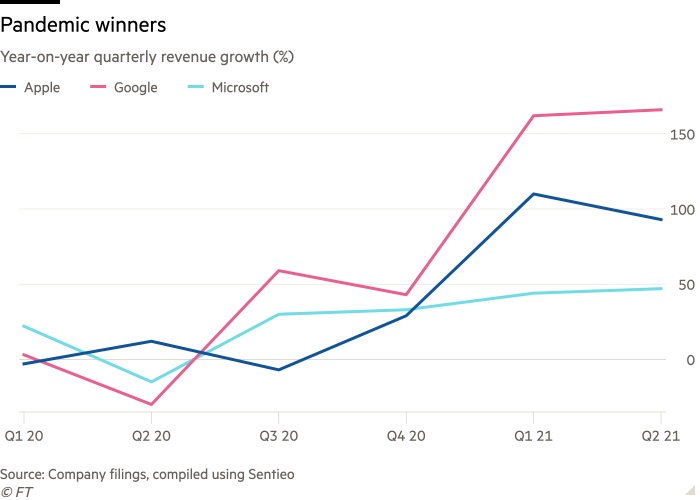

Big Tech profits have surged to unexpected heights, even as the global economy has started to emerge from the coronavirus pandemic that gave a boost to the biggest technology companies last year.

Earnings announced by Apple, Alphabet and Microsoft on Tuesday showed that demand for digital services and gadgets has continued to soar, making tech the biggest beneficiaries of this year’s gradual recovery, just as it proved to be one of the most resilient sectors during the Covid-19 downturn.

The three US tech groups brought in combined after-tax profits of almost $5bn a week during the latest quarter. At $56.8bn, the total was almost double the year before and 30 per cent more than Wall Street had predicted.

The figures were “absolutely stunning”, said Jim Tierney, a portfolio manager at AllianceBernstein, adding that “digital advertising is just on fire”, as advertisers race to follow audiences who have turned to online services in huge numbers.

“I think the takeaway is, all the digital habits that we picked up over the past 12 months, they’re going to stick with us when we come out of this,” Tierney added.

The latest crop of figures, which will be followed by earnings reports from Facebook on Wednesday and Amazon on Thursday, showed that the digital boom sparked by pandemic lockdowns would continue long after the crisis had passed, according to tech executives and investors.

Satya Nadella, chief executive of Microsoft, said his company’s strong performance demonstrated that the jump in tech spending since early last year was not a one-off but would be followed by a sustained surge as businesses moved quickly to digitise their operations.

“Five per cent of world GDP is tech spending, it’s projected to double — the doubling is going to happen at an accelerated rate,” he said.

The huge swell in profits comes as politicians and regulators around the world are seeking to restrain the power of the biggest US tech companies and could fuel a backlash.

The latest earnings figures showed that “these companies have such significant power over so many aspects of our lives,” said Samir Jain, director of policy at the Center for Democracy and Technology.

“Commerce, speech, entertainment, news, work — as we’ve become more dependent on technology as a result of the pandemic, it’s not surprising to see these companies doing well.”

Asked by the Financial Times whether Apple’s results were so good that they might invite further criticism from regulators, Luca Maestri, chief financial officer, said: “We focus the company on doing what is right for our customers and our users. Typically, if we do that, I think we’re going to be on the right side of those discussions.”

Apple’s earnings at a glance

Actual vs estimates

Revenue: $81.4bn vs $73.3bn

Net income: $21.7bn vs $16.62bn

EPS: $1.31 vs $1.01

iPhone revenue: $39.57bn vs $34.04bn

Services revenue: $17.49bn vs $16.28bn

Estimates from Refinitiv and FactSet

The quarterly numbers revealed an across-the-board boom in digital demand from consumers and business customers. Sales of Apple’s iPhones jumped 50 per cent, while Google’s advertising sales soared 69 per cent from a year earlier, when the pandemic resulted in the company’s first-ever revenue decline.

Growth at Microsoft’s Azure cloud platform, its most important new business, re-accelerated to more than 50 per cent. The rates of expansion were astounding given the huge sales the companies were already generating from their core businesses, Tierney said.

Even supply chain problems that have weighed on companies globally this year, particularly a shortage of semiconductors, failed to dampen the tech companies’ ability to rake in revenues.

Apple shrugged off the worst of the shortages, which had been expected to subdue sales of iPads and Mac computers, although Tim Cook, chief executive, said the company would have done even better had it been able to meet demand that was “so great and so beyond our expectations”.

Microsoft’s earnings at a glance

Actual vs estimates

Revenue: $46.2bn vs $44.24bn

Net income: $16.5bn vs $14.53bn

EPS: $2.17 vs $1.92

Azure growth: 51% vs 42%

Commercial cloud revenue: $19.5bn vs $18.7bn

Estimates from Refinitiv, FactSet and Cowen

However, despite forecasting “very strong double-digit year-on-year growth” next quarter, Apple cautioned that its revenue would not climb as quickly as during the current quarter.

It warned that increased supply constraints would catch up with the company and crimp iPhone sales as it approaches the traditional September launch of its new smartphones. It also said that services growth would slow.

Apple stock slid by more that 2 per cent in after-hours trading. Shares of Alphabet added 3 per cent, while Microsoft’s stock barely budged. The stock prices of all three companies had hit record highs in recent days.

With the danger of a backlash growing, the tech companies went to pains to stress how much they had done to help consumers and businesses deal with the challenges of the pandemic. Sundar Pichai, Alphabet’s chief executive, told investors that the company had paid out record amounts to YouTube creators and the third-party websites that carry Google’s advertising.

Alphabet’s earnings at a glance

Actual vs estimates

Revenue: $61.88bn vs $56.16bn

Net income: $18.53bn vs $13.07bn

EPS: $27.26 vs $19.34

Advertising revenue: $50.4bn vs $45.07bn

Cloud revenue: $4.63bn vs $4.40bn

Estimates from Refinitiv and FactSet

Cook made reference to his company’s investments in racial equity, education, affordable housing and supporting the “global response to the pandemic”.

Philipp Schindler, Google’s chief business officer, said: “We’ve been deeply focused on helping businesses, big and small, navigate profound change. First, as a lifeline during the pandemic, and now, as a partner to reaccelerate growth as the world begins to reopen.”

The efforts to head off criticism of the outsized profits failed to silence critics, however, who accused the companies of abusing monopoly positions. Barry Lynn of the Open Markets Institute said the tech groups should not necessarily be credited for opening the door when the pandemic came knocking.

“They were able to answer the door because they have their hands on every single doorknob,” he told the FT. “That’s the thing about having a monopoly. You win when things are good, you win when things are bad, you’re going to win. Always.”

In total, the three tech companies generated $189.4bn in revenue during the latest quarter. That was 39 per cent more than the same period the year before, and some $15bn more than Wall Street had been expecting.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.