Clinical Laboratory Services Market Size to Exceed USD 352 Billion by 2032 | CAGR of 5.3%

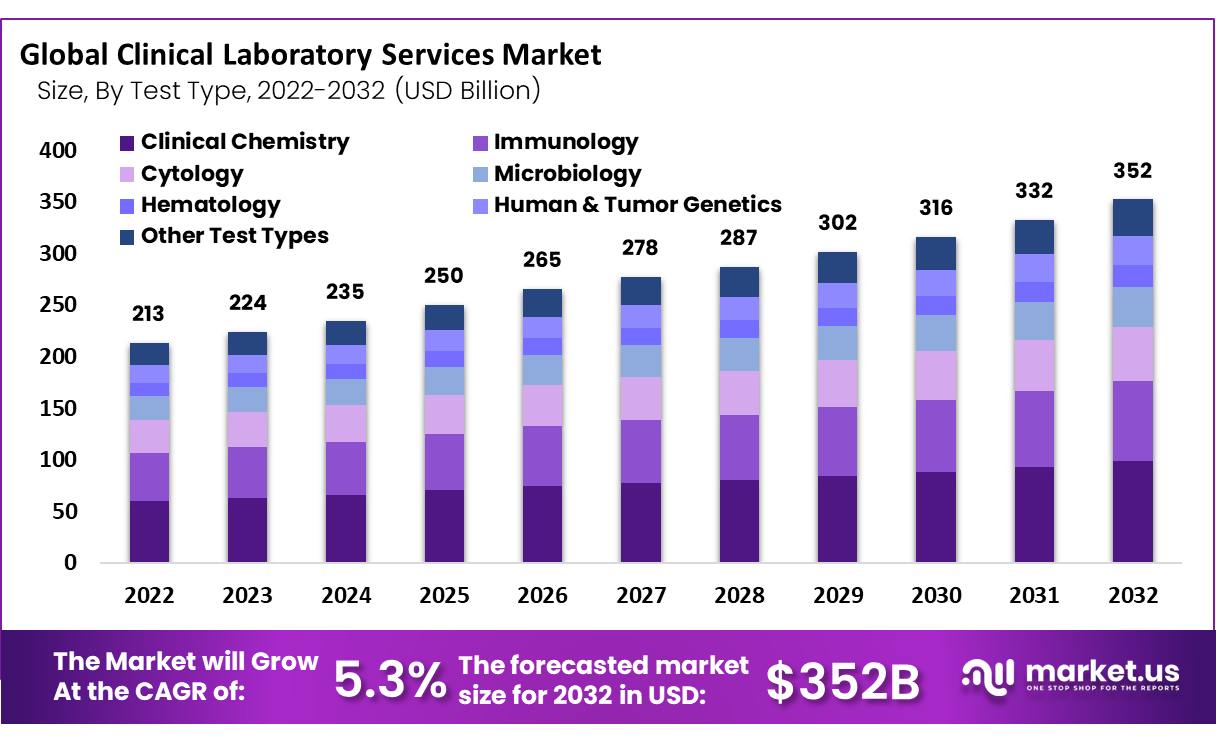

New York, May 17, 2023 (GLOBE NEWSWIRE) — Market.us research analyses that the clinical laboratory services market, which was USD 213 Billion in 2022, is expected to reach USD 352 Billion by 2032, at a CAGR of 5.3% during the forecast period 2023 to 2032.

The Number of substances is detected and quantified using clinical laboratory services. Various abnormal metabolic activities, infections, infectious and noninfectious diseases, and inflammatory conditions can be identified by changes in biomolecule concentration. Accurate and rapid diagnosis of serious diseases and the appropriate treatment are the key factors that largely contribute to optimal clinical outcomes and public health.

Market.us offers in-depth market insights that assist global businesses to obtain growth opportunities. Read Sample Report@ https://market.us/report/clinical-laboratory-services-market/request-sample/

Key Takeaway:

- By Test Type, the clinical chemistry segment held the largest revenue share in the global clinical laboratory services market due to several clinical chemistry tests involved in the pathology analysis of body fluids.

- By Application, the bioanalytical & lab chemistry segment accounted for the most lucrative segment in the global market for clinical laboratory services in 2022.

- By Service Provider Analysis, the hospital-based laboratory segment is anticipated to expand at the fastest CAGR during the forecast period.

- In 2022, North America dominated the market with the highest revenue share of 44.3%.

- Asia Pacific is expected to be the fastest-growing market due to the availability of high-end medical treatments, rising public awareness of healthcare benefits, and positive changes in healthcare benefits.

The market expansion is influenced due to the factors like the increasing demand for diagnostic tests owing to the rising prevalence of chronic diseases and early diagnostics. Additionally, during the forecast period, it is anticipated that rapid advancements in the preparation of samples and data management will positively drive market expansion.

Factors Affecting the Growth of the Global Clinical Laboratory Services Market

There are several factors that can affect the growth of the global clinical laboratory services market. Some of these factors include:

- Rising incidence of chronic and infectious diseases: The market expansion is mainly subjected to the rising incidence of chronic and infectious diseases, resulting in the demand for early and accurate disease diagnosis techniques.

- The burden of infectious diseases and chronic disorders: As clinical diagnostic tests represent the most accurate methods for characterizing and identifying various biomarkers of chronic diseases and for the detection of microorganisms, the demand for these tests is increasing along with the rising burden of diseases such as tuberculosis (TB) and cancer.

- Technological advancements: Due to the increasing burden of targeted diseases, market key players are highly focused on the advancement of technology to have a competitive edge for their products over the other players, which is likely to boost market growth.

- Rising investments: Owing to the rise in public-private investments, research grants, and funding for the creation of new laboratory testing procedures, the market’s expansion is also influenced by the increased demand for regulatory-compliant laboratory services.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/clinical-laboratory-services-market/#inquiry

Top Trends in the Global Clinical Laboratory Services Market

The highly populated and emerging countries such as China and India, where a large portion of the population have negligible access to accurate medical diagnostic facilities, there are numerous opportunities for independent laboratories to boom in the market, as they can fill the gap of clinical service providers in these countries. Hence, there is a rise in number of independent laboratories. The independent laboratory is facing huge consolidation as the key players are highly focused on collaborations and strategic partnerships, which are expected to surge the market growth.

Market Growth

Rapid and accurate diagnosis of serious diseases and the effective treatment of those diseases are the factors that largely contribute to optimal clinical outcomes and public health. As a result, at-home testing is becoming increasingly popular for regular health condition monitoring and disease diagnosis. On the other hand, the lockdown led to a decreased routine testing in the first quarter of 2021. However, the surge in COVID-19 testing volume has significantly led to the growth of the market.

Regional Analysis

Based on regions, the global clinical laboratory services market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Due to the presence of a well-organized healthcare system and reimbursement policies for clinical lab services, the rising geriatric population, and the increasing prevalence of chronic diseases, North America is likely to experience significant growth. Additionally, major players are largely concentrated on creating new tests. For instance, at the American Association for Clinical Chemistry (AACC) Clinical Lab Expo in July 2022, Abbott demonstrated new diagnostic techniques that would improve patient care. The American Clinical Laboratory is a national trade group representing leading clinical labs that provide patients and healthcare professionals with crucial diagnostic information.

Asia-Pacific is accounted to be the region’s fastest-growing market at a significant CAGR during the forecast period. The availability of high-end medical treatments, rising public awareness of healthcare benefits, and positive changes in healthcare benefits are anticipated to support the region’s growth. The numerous scientific research activities, high unmet medical needs, economic expansion, and improving healthcare regulatory conditions together contribute to the rapid expansion. Collaborations for the provision of new lab testing services are the primary focus of key players. In addition, due to the growing demand for testing, clinical laboratories have gained a lot of importance during the COVID-19 pandemic.

Competitive Landscape

There are a lot of local and international companies operating in the clinical laboratory services market, which is highly competitive. Local companies are also focusing on providing innovative services to the public, which enables them to establish their significant position in this market. Global players hold a significant share of the market. It is anticipated that few new players will enter the market in the future due to the growing demand for technology, with these established players gaining a significant share. Geographic expansion, partnerships, and strategic collaborations with other companies are the primary priorities of the industry’s major players, particularly in developing and economically prosperous regions. Some of the major players include,

Key Market Players

- QIAGEN N.V.

- OPKO Health

- Siemens Medical Solutions USA, Inc.

- Quest Diagnostics

- Abbott Laboratories

- NeoGenomics Laboratories, Inc.

- Fresenius Medical Care AG & Co.

- Sonic Healthcare Limited

- Associated Regional and University Pathologists, Inc.

- Laboratory Corporation of America Holdings,

- Other Key Players

Have Queries? Speak to an expert or Click Here To Download/Request a Sample

Scope of the Report

| Report Attributes | Details |

| Market Value (2022) | US$ 213 Billion |

| Market Size in 2032 | US$ 352 Billion |

| CAGR (2023 to 2032) | 5.3% |

| North America Revenue Share | 44.3% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

Early diagnosis of diseases like cancer and infection can significantly increase the likelihood of successful treatment. As a result, governments of different countries and international organizations have launched numerous initiatives to raise awareness of early diagnosis. In addition, a number of increasing diseases can potentially cause significant economic harm, morbidity, and mortality. During the forecast period, government efforts to prevent rising diseases are expected to fuel the market size. As a result of improved access to healthcare and rising healthcare costs, life expectancy has risen significantly, particularly in developed nations. Age-related disorders have increased as the elderly population has grown. This, in turn, is increasing the annual number of clinical tests done. Cancer, diabetes, and cardiovascular diseases are common conditions that can affect people over 50.

Market Restraints

For a variety of diseases, half of the world’s population has negligible access to basic diagnostic services. Only about 20 percent of people in low- and middle-income countries have access to basic diagnostic tests (other than those for HIV or malaria). Additionally, the consistency of clinical laboratory services gradually influences the management of both non-communicable and communicable diseases.

Moreover, the price pressure that healthcare payers and providers face and the shift from lab-based diagnosis to home-based/point-of-care testing procedures are likely to impede market expansion. In addition, the clinical laboratory services market is anticipated to be challenged by public concerns regarding data security and privacy during the forecast period.

Market Opportunities

The constant pressure to reduce healthcare costs is likely to make the laboratory an essential part of the treatment plan and shift healthcare utilization in its favor. Since there is short time spent in the hospital and less time spent talking to the patient’s doctor, labs must get accurate information to the doctor quickly and accurately. This continues to have an impact on the industry. Hence an increase in clinical labs, particularly in the independent sector, is anticipated. The market’s expansion is also influenced by the increase in demand for regulatory-compliant laboratory services and owing to the rise in public-private investments as well as research grants and funding for the creation of new laboratory testing procedures. Another opportunity in the market for clinical laboratory services is the rising incidence of target diseases like tuberculosis, diphtheria, poliomyelitis, and measles.

The report provides a full list of key vendors, their strategies, and the latest developments. Buy now@ https://market.us/purchase-report/?report_id=101504/

Report Segmentation of the Clinical Laboratory Services Market

Test Type Insight

Based on test type, the clinical laboratory services market is divided into clinical chemistry, immunology, cytology, microbiology, hematology, human & tumor genetics, endocrinology, and other test types. In 2022, the clinical chemistry segment registered a revenue share of more than 55.0%. Basic diagnosis and laboratory testing both include clinical chemistry tests. The availability of several clinical chemistry tests involved in the pathology analysis of body fluids, including the analysis of urine, serum, plasma, and other body fluids, is credited with the segment’s dominance. Electrophoresis, immunoassay, and spectrophotometry are some of the methods used to measure the concentration of various kinds of molecules in the sample.

During the forecast period, the human and tumor genetics tests segment is anticipated to experience the highest CAGR. Increasing automation to improve the customer experience is gaining traction in the market. In the context of hereditary and gene-mutation-related disorders, there has been an increase in intensive genetic and proteomic research. Furthermore, there is a rising demand in oncology for individualized care with a quick and accurate diagnosis. Owing to this, the segment is expected to grow more.

The microbiology testing segment in the clinical laboratory services market is expanding at the quickest rate. The purpose of microbiology research is to determine whether or not humans are infected with pathogenic microorganisms and their metabolites. Microbial testing is becoming increasingly important as nosocomial, infectious, fungal, and bacterial parasitic infections rise. The segment’s expansion is sped up by the introduction of new sequencing technology brought about by lower sequencing costs.

Application Insight

On the basis of application, the clinical laboratory testing market is classified into bioanalytical & lab chemistry, cell & gene therapy, toxicology testing, preclinical & clinical trials, drug discovery & development, and other applications. The bioanalytical & lab chemistry segment dominated the market with the largest revenue share in 2022. Bioanalytical and lab chemistry laboratories employ a variety of techniques and technology platforms to meet diagnostic requirements. In bioanalytical and laboratory chemistry applications, the most frequently utilized technologies are ELISA, chromatography, mass spectroscopy, immunochemistry, and molecular biology. In drug discovery and development, bioanalytical services are an important tool for defining the concentration of drugs and their metabolites.

Service Provider Insight

On the basis of service providers, the global market for clinical laboratory services is segmented into standalone laboratories, hospital-based laboratories, clinic-based laboratories, and other service providers. With the largest revenue share in 2022, the hospital-based laboratories segment is estimated to grow at the fastest CAGR during the forecast period. This is because there many patients who require their tests quickly, especially patients with serious and complex diseases that are more expensive. With the rising number of hospitals incorporating laboratories into their facilities, it is predicted that it will likely remain dominant. Additionally, the segment is anticipated to be positively driven by the high turnaround rate of patients with major and complex diseases and the growing number of hospital outreach programs.

The increase in accessibility of patients to laboratory services would benefit from this. By providing diagnostic facilities at the retail level, the standalone laboratories segment is anticipated to exhibit a significant CAGR over the forecast period. The Center for Breakthrough Medicines (CBM) has a separate safety testing facility from GMP activities on a single campus. Moreover, the service providers are expected to benefit from economies of scale if standalone labs can accelerate the processing of larger volumes of diagnostic tests and deliver superior results at prices comparable to those of larger labs.

For more insights on the historical and Forecast market data from 2016 to 2032 – download a sample report at https://market.us/report/clinical-laboratory-services-market/request-sample/

Market Segmentation

Based on the Test Type

- Clinical Chemistry

- Immunology

- Cytology

- Microbiology

- Hematology

- Human & Tumor Genetics

- Endocrinology

- Other Test Types

Based on Application

- Bioanalytical & Lab Chemistry

- Cell & Gene Therapy

- Toxicology Testing

- Preclinical & Clinical Trials

- Drug Discovery & Development

Based on the Service Provider

- Standalone Laboratories

- Hospital-Based Laboratories

- Clinic-Based Laboratories

- Other Service Providers

By Geography

North America

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Recent Development of the Clinical Laboratory Services Market

- In October 2022, The launch of Bionano Laboratories, a brand-new organization that combines Lineagen’s clinical testing services with Bionano’s optical genome mapping (OGM) data services, was announced by Bionano Genomics Inc. It also announced the launch of the first OGM-based laboratory-developed test (LDT) developed by Bionano Laboratories.

- In March 2022, The most recent BC-700 Series hematology analyzers from Mindray included both CBC and ESR tests designed for use in small to medium-sized labs.

- In March 2022, Illumina Inc. introduced TruSight oncology, a single test that can evaluate a variety of tumor genes and biomarkers to determine a patient’s specific genetic makeup.

Browse More Related Reports:

- Clinical Trials Market size is expected to be worth around USD 886.5 Billion by 2032 from USD 450.1 Billion in 2022, growing at a CAGR of 7.2% during the forecast period from 2022 to 2032.

- Clinical Laboratory Test Market size is expected to be worth around USD 452.41 Billion by 2032 from USD 204.19 Billion in 2021, growing at a CAGR of 7.5% during the forecast period from 2022 to 2032.

- Laboratory Information Management System (LIMS) Market size is expected to be around USD 3400.70 million by 2031 from USD 1,650 million, growing at a CAGR of 7.5% from 2021 to 2031.

- Clinical Microbiology Market size is estimated to be worth USD 4.71 Bn in 2023 and is forecast to USD 8.84 Bn by 2033 with a CAGR of 6.50%

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog:

For all the latest Health News Click Here

For the latest news and updates, follow us on Google News.