China Oceanwide’s retail investors look to Blackstone deal for hope

When the US private equity group Blackstone announced in June it would buy International Data Group, a media and research company based in Massachusetts, retail investors in China were watching the news nervously.

The $1.3bn deal, which was completed on Wednesday, will transfer funds to China Oceanwide Holdings, IDG’s former owner and a property developer with an international footprint and a series of unpaid debts.

The sale is a rare link between global dealmaking and the plight of retail investors exposed to China’s vast real estate industry, where developers including Evergrande and Kaisa are struggling to honour billions of dollars of liabilities.

Oceanwide’s need for cash also highlights the risks in China’s huge wealth management industry, where some property developers have raised funds without always disclosing the amounts in their financial statements.

Oceanwide investors allege they have not been repaid on investment products they bought from the company’s subsidiaries last year when its financial health was already under immense pressure — and say they were told money from the IDG sale would go towards repaying them.

“For investors, IDG is the last hope,” said one holder of Oceanwide wealth management products, who said they had not heard of Blackstone previously and questioned how much of the proceeds would be available to them. Another suggested the “hole is too big”.

Some investors said they had launched official complaints with authorities in China, including the China Securities Regulatory Commission and an economic investigations department of the police in Shanghai.

Oceanwide declined to comment.

Oceanwide bought IDG in 2017, during a period of ambitious overseas expansion that was echoed across corporate China — led by conglomerates such as HNA and Dalian Wanda — that left the company with significant US real estate holdings.

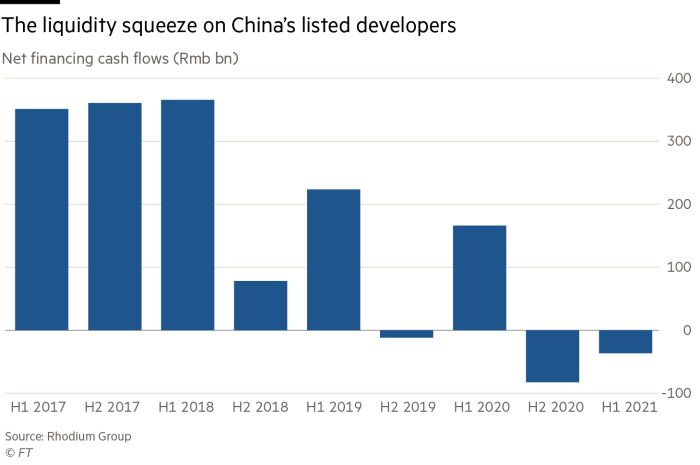

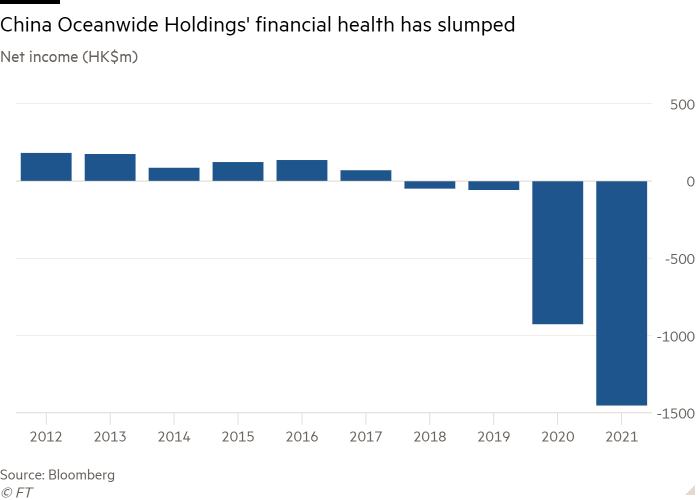

But the group has become embroiled in financial difficulties over the past two years, culminating in the seizure of its assets in San Francisco by creditors in October. Strict limits imposed by Beijing on property leverage, which have been thrust into the global spotlight by the recent plight of Evergrande, have also made it harder for Oceanwide and its peers to raise money and meet obligations.

Troubles in wealth management products linked to developers have even led to social unrest. In September, angry investors descended on Evergrande’s Shenzhen headquarters to protest against delays on payments on wealth management products that it had guaranteed.

Kaisa, another developer, recently confirmed that investment products it guaranteed had missed payments. Fitch, the rating agency, noted this month that the company did not record the products on its financial statements.

The difficulties have come alongside missed payments on international bonds from several companies. “We expect defaults for Chinese developers to increase over the next six to 12 months,” said Edward Chan, an analyst at S&P.

Oceanwide, which was run by its billionaire founder Lu Zhiqiang until 2020, became a financial conglomerate with real estate developments in New York, Hawaii and San Francisco in addition to its mainland Chinese projects.

But in early 2019, its auditor PwC resigned. The group’s financial health deteriorated further during the coronavirus pandemic, and S&P and Fitch stopping grading its bonds at the company’s request in March 2020.

PwC declined to comment.

The San Francisco project was seized after bonds worth about $330m matured and another Oceanwide subsidiary defaulted in May. A longstanding attempt to acquire Genworth Financial, a US insurer, fell through in April ahead of the IDG sale. Blackstone declined to comment.

In its final report on Oceanwide early last year, S&P lowered its rating to triple C and warned of the “rising repayment risk of Oceanwide’s near-term debt maturities”.

But Oceanwide continued to issue onshore wealth management products in 2020 through a company called Oceanwide Investment Fund Management, a subsidiary of Minsheng Wealth, a financial services company that is a wholly-owned subsidiary of China Oceanwide Holdings.

The 75-page offering for one product issued in November 2020 stated the proceeds would be invested in general credit markets.

Investors said payments largely stopped in February. In July, Oceanwide published a repayment plan on its account on WeChat, the Chinese messaging platform, that it said would result in full payment by March 2022.

One 39-year-old investor, who says he spent Rmb3m on a wealth management product recommended by a friend, said that local authorities had “gone to great lengths in prevent investors from organising themselves”.

Another investor in a big eastern city in China said that after payments stopped and they reported the issue to police, they were targeted for government surveillance. When they travelled to Oceanwide’s headquarters in Beijing, they said they were followed by seven officials from their home city.

“The local government has invested heavily in making us behave rather than solving our problems,” the person said. “That’s because they could be punished if we keep reporting our case to the central government.”

Reporting by Thomas Hale in Hong Kong, Sun Yu in Beijing and Wang Xueqiao in Shanghai

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.