The blockchain and crypto industry witnessed an immense growth in funding from 2017 through the start of 2022. It started off with a period now referred to as the ICO (initial coin offering) boom, wherein companies raised funds by issuing their own crypto tokens.

As per Crunchbase, an estimated US$4.9 billion was raised through ICOs in 2017 alone. Investors were enticed by the potential for high returns, with tokens often gaining significant value post-offering. The trend spiralled quickly and soon, fraudulent projects became commonplace.

Once it became clear that these returns weren’t sustainable and a majority of projects were seen bailing on their commitments post-ICO, the bubble burst and led to a market crash. A study published by Statis Group would later reveal that over 80 per cent of ICOs launched in 2017 had turned out to be scams.

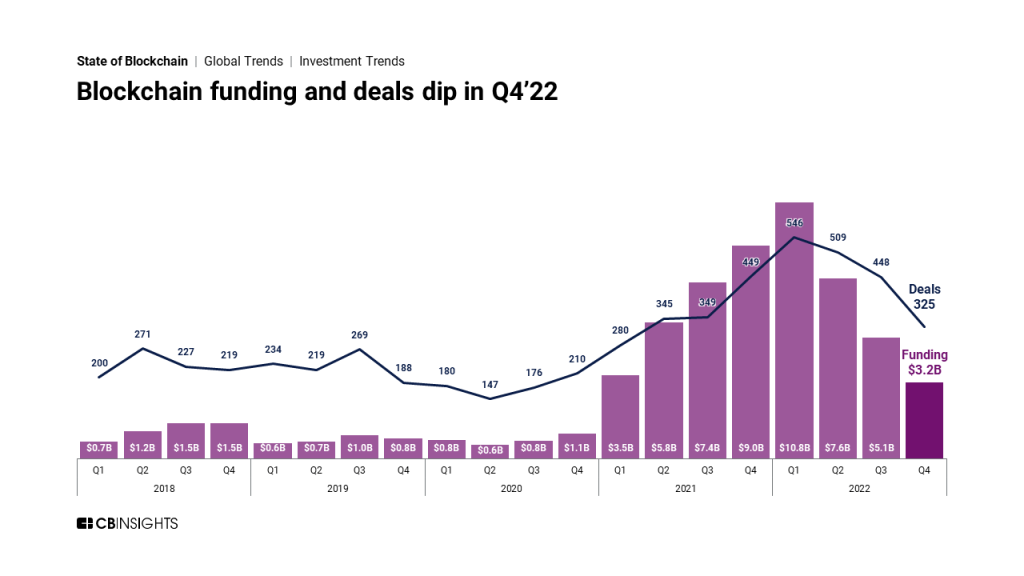

Even with this setback, the interest for crypto projects remained intact. After a lull period following the market crash, venture capital (VC) funding began picking up steam. Starting the second quarter of 2020, VC funding towards blockchain projects increased for seven consecutive quarters, peaking at US$10.8 billion in Q1 2022.

Then, disaster struck once again. The crash of Terra Luna – at the time, the third largest crypto ecosystem behind Bitcoin and Ethereum – wiped out US$50 billion from the crypto markets within three days. Along with this, it brought back the same sentiments of fear and distrust which defined the industry after the ICO bubble burst.

Later in the year, the collapse of crypto giants such as FTX worsened these issues, bringing crypto funding to a grinding halt. Today, the industry is still reeling from the setback with only US$500 million raised by VCs through the first five months of 2023.

Is crypto funding gone for good?

AI has claimed the top spot as tech’s buzzword of the year and even with the crypto markets recovering, blockchain no longer seems to draw the attention it once did. It stands to reason whether hype was, in fact, the primary factor behind crypto’s half-a-decade of dominance.

In Singapore – long known to be a crypto-friendly jurisdiction – regulators have furthered their stance of protecting retail consumers. The use of crypto as a speculative investment is discouraged, and the Monetary Authority of Singapore (MAS) only sees benefit in blockchain use-cases which solve real-world problems.

A KPMG report from 2022 revealed that although the FTX and Terra Luna crash had turned investors away from crypto, there was still demand for other blockchain-based innovations. Use-cases such as real-time settlement and tokenisation, which can help improve existing financial systems, have seen growth led by companies including Ripple and StraitsX.

Over in Dubai – a region quickly emerging as a global crypto hub – a similar view is echoed.

“The funding landscape has evolved significantly following the crypto winter,” says Belal Jassoma, Head of Business Development at the Dubai Multi Commodities Centre. “We’ve seen the market mature. The noise of hype-fuelled and speculative projects has been filtered out.”

A healthier crypto industry

Investors have undergone a change in mindset, now valuing aspects such as the long-term sustainability of a crypto project. This was often overlooked during previous market cycles when investments were largely driven by prevailing trends.

“We’ve seen more demand from institutional investors, banks, and hedge funds. Asset managers are allocating more of their portfolio to crypto and Web3 projects. That has helped the industry as well,” Jassoma adds.

As regulations have shaped up around the world, there has been an increase in confidence among institutional investors. Real-world use-cases have become more common and even risk-averse investors have started to give blockchain a serious thought.

Crypto may no longer be trending on social media but among businesses, there seems to be a renewed interest in blockchain technology following the crypto winter. Regulators and governments are helping support this through public-private partnerships and incentives for blockchain innovation.

In Singapore, MAS has regularly engaged in collaborations with industry players through the Project Guardian initiative. Established in May 2022, the project was recently expanded to test the potential of tokenisation across a wider range of financial asset classes.

In Dubai, the DMCC crypto centre has been looking into ways through which blockchain can help improve trade. “We want to foster the adoption of this tech by our mainstream sectors like commodities, energy, and precious metals and stones,” Jassoma says.

DMCC plays an active role in helping companies secure funding and ensuring that investments flow into worthwhile projects. “VCs like to work with us because we give them access to a curated deal flow. Companies established in DMCC go through a complete due diligence performance and that gives more confidence to investors.”

All things considered, blockchain technology is still well and alive, albeit with a new face. It’s no longer represented by speculative cryptocurrencies and high-risk investments, but rather, applications which can help improve real-world systems and processes.

Featured Image Credit: CryptoSlate

Also Read: E-commerce meets crypto: GM.co founder speaks about the demand for crypto payments

For all the latest Life Style News Click Here

For the latest news and updates, follow us on Google News.