GA-Kedaara may pick up 49% in ASG Eye Hospitals – ET HealthWorld

A consortium of private equity funds General Atlantic and Kedaara Capital is likely to acquire a significant minority stake in ASG Eye Hospitals, the largest eye care hospital chain in India, two people aware of the development told ET.

The new investor group is likely to acquire about 49% in ASG for ₹1,180 crore ($150 million), valuing the company at about ₹2,400 crore. The round will see the exit of an existing investor, Investcorp, which will sell its 15% stake, while around ₹800 crore will be invested as primary capital, said the people.

The new money will help ASG acquire Vasan Eye Care’s network and revive the once-premier institution of eye care hospitals in the country.

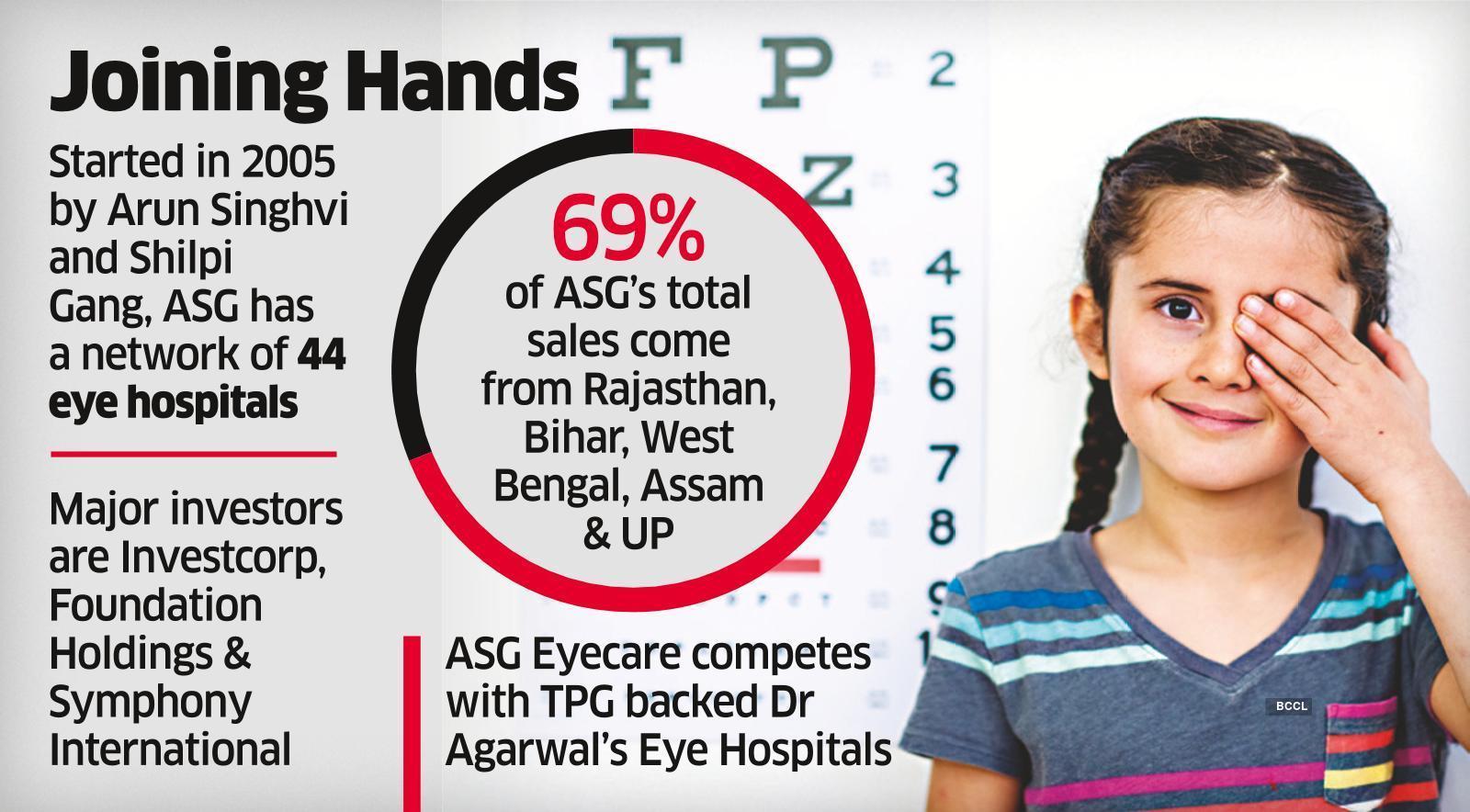

At present, promoters of Jaipur-based ASG hold an about 48% stake, while the rest is held by Investcorp, Foundation Holdings and Symphony International Holding.

ICICI Securities is advising ASG for the stake dilution.

Mails sent to GA, Kedaara, Investcorp and ASG Eyecare did not elicit any responses till press time Wednesday.

ET reported last month that top buyout funds including General Atlantic were the contenders to acquire the stake in ASG.

In February, ET reported that creditors had approved ASG Hospital’s ₹550 crore offer to acquire the debt-ridden eyecare chain Vasan Eye Care under the bankruptcy law.

Started in 2005 by Arun Singhvi and Shilpi Gang, ASG has a network of 44 eye hospitals across 33 cities of India. It offers end-to-end ophthalmology services related to cataract, retina, glaucoma and refractive issues. Through its subsidiaries, ASG also operates eyecare centres in Kathmandu and Uganda’s capital Kampala. The hospital has 180-plus eye specialists from different subspecialists of ophthalmology.

ASG earns about 70% of its total sales from five states — Rajasthan (23%), Bihar (15%), West Bengal (13%), Assam (10%) and Uttar Pradesh (9%), said a recent report from Care Ratings.

The acquisition of Vasan is expected to give ASG a stronghold also in the South Indian market.

ASG’s total operating income increased from ₹90 crore in FY17 to ₹144 crore during FY21.

“Over a period of four years ended FY21, private equity firms invested nearly ₹160 crore in the company by subscribing to compulsory convertible preference shares, which had led to strengthening of its net- worth base,” Care rating said in a recent note. The net worth was healthy at ₹209 crore as on March 31, 2021 as against the total debt of ₹62.78 crore, resulting in a comfortable capital structure, it added.

For all the latest Health News Click Here

For the latest news and updates, follow us on Google News.