Blackstone, the world’s largest private equity group, and Temasek’s Singapore platform Sheares Healthcare have emerged as top contenders for buying Care Hospitals, said multiple sources aware of the development. The deal could value Care, one of India’s largest hospital chains, at ₹8,000-8,200 crore (about $976 million-$1 billion), they said.

The race has heated up in the last few weeks, with Blackstone emerging as the frontrunner thus far.

Ahmedabad-based Torrent Group and buyout group CVC are also in the fray. Final rounds of due diligence are ongoing and binding bids are expected in the coming weeks.

The 2,400-bed hospital chain, owned by a TPG Growth platform Evercare, also saw interest from Max Healthcare and Carlyle, among others. Investment banks Rothschild and Barclays are advising TPG on the sale process.

Blackstone, TPG and Temasek spokespersons declined to comment. CVC and Torrent did not respond to ET’s queries.

ET, in its September 13 edition, was the first to report about interest from Blackstone, Temasek, CVC and Max Healthcare in acquiring Care Hospitals.

Care has 15 hospitals in India and two in Bangladesh. Once the deal fructifies, this would be the second-largest hospital buyout in India after the IHH-Fortis transaction of 2018.

If Blackstone emerges as the winner, it will mark the debut of the private equity (PE) major in the Indian, as well as the South Asian, healthcare market.

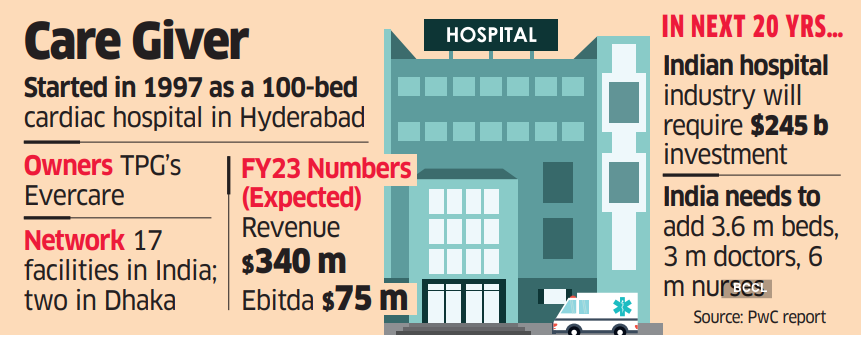

Care Hospitals is expected to post revenue of $340 million in FY23, with an Ebitda of $75 million, against $211 million revenue and $47 million Ebitda in FY22, a source said. Revenue is expected to grow 15-29% this financial year.

The chain was started in 1997 as a 100-bed cardiac hospital in Hyderabad, by cardiologists Dr B Soma Raju and Dr N Krishna Reddy, along with associates. It has expanded into a network of 17 healthcare facilities in six states, with more than 2,400 beds offering 30 clinical specialties in India and Bangladesh. It has two hospitals in Dhaka, with 1,000 beds.

Through the acquisition of Indore-based CHL Hospitals, Care added 250 beds in July. In the same month, it took a “significant majority stake” in Aurangabad-based United Ciigma Hospital, its third such deal since April to consolidate and deepen its presence in fast-growing tier-II markets.

Interested Parties

In 2018, TPG Growth-backed Evercare acquired the healthcare portfolio of UAE’s Abraaj Growth Markets Health Fund, which owned a majority stake in Care Hospitals. Abraaj had purchased 72% in Care from Advent Capital for ₹2,000 crore in January 2016. The Dubai-based company collapsed after allegations of mismanagement of its $1-billion healthcare fund.

TPG is also selling its 20% stake in Ranjan Pai-led Manipal Hospitals and is in talks with PE fund KKR. The PE group also has a controlling stake in Motherhood Hospitals, a network of women and children’s hospitals in India. Blackstone was also a frontrunner to acquire the wholly owned injectables arm of Aurobindo Pharma, valuing the business at ₹26,000-30,000 crore ($3.4-4 billion). However, the deal was called off due to a valuation mismatch.

For all the latest Health News Click Here

For the latest news and updates, follow us on Google News.