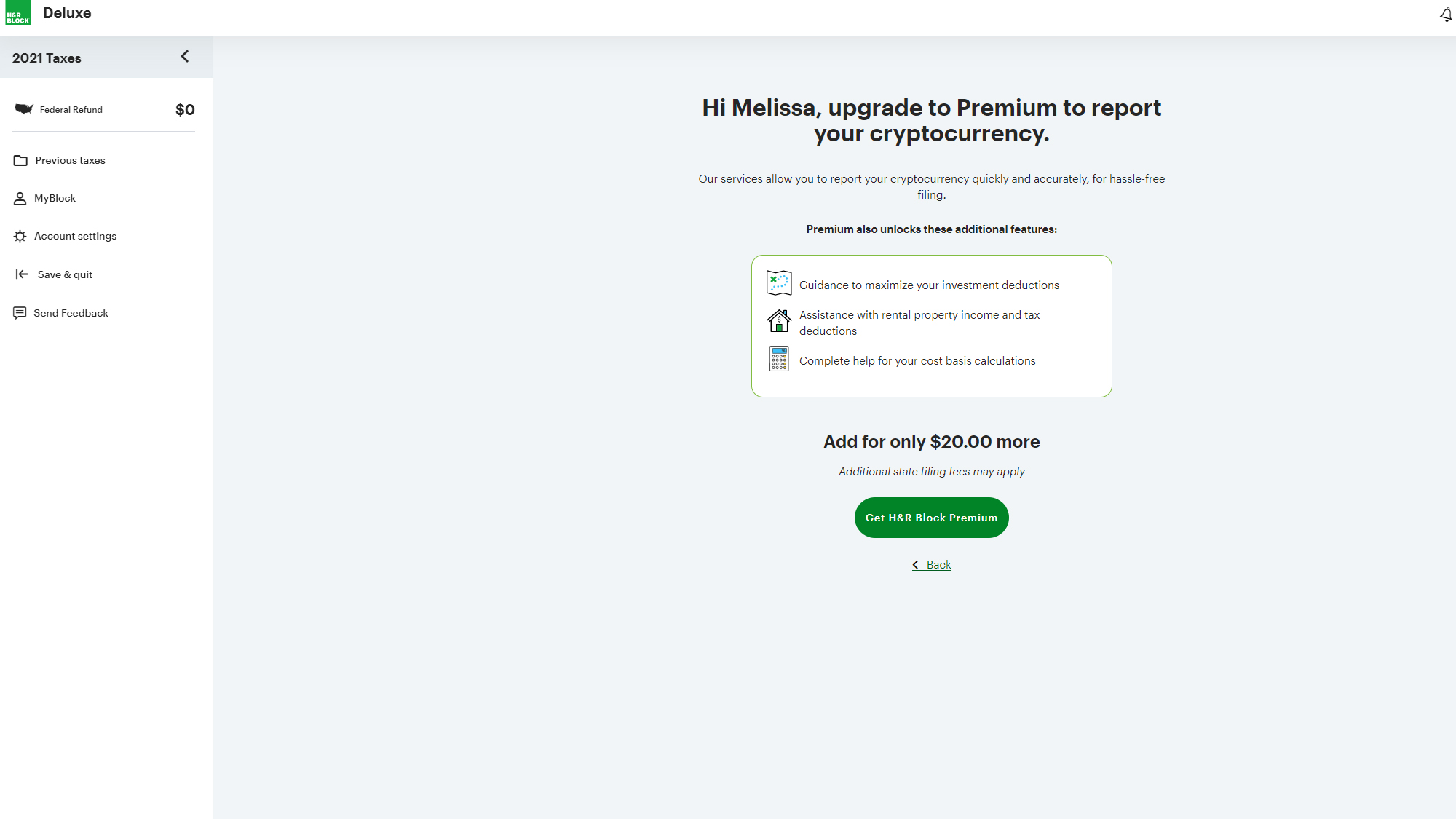

A series of on-boarding questions, much like what TurboTax offers, guided us to which package was most appropriate. But if you start with a lower tier, the service still prompts you to upgrade to the appropriate product. For example, we started our review with H&R Block Deluxe, the first step up from the company’s free tier. Once we had entered that we had 1099-Misc forms and were self-employed with expenses, the service directed us to upgrade to that version to have access to the correct tax forms. Same thing happened when we informed the software we had cryptocurrency.

If you’re a new user, H&R Block has some new information for those making the switch to H&R Block. The questions are the same, but now H&R Block makes it easier to upload the previous year’s tax return to jump-start the process. If you’re coming to H&R Block from TurboTax, you also get an AI review of their prior tax return to ferret out missed deductions; if H&R Block finds those, it walks you through getting money back from last year’s return.

Overall, the H&R Block online interface continues to reflect a unified, cohesive experience with large, bold fonts and friendly language. The site’s responsive design works on mobile web as well as laptop. Plus, H&R Block has a mobile app.

The look is the most visually engaging of any of the online tax software services, and remains ahead of TurboTax. As you move through the service, a help pane slides out at right and guides you through what something means, or the impact of the tax code changes.

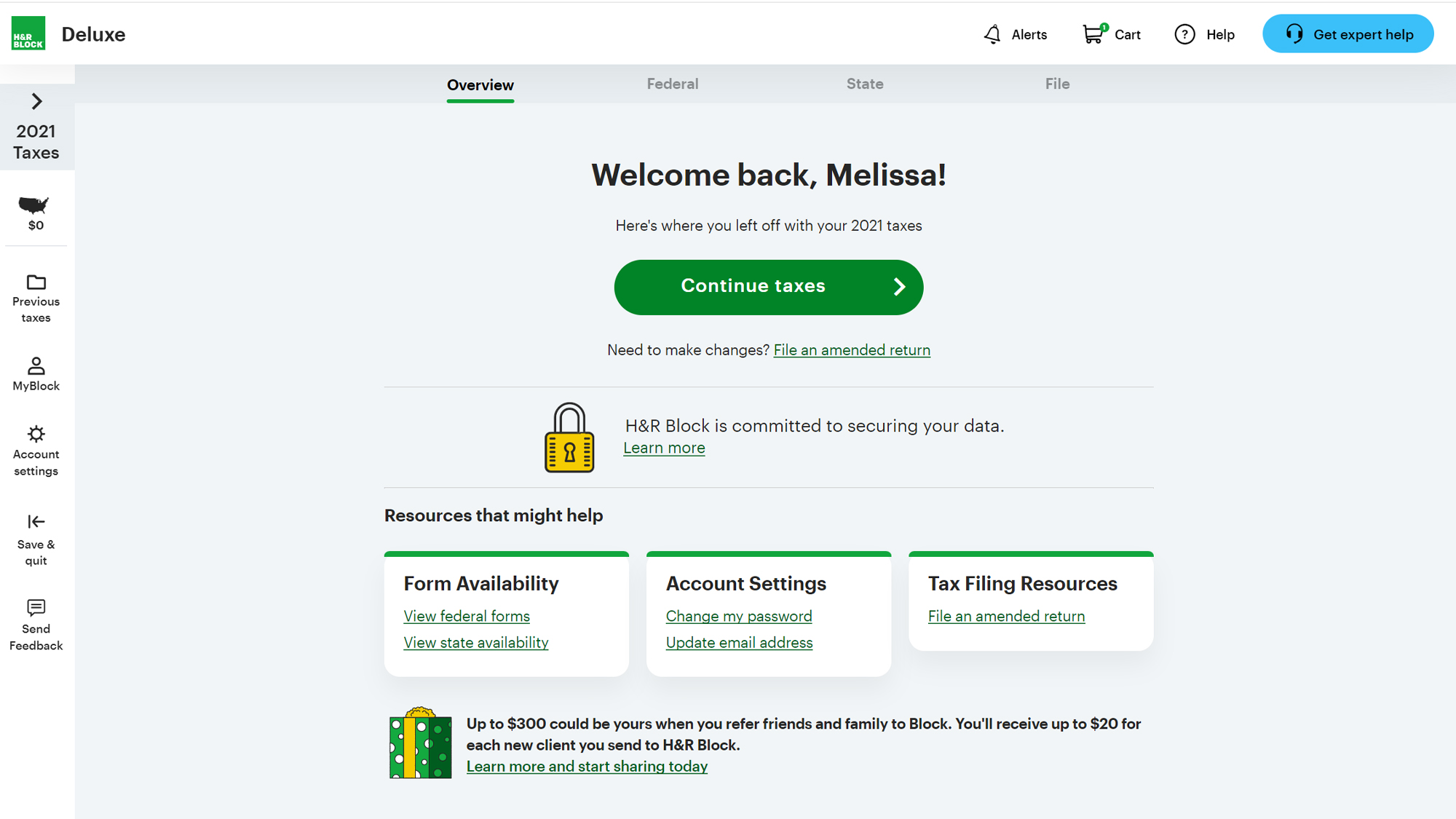

As you make your way through the options, the topics populate beneath the icons, so you can easily navigate among sections after you’ve entered data. Of note: The overview gives quick links to a summary of tax forms, as well as the ability to amend a return.

As with TurboTax, H&R Block’s approach to tax prep guides you through a series of questions, and then they do the magic of filling in the actual tax forms in the background. (Before filing, you can see the actual forms that make up your return.)

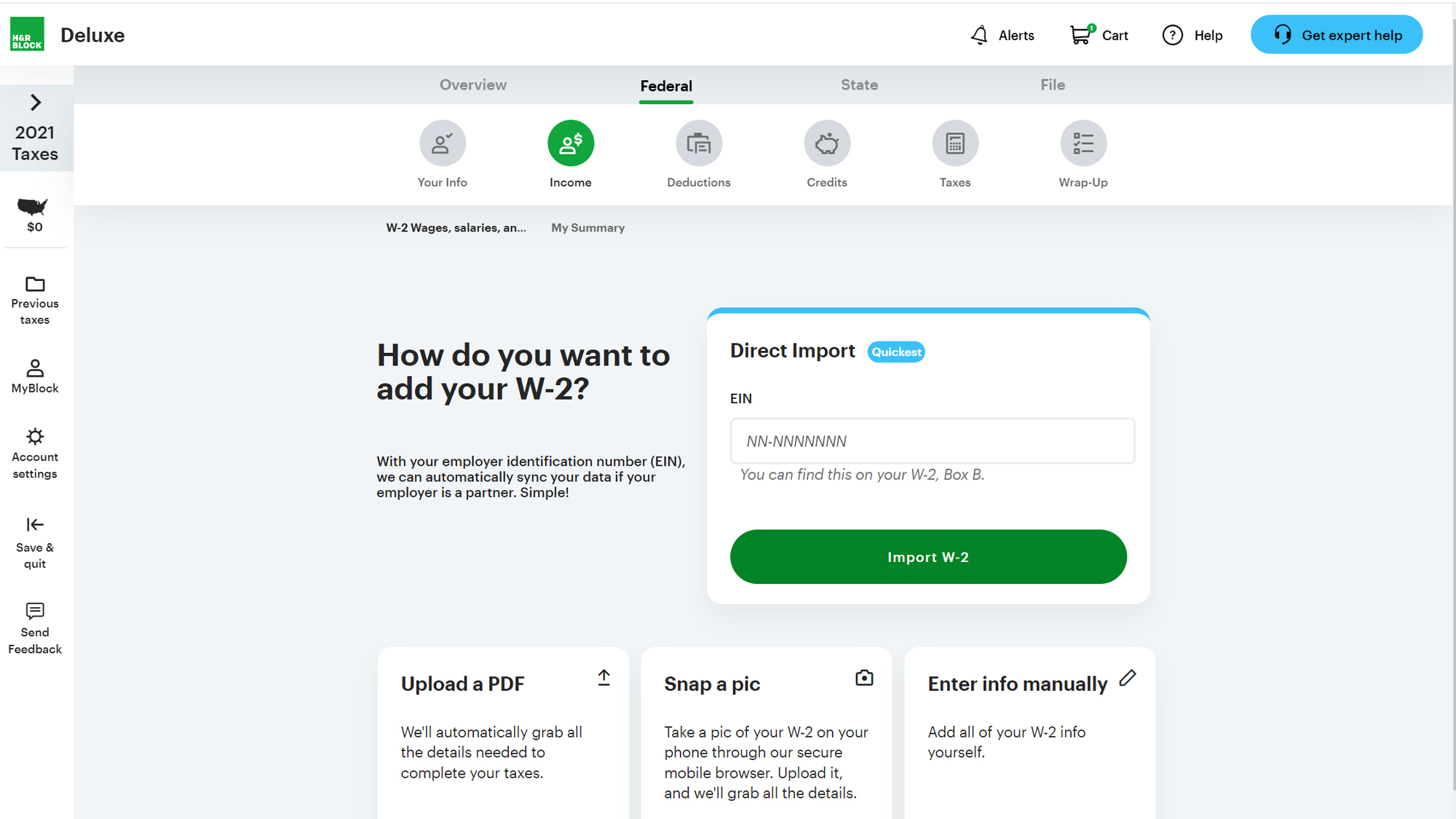

The income hub has been visually updated to make it easier to add W-2 information, either directly or using a PDF or picture snapped on your mobile. Where other services use a QR code, H&R Block instructs you to trim the edges of your W-2, share your mobile number, and follow the secure link the service sends to upload your photo. You can also add the info manually, and add more than one W-2. The program did a good job prompting us to add information as we moved through questionnaires in the different sections.

After the W-2 entry, for example, it asked for our main occupation, and gave check boxes for secondary occupation and military service. Another screen asked whether we received, sold, exchanged, or disposed of cryptocurrency, tweaks to the already-clearest wording — and help — we’ve seen of this question. It also asked whether we earned money in another state.

The presentation is neat and easy to view, and certainly more expeditious than if the system kept questioning do you have X income (as TurboTax does). But they’re very different approaches to the same challenge: Helping you document all relevant data. As you add an income type, you further build out the income hub with the new tile-style visuals for grouping together relevant topics. While the service lets you move around within Income cards, you can’t jump to another section further ahead in the return without completing Income first.

An update from last year: H&R Block can import crypto transactions directly from your CoinTracker, and will be adding Coinbase as well (but it wasn’t an option when we tested the service). All of the crypto screens are improved, though, with clear explanations of what you need to do for transactions.

On the whole, we found entering data more streamlined than in many competitors (for example, what you need to do to enter charitable deductions). Even entering self-employed and small business information is improved, with a central hub design and a smoother flow of prompts to tell their businesses’ financial story. But you can’t input data by taking a photo of a tax document (beyond your W-2); the only choices are to upload a file or input the data manually.

H&R Block Deluxe 2023 review: Verdict

H&R Block Deluxe 2023’s cohesive design and helpful guidance, combined with more affordable tax pro help pricing, makes it one of the best tax software programs to use when it’s time to file your taxes.

For those seeking a full-service digital experience, TurboTax Deluxe is the better option as it has more extensive tax pro assistance — even if you have to pay more for the service. For everyone else, H&R Block Deluxe is easier to navigate and more refined at all levels.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.