GIC results: Every dollar invested is worth about 4x more after 20 years – can you do it too?

Disclaimer: Opinions expressed below belong solely to the author and do not constitute financial advice.

The latest annual report by GIC has just been published, but it may be quite difficult to make sense out of it for most people.

If the company is seemingly doing so well, you might be a little concerned by the figures posted in the media — just 4.6 per cent average annual return? Isn’t it a little low? Isn’t Temasek posting something like nine per cent over a similar 20-year window?

The confusion is down to GIC’s fairly unusual policy of posting real, inflation-adjusted returns, rather than nominal figures that all other investments are typically measured by.

So, the number you’re looking for isn’t 4.6, but actually 6.9 — close to 7 per cent per annum — out of a portfolio that is distinctly more risk averse than the one managed by Temasek (which also doubles as a de facto company owner in several cases).

A quick, back-of-the-envelope calculation shows that this sort of a regular, compounded, annual return produces quite sizeable results over time. After 20 years, every S$1 invested by GIC is worth S$3.8 — nearly four times more.

This may still not seem record-setting until you remember the sums that the company manages are in the hundreds of billions of dollars. Every S$100 billion it managed in 2003 is now worth S$380 billion, and at this rate, will be worth close to S$1.5 trillion by 2043.

Considering that assets under GICs management are currently estimated at about US$700 billion (though they indirectly include your CPF savings), it would translate into over US$2.5 trillion (all things being equal) after the next 20 years — a mindbogglingly huge sum of money for such a small country.

This is on top of Temasek’s nine per cent annual return, which multiplies whatever it has by over 5.5 times over the same period for another couple of trillion (in SGD this time) from its current portfolio of S$380 billion.

Investing like GIC

Is it even possible? I once heard anecdotes of some determined people calling GIC hoping the company takes private money under its wings, only to be rebuffed, of course. But could you replicate its strategy?

This isn’t going to be a detailed deep dive, but perhaps we can learn something from Singapore’s largest state-owned investor.

If you’re young and can afford greater risk over long-term, while being reasonably diversified, the easiest choice would be to invest in index funds, that simply follow the stock markets (particularly the American indices). Equities usually produce higher returns if you can accept occasional volatility and risk.

Historical averages for American S&P 500 currently sit at close to 10 per cent annual return over the past two decades, assuming you reinvest the dividends. This is more than GIC has delivered and even slightly higher than Temasek, but it does expose you to greater risk as well.

If you have decades of life ahead, you might not worry about the potential downsides, but if your retirement is closing in, you might want to protect your nest egg with a more conservative approach.

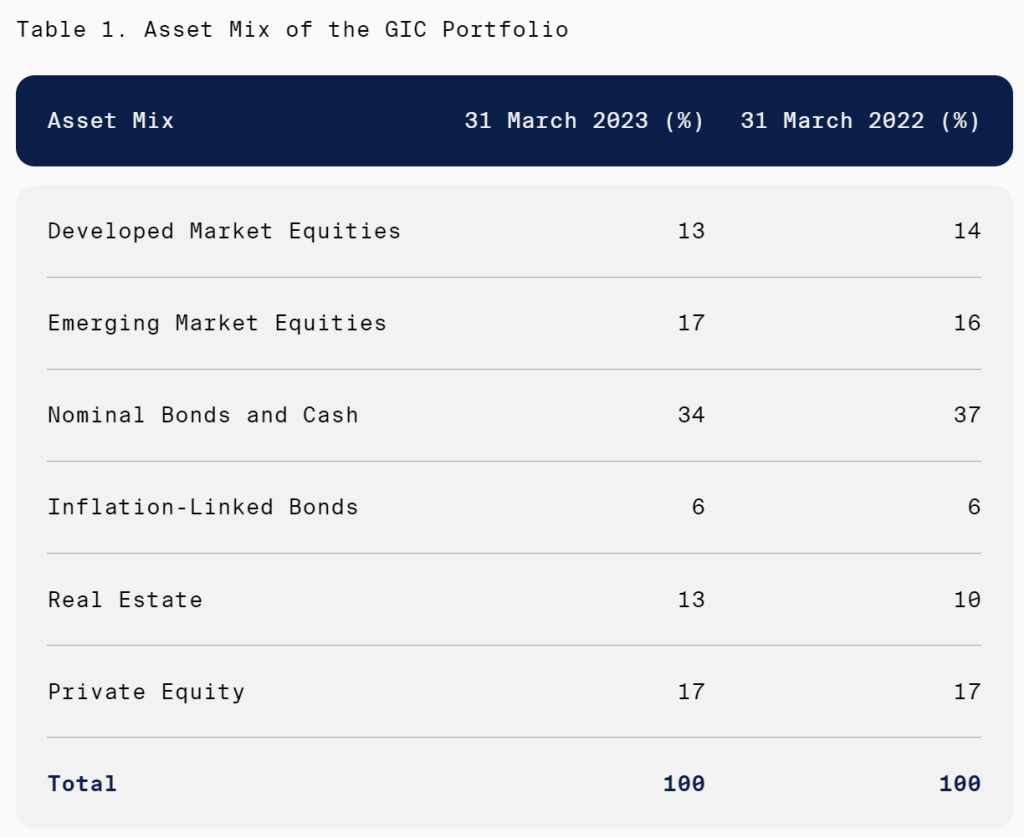

So, how does GIC do it? Let’s look at the breakdown of its portfolio:

Over half of it is placed, rather conservatively, into bonds (40 per cent of the total) and real estate (13 per cent), with the remaining part placed into more risky equities distributed between emerging and developed markets alike.

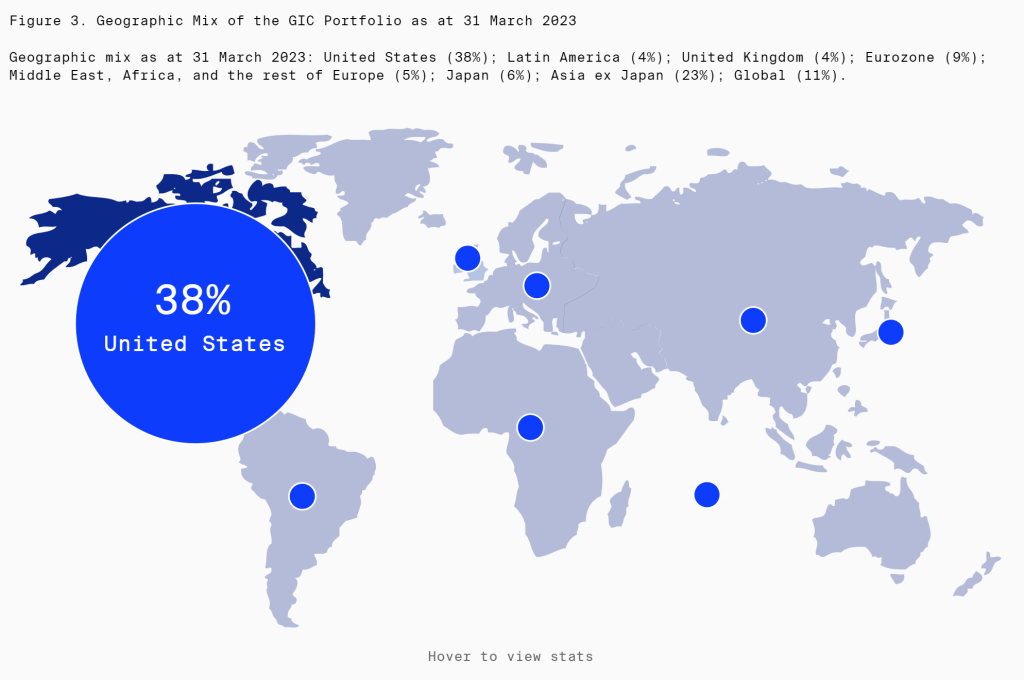

Geographically, GIC is still leaning heavily towards the USA, with 38 per cent of its investments located there, followed by Asia (chiefly China and Japan), Europe, and then the rest of the world (remember however, that GIC does not invest in Singapore):

There are certain aspects to how the company manages its funds that may not be relevant to retail investors, such as concerns about its public image and the impact its decisions may have on it.

This pushes it to put money into more environmentally-friendly, sustainable investments, away from dirty industries (but may not be a concern to you).

The general takeaway here is that it’s possible to have very healthy, long-term returns from a portfolio heavily dependent on investments perceived as relatively safe, as long as the risky equity side is sufficiently diversified and yields (presumably) above average return rates to push the returns upward.

GIC doesn’t beat the markets, overall, but that was never its goal. It comes very close, however, while taking far lower risks.

Startups going down, mixed signals on China

According to conversations GIC’s Chief Investment Officer Jeffrey Jaensubhakij and CEO Lim Chow Kiat, recently had with Reuters and Financial Times, the company’s push into private markets (including major deals with technological startups) — whose share in its portfolio increased from nine to 17 per cent over the past six years — may face a slowdown or even a retreat, should the current high interest rates and slower economic activity persist.

There may still be opportunities, but the cheap money bonanza is clearly over.

Nobody really knows how long this new situation — which follows over a decade of near-zero rates in the developed world — is going to last.

Meanwhile, when it comes to China — an economically and politically a hot button issue — the reports about what GIC leadership thinks were bizarrely inconsistent across just past two days.

At first, Reuters ran a story with a big headline, suggesting that GIC bets big on China:

But then, Financial Times reported GIC’s CEO speaking very cautiously about investment prospects on the mainland:

Between the two, I think Reuters really jumped the gun and read more into what GIC leaders told it — and we do have to bear in mind that they must also watch what they say due to unforeseen repercussions. Their every word could have significant impact in Beijing and on GIC’s investments in the country.

However, remembering the recent crackdown on Chinese billionaires and the outflow of wealthy mainlanders — i.a. to Singapore — it’s hard to be optimistic about China in the near future.

Featured Image Credit: Vulcan Post

For all the latest Life Style News Click Here

For the latest news and updates, follow us on Google News.