Live news: Asian stocks edge up as interest rates remain in focus

Friday marks the first anniversary of Russia’s full-scale invasion of Ukraine, an event that shocked the world by bringing large-scale conflict to European soil.

US president Joe Biden’s visit to Poland at the start of the week will serve as a show of strength to Ukrainian and Nato allies in the face of Russia’s long-expected spring offensive.

The EU’s Foreign Affairs Council meeting on Monday will focus on the war and it will be the keynote item at Friday’s UN Security Council meeting in New York. Ukrainian president Volodymyr Zelenskyy may travel to Manhattan to address the assembled delegates.

The Financial Times has a special magazine issue marking the anniversary of the war featuring essays by our Ukraine correspondent Christopher Miller and academic Mary Elise Sarotte, alongside a powerful picture package by Ukrainian photographers.

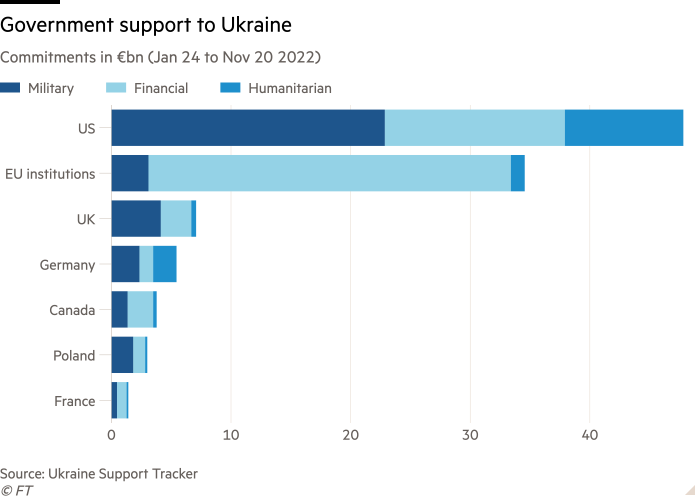

Henry Foy examines how western governments have provided more than $110bn in support to Kyiv since last February — $38bn in the form of weapons — and how the reality of maintaining these numbers is only just beginning to dawn on the west.

The UK’s winter of industrial unrest rumbles on. Staff at more than 150 higher education institutions will walk out in a long-running dispute over pay and conditions while regional ambulance staff in England and Northern Ireland will hold various strikes this week.

FT Live holds a free online event, the Future of Business Education: Spotlight on MBA, on Wednesday, where the FT’s global education editor and business education rankings manager, will share details about how the best business schools are rated. Click here to register.

Economic data

Gross domestic product is the main US data point on Tuesday and minutes from the last Federal Reserve’s meeting land on Wednesday.

UK public-sector borrowing figures for January are out on Tuesday. Increases in debt interest and spending on energy support schemes made last month’s release the highest monthly total since records began in January 1993.

Turkey’s central bank announces interest rates on Thursday.

Companies

UK banks will stay in the spotlight. Last week NatWest announced an almost tripling of profits driven by higher interest rates. These should also boost profits for HSBC and Lloyds Banking Group when they report on Tuesday and Wednesday respectively, but these revenue channels are looking increasingly exhausted.

Several miners report this week, including Newmont, the world’s largest gold miner, which launched an all-share $17bn bid for Australian rival Newcrest earlier this month. Global demand for gold is surging as central banks and investors shelter from persistent inflation and geopolitical upheaval.

Read the full week ahead calendar here.

For all the latest Business News Click Here

For the latest news and updates, follow us on Google News.