Charting the Global Economy: China, Turkey Shock With Rate Cuts

Central bankers in China and Turkey bucked a global trend of raising interest rates, with officials easing policy amid signs of an economic slowdown in those countries.

Article content

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Advertisement 2

Article content

Central bankers in China and Turkey bucked a global trend of raising interest rates, with officials easing policy amid signs of an economic slowdown in those countries.

China is battling a worsening property downturn as well as sluggish retail sales and rising youth unemployment. In Turkey, where inflation is running at the fastest pace in 24 years, policy makers said they’re only responding to a possible slowdown in manufacturing.

Elsewhere, growth is diverging. The euro-area and Chile are under heightened recession risk, while strong consumer spending in Japan propelled the country to its pre-pandemic size in the second quarter. Still, Japan’s economy has been slower to recover than other nations, economists said.

Advertisement 3

Article content

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Asia

China’s economic slowdown deepened in July due to a worsening property slump and continued coronavirus lockdowns, with an unexpected cut in interest rates unlikely to turn things around while those twin drags remain. Retail sales, industrial output and investment all slowed last month and missed economists’ estimates. China’s central bank cut both one-year and seven-day lending rates by 10 basis points.

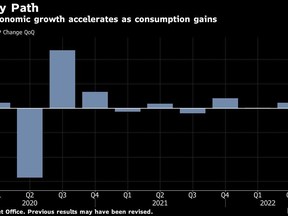

Japan recovered to its pre-pandemic size in the second quarter, as consumer spending picked up following the end of coronavirus curbs on businesses. Gross domestic product for the world’s third-largest economy grew at an annualized pace of 2.2% in the second quarter.

Advertisement 4

Article content

Emerging Markets

Turkey’s central bank delivered a shock cut to interest rates despite inflation soaring to a 24-year high and the lira trading near a record low. The Monetary Policy Committee signaled it’s only responding to a possible slowdown in manufacturing and not embarking on a monetary-easing cycle, saying “the updated level of policy rate is adequate under the current outlook,” according to a statement.

Chile’s economy is teetering on the brink of recession after unexpectedly flatlining in the second quarter amid soaring inflation and heightened political uncertainty over a new constitution.

Europe

The euro-area economy grew slightly less than initially estimated in the second quarter as signs continue to emerge that momentum is unraveling. Analysts worry that energy shortages will drive record inflation higher still, tipping the continent into a recession.

Advertisement 5

Article content

UK inflation accelerated last month to the highest in 40 years, intensifying a squeeze on consumers and adding to pressure for action from the government and Bank of England. The consumer price gauge rose 10.1% in July from a year earlier after a 9.4% gain the month before.

UK job vacancies fell for the first time since August 2020 as real wages dropped at the sharpest pace on record, indicating a tightening inflation squeeze on consumers and businesses.

US

US retail sales stagnated last month on declines in auto purchases and gasoline prices, though gains in other categories suggested consumer spending remains resilient.

Employers battling to fill job vacancies in the tight US labor market this year have had a silver lining, as it were: decades-high inflation was bringing retired people back to the workforce. But recent data suggest the trend may already be petering out.

World

European investment in China is holding up for now despite deteriorating political relations between the two trading partners, with businesses looking for ways to work around any decoupling threat.

While Turkey and China’s central banks grabbed the headlines this week with rate cuts, at least six of their peers increased borrowing costs, including a record 300 basis-point hike by Ghana.

Advertisement

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.