FDI net inflows rise to 4-month high – BusinessWorld Online

By Keisha B. Ta-asan

NET INFLOWS of foreign direct investments (FDIs) into the Philippines surged to a four-month high in April as further reopening of the economy and trade liberalization reforms lifted investor confidence.

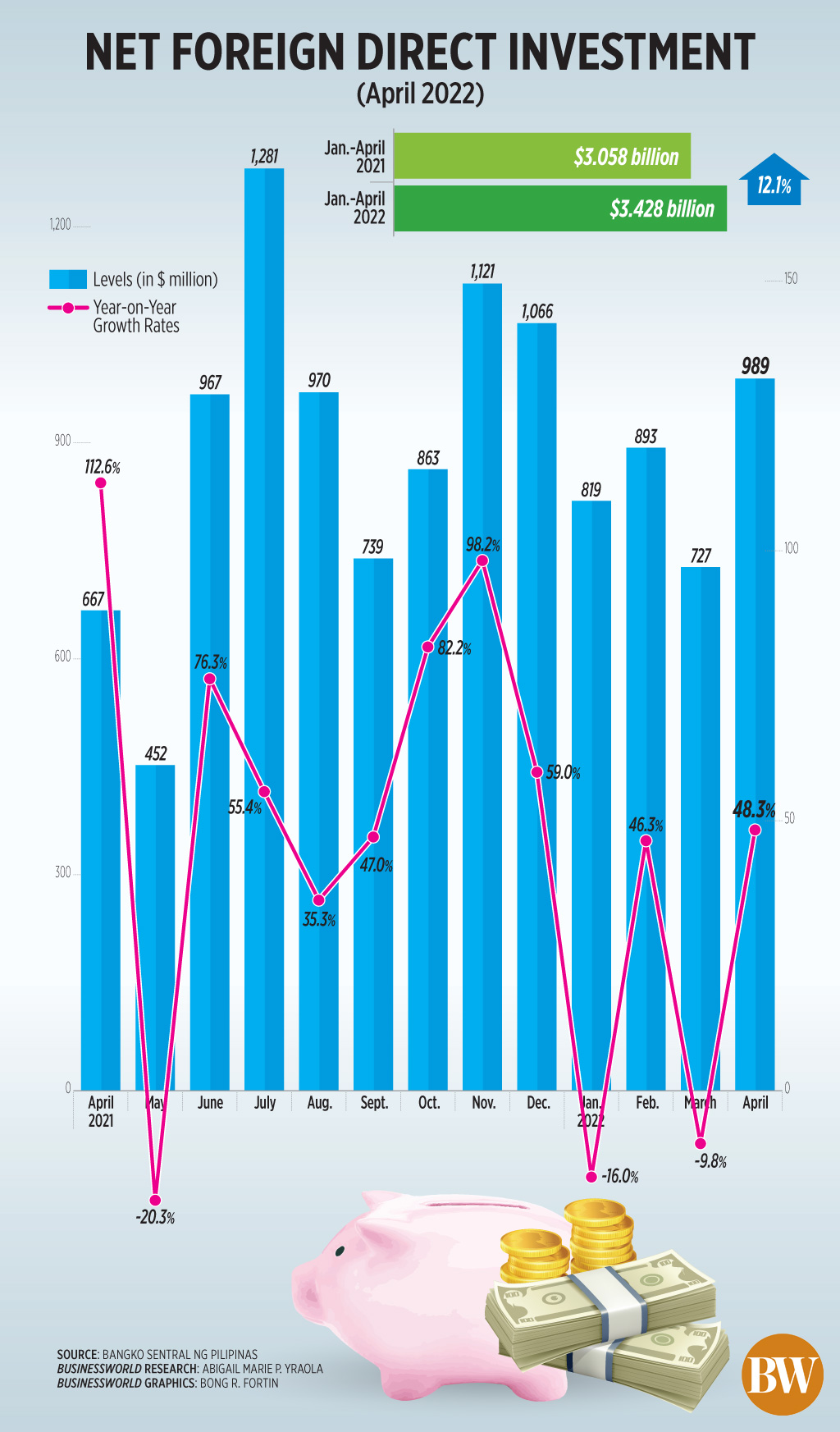

Data released by the Bangko Sentral ng Pilipinas (BSP) on Monday showed that FDI net inflows rose by 48.3% to $989 million in April from $667 million in the same month in 2021.

This was the highest monthly FDI inflow recorded since the $1.06 billion in December last year.

Month on month, net inflows of FDIs, which stand as a key source of jobs and capital for the local economy, grew by 36% from $727 million in March.

Month on month, net inflows of FDIs, which stand as a key source of jobs and capital for the local economy, grew by 36% from $727 million in March.

“The pickup in FDI reflects the positive fallout from reopening of the economy. With the Philippines posting a solid 1Q GDP report and with mobility restrictions lowered, this may have prompted investments into the Philippines, including the placement of equity or ‘fresh FDI,’” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail.

Metro Manila and most areas in the country have been under the most lenient alert level since March, as coronavirus infections declined.

“Vaccination rates and the country’s ability to control COVID surges without having to resort to crippling lockdowns also indicated a better business outlook for investors,” China Banking Corp. Chief Economist Domini S. Velasquez said in a Viber message.

Ms. Velasquez also noted the FDI inflows are mainly driven by the economic reforms put in place by the Duterte administration.

“The amendments to the Public Service Act (PSA) and the Retail Trade Liberalization Act (RTLA) which loosened restrictions of some sectors to foreign ownership likely drew investors’ interests,” she added.

President Rodrigo R. Duterte in March signed into law Republic Act No. 11659, which amended the PSA to allow up to 100% foreign ownership in airports and airlines, subways and railways, telecommunications, domestic shipping, and tollways and expressways.

Mr. Duterte also signed into law the measures amending the RTLA and the Foreign Investment Act, which are expected to boost the competitiveness of the Philippines’ industries and services.

Data from the BSP showed net inflows of FDI went up, following the increases recorded across all components, led by non-residents’ net investments in debt instruments.

April data showed a 40.6% increase in foreign firms’ investments in debt instruments of local affiliates to $684 million from $487 million a year ago.

Foreigners’ net investments in equity capital surged by 127.8% to $206 million in April. Equity capital placements jumped by 103.3% to $224 million, while withdrawals declined by 9.9% to $18 million.

The equity placements were mainly from Malaysia, the United States, and Japan, and invested mostly in construction, real estate and manufacturing industries.

Reinvestment of earnings fell by 10.2% to $99 million in April.

For the first four months of the year, total FDI net inflows grew by 12.1% to $3.4 billion.

“Cumulative FDI net inflows rose due mainly to the increase in non-residents’ net investments in debt instruments,” the BSP said, referring to the 35.3% jump in foreign investments in debt instruments to $2.5 billion.

Reinvestment of earnings was flat at $329 million in the January to April period.

Meanwhile, investments in equity capital slumped by 37.2% to $517 million in the four-month period, as placements declined by 39.4% to $576 million. Equity withdrawals also dropped by 53.2% to $59 million.

Net inflows of FDIs are expected to slow in the next few months, amid the darkening global economic outlook.

“We could see a moderation in the near term as the economy faces short-term headwinds but should the Philippines weather the turbulence, we can expect FDI to resume once we have cleared the present challenges,” Mr. Mapa said.

Aside from economic reforms, Ms. Velasquez said FDI net inflows may get a boost from “infrastructure investments with private sector participation, and efforts to streamline tax administration.”

“Outside of these reforms, ease of doing business, anti-corruption efforts, and firmly instilling the rule of law will be favorable to investors,” she added.

The central bank projects FDI net inflows will reach $11 billion this year.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.