ECB Must Be Determined But Avoid ‘Brutal’ Moves, Villeroy Says

The European Central Bank must show determination in tackling record inflation to avoid being forced into “unnecessarily brutal” interest-rate moves later on, according to Governing Council member Francois Villeroy de Galhau.

Article content

(Bloomberg) — The European Central Bank must show determination in tackling record inflation to avoid being forced into “unnecessarily brutal” interest-rate moves later on, according to Governing Council member Francois Villeroy de Galhau.

Advertisement 2

Article content

Sustained hikes will be necessary at least until borrowing costs reach a level at which they neither stimulate nor constrain the economy, the French central bank head said in a speech at the Federal Reserve’s Jackson Hole symposium. That may happen by year-end after “another significant step in September.”

Article content

With a rate-setting meeting less than two weeks away, a debate has started over whether the next move should mirror July’s initial half-point increase or whether a 75 basis-point step is warranted as inflation nears 10%. Much will depend on fresh economic projections, which may shed light on how an ever-likelier recession will affect prices in the 19-nation euro zone.

“We can be gradual, but we should not be slow and delay normalization until higher inflation expectations force us into aggressive interest-rate hikes,” Villeroy said Saturday. “What remains essential, however, is to be orderly, in order to avoid undue market volatility and ultimately economic volatility.”

Advertisement 3

Article content

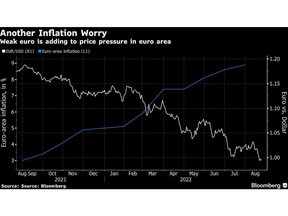

Growth prospects have soured of late while inflation risks have increased due to rising energy prices and a weaker euro, the French official said. That kind of uncertainty leaves “less need and space” for specific signals on where policy is headed next — a tool commonly referred to as forward guidance.

“We should aim to build a ‘new predictability,’ a different one suited for uncertain times,” he said. “The more open we are about the path, the more committed we must be about the destination of the journey.”

That destination is inflation at the 2% target. If that’s not in sight once rates reach neutral territory, which Villeroy puts at 1%-2%, there should be “no doubt” the ECB will raise borrowing costs further.

“Bringing inflation back to 2% is our responsibility,” he said. “Our will and our capacity to deliver on our mandate are unconditional.”

Advertisement 4

Article content

At the same time, the end of eight years of subzero rates poses another challenge: how to remunerate trillions of euros of excess liquidity that banks park each night at the ECB.

Paying deposit rates would provide a “sizeable risk-free income to the banking system, and a similar loss for the Eurosystem,” Villeroy said, suggesting the former risks endangering monetary-policy transmission.

“We have to think about a reserve-remuneration system adapted to this new context,” he said. “We will conduct this assessment in a swift and pragmatic way, looking at various options having existed across history and across jurisdictions.”

Advertisement

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.