A pillar of resilience and forward-thinking in the Philippine financial system – BusinessWorld Online

BancNet as country’s interbank electronic payment network has been instrumental in the resilience of the Philippine economy during the worst of the COVID-19 pandemic. It had proven its agility and reliability in the face of adversity by serving as a pillar to the Philippine financial system, sustaining businesses with the facilities and infrastructure to continue operations while simultaneously tapping new opportunities to provide more accessible, more secure banking services for all.

“If 2020 was the year when we showed our resiliency and agility, 2021 witnessed how BancNet defied even bigger odds as COVID-19 continued to rage across the globe and protracted mobility constraints wreaked havoc on businesses and economies,” Nestor V. Tan, chairman of the board at BancNet, and Fabian S. Dee, BancNet president, said in a joint statement.

Despite the challenges of 2021, the network successfully completed complex, industry-wide projects such as the migration of InstaPay. In March, BancNet commenced the first phase towards the full switchover of InstaPay to the world-class system that runs on the Vocalink technology. As a more robust and highly scalable system, the state-of-the-art infrastructure will provide InstaPay participants improved services, better data capabilities and stronger security features.

This was a win for many consumers, as it allowed four major banks — BPI, China Bank, RCBC, and UnionBank — to pilot the new multi proxy service that comes with the infrastructure. The multi proxy service is an overlay service within the Vocalink system that uses mobile numbers or email addresses instead of account numbers to send and receive funds through InstaPay.

The results speak for themselves, as InstaPay generated a total of 429.14 million transactions in 2021, up 97% from 218.30 million in 2020. What’s more, the number of InstaPay transactions posted a milestone on December 15, 2021 when it reached 1.88 million — the largest single day total since InstaPay was launched in 2018.

Cumulative value of transactions in 2021 was recorded at P2.53 billion, soaring 121% over the total value of P1.14 billion the year before.

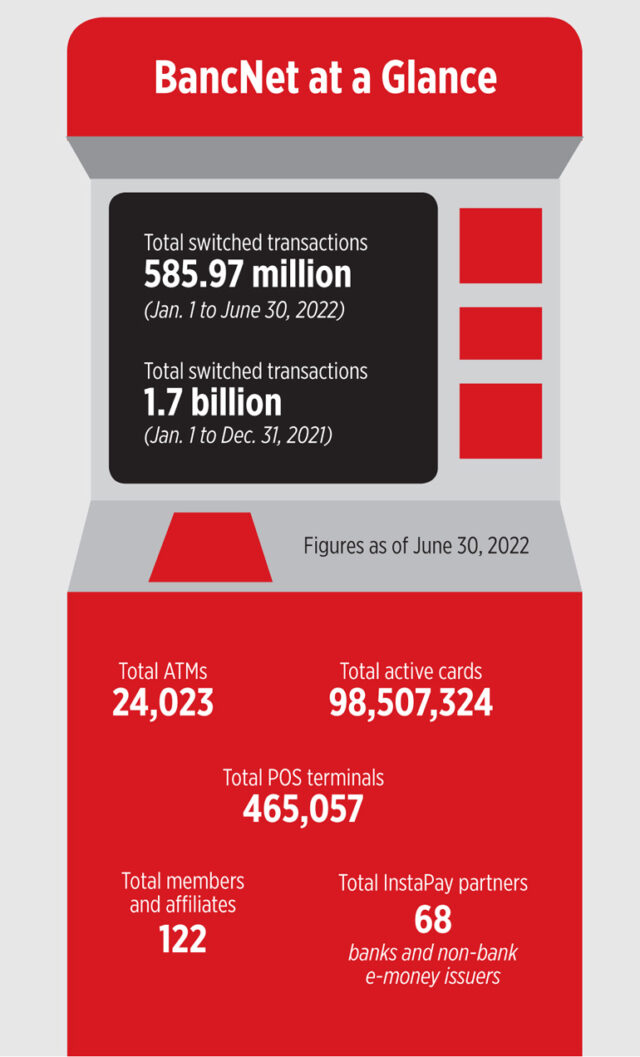

Meanwhile, 10 additional partner banks and non-bank e-money issuers joined InstaPay in 2021 to bring the total InstaPay participants to 62. As digital transactions continue to break into the mainstream, online payments to government agencies BIR, SSS, PhilHealth and Pag-IBIG Fund also increased significantly during the year, aggregating 2.68 million transactions worth P325.04 billion. Payment transactions on BancNet’s Internet payment gateway grew 22.91% to 95,807 transactions. Lastly, despite purchases being largely constrained to essentials and store capacity being limited, cashless payments through point-of-sale (POS) terminals onsite rose to 99.19 million transactions from 87.33 million, growing by 13.58%.

Meanwhile, 10 additional partner banks and non-bank e-money issuers joined InstaPay in 2021 to bring the total InstaPay participants to 62. As digital transactions continue to break into the mainstream, online payments to government agencies BIR, SSS, PhilHealth and Pag-IBIG Fund also increased significantly during the year, aggregating 2.68 million transactions worth P325.04 billion. Payment transactions on BancNet’s Internet payment gateway grew 22.91% to 95,807 transactions. Lastly, despite purchases being largely constrained to essentials and store capacity being limited, cashless payments through point-of-sale (POS) terminals onsite rose to 99.19 million transactions from 87.33 million, growing by 13.58%.

“The migration to the Vocalink platform enabled us to develop new real-time payment use cases that support the Bangko Sentral ng Pilipinas’ (BSP) target volumes for cashless payments,” Mr. Tan and Mr. Dee said.

“We have turned the challenges we faced in 2021 into opportunities that put us in a superior position as we prepare for the gradual exit from the pandemic and consequent recovery of the economy, increased consumption and higher demand for services. In particular, we have embraced the use of technology in both our internal business operations as well as our development and delivery of services to our members and participants,” Mr. Tan and Mr. Dee said.

Moving forward, the e-payment network seeks to build on its momentum of providing better quality financial services by working on InstaPay Debit Pull, which is also an account-to-account fund transfer that involves sending of a pull request from the receiving financial institution. This service will be positioned to replace the current bilateral relationships on wallet top-up between financial institutions. This model can also support Corporate Pull transactions and, consequently, allow BancNet to move into large-value wholesale real-time payments.

Trace and Alert, a fraud analytics tool that will warn participants of unusual transaction patterns so that they could investigate and avert or mitigate money laundering attempts, is also an initiative that is set for implementation.

BancNet is also keeping close ties with the Philippine Payments Management, Inc. (PPMI), the InstaPay ACH and the BSP to enable cross-border payments between Philippines and Singapore and Malaysia.

“The continuing conflict in Europe along with such domestic concerns as political leadership changes, rising inflation, a more stringent regulatory environment plus the threat of new COVID variants have given rise to new uncertainties and threats. Challenges remain but we are confident that working even harder to enhance our operational resiliency by building on our strengths, we will be able to achieve our goal of sustaining business viability while delivering on or even exceeding the expectations of our partners, members, and shareholders.” — Bjorn Biel M. Beltran

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.