Elon Musk is Out, But Should You Be In Twitter Stock?

Social media platform Twitter (NYSE: TWTR) stock has had a tumultuous year as Tesla (NASDAQ: TSLA) CEO Elon Musk pulled his $54.20 per share and $44 billion takeover offer. There is much speculation that Musk might still be interested in the social media giant but at a cheaper price. The Company has sued Musk over the pulled takeover bid which is scheduled for a five-day trial beginning Oct. 17, 2022. Elon Musk has also countersued Twitter. Twitter claims to have spent $33 million in transaction expenses and is still set to take a shareholder vote on Sept. 13, 2022. Musk’s bid was able to keep Twitter’s share price up and relatively unscathed down only (-2.5%) on the year. Meanwhile, peers like Snap (NASDAQ: SNAP) and Pinterest (NASDAQ: PINS) saw their shares demolished by (-78%) and (-46%), respectively in the technology bear market. Twitter’s Q2 2022 earning report was negative for the most part but the silver lining was the 16.6% rise in monetizable daily active user (mDAU) at 237.8 million. Due to the pending acquisition of Twitter by an affiliate of Elon Musk, the Company has declined having an earning conference call, a shareholder letter or providing forward guidance. Prudent investors may consider opportunistic pullbacks to gain exposure in this popular social media platform.

MarketBeat.com – MarketBeat

Q4 Fiscal 2021 Earnings Release

On July 22, 2022, Twitter released its fiscal second-quarter 2022 results for the quarter ending June 2022. The Company reported an adjusted earnings-per-share (EPS) loss of (-$0.08) excluding non-recurring items versus consensus analyst estimates for a profit of $0.14, missing estimates by (-$0.22). Revenues fell (-1.2%) year-over-year (YOY) to $1.18 billion missing analyst estimates for $1.34 billion. Average monetizable daily active users (mDAU) rose 16.6% YoY to 237.8 million. Average U.S. mDAU rose 14.2% to 41.5 million and international mDAU rose 17% to 196.3 million.

Company Statement

There was no conference call or forward guidance. The Company issued a statement, “As announced on April 25, 2022, we entered into a merger agreement, pursuant to which Twitter agreed to be acquired by an entity wholly owned by Elon Musk, for $54.20 per share in cash. Upon completion of the transaction, Twitter will become a privately held company. On July 8, 2022, representatives of Mr. Musk delivered a notice purporting to terminate the merger agreement. Twitter believes that Mr. Musk’s purported termination is invalid and wrongful, and the merger agreement remains in effect. On July 12, 2022, Twitter commenced litigation against Mr. Musk and certain of his affiliates to cause them to specifically perform their obligations under the merger agreement and consummate the closing in accordance with the terms of the merger agreement. On July 19, 2022, Twitter’s request for an expedited trial was granted, and the trial is being scheduled for October 2022. Adoption of the merger agreement by our stockholders is the only remaining approval or regulatory condition to completing the merger under the merger agreement. The exact timing of completion of the merger, if at all, cannot be predicted because the merger is subject to ongoing litigation, adoption of the merger agreement by our stockholders and the satisfaction of the remaining closing conditions.”

Forced Acquisition

Elon Musk terminated his acquisition deal with Twitter mainly under the ground that the Company was lax in calculating fake accounts. However, Twitters asserts that Musk had no interest in understanding Twitter’s sampling process as provided to him. The Company asserts there was no materially inaccurate representations provided to Musk. Twitter is set to begin an expedited trial on Oct. 17, 2022, to force Musk to follow through on the original merger deal at $54.20 per share. Investor may be buying the rumor to sell the news.

TWTR Opportunistic Pullback Levels

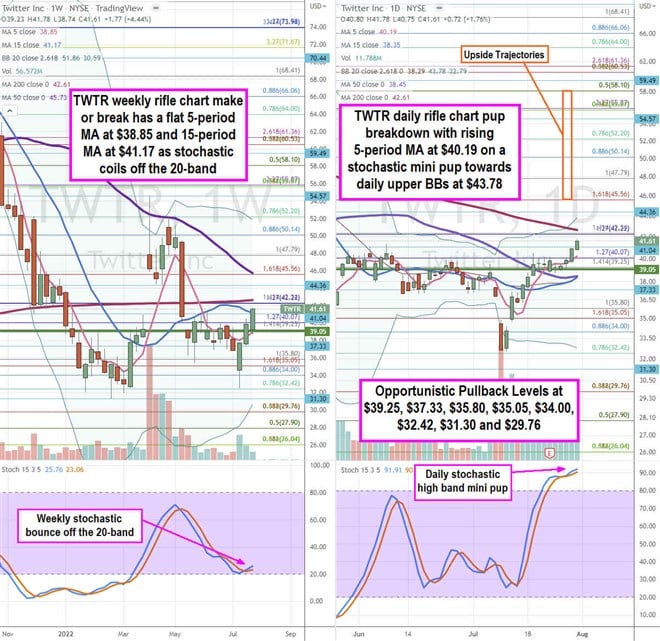

Using the rifle charts on the weekly and daily time frames provides a precision playing field view of the landscape for TWTR stock. The weekly rifle chart bottomed off the $32.42 Fibonacci (fib) level. The weekly 5-period moving average (MA) is sloping up at $38.85 towards the 15-period MA at $41.17. The weekly 200-period MA sits at $42.61 and 50-period MA at $45.73. The weekly lower Bollinger Bands (BBs) sit at $30.59 and upper BBs sit at $51.86. The weekly market structure low (MSL) triggered on the breakout through $39.05. The daily rifle chart triggered a pup breakout with a rising 5-period MA at $40.19 followed by the 15-period MA support at 38.35 overlapping the 50-period MA at $38.45. The daily 200-period MA resistance sits at $42.61. The weekly stochastic triggered a higher band mini pup through the 90-band. Prudent investors can watch for opportunistic pullbacks at the $39.25 fib, $37.33, $35.80 fib, $35.05 fib, $34.00 fib, $32.42 fib, $31.30, and the $29.76 fib level. Upside trajectories range from the $45.56 fib up towards the $58.10 fib level.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.