Max Health tops Manipal’s AMRI bid by ₹900 crore in battle for hospital beds – ET HealthWorld

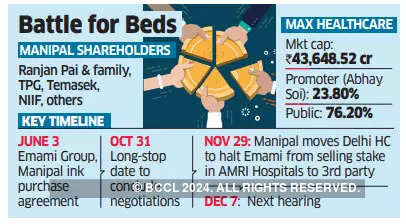

Max Healthcare Institute is believed to be eyeing the Kolkata-based Emami Group’s AMRI Hospitals with a counter offer that trumps an earlier Manipal Health Enterprises (MHE) bid by Rs 900 crore, triggering a potential full-blown corporate war between two of the country’s leading hospital chains, people aware of the escalating takeover tussle told ET.

Sources close to Emami, with business interests as diverse as consumer goods, medical care and property development, said Max has made a counter offer of Rs 2,700 crore to buy the AMRI chain to strengthen its position in the east. AMRI has three super-speciality hospitals in Kolkata and another one in Bhubaneswar. The chain has a capacity of 1,200 beds across its hospitals.

To be sure, sources close to Max Healthcare told ET that it has neither made any offer for AMRI, nor have its officials met to discuss the subject.

ET in its November 29 edition reported that MHE has moved the Delhi High Court seeking to restrain the Emami Group from selling or transferring its 94% stake in the latter’s healthcare business, AMRI Hospitals, to any third party or alter its management during the pendency of the arbitration proceedings.

MHE has not named Max in its legal plea, but has sought the court’s intervention to complete the Rs 1,800-crore deal it had agreed upon with the promoter family of Emami.

Manipal, Emami Brass Met Last Week

MHE, the country’s second largest chain, has urged the High Court that AMRI be restrained from selling or transferring or creating third-party rights with regard to its 94% stake (6,01,44,288 equity shares and 1000 Compulsory Convertible Debentures), which was the subject matter of the June 3 purchase agreement executed between the two parties.

Ranjan Pai, Chairman of the Manipal Group, declined to comment on the matter. Abhay Soi, the chief executive of Max, declined to comment. Responding to ET’s detailed questionnaire, a spokesperson at the Emami Group said: “We regret our inability to comment since the matter is sub-judice.”

Cul-de-sac?

According to people aware, the long-stop date for bilateral negotiations between Manipal and Emami Group ended on October 31. Since early November, the Emami family has been dragging its feet to fulfil key condition precedent (CP) obligations.

A condition precedent (CP) prior to closing is a condition that must be satisfied by a party to a transaction, failing which the other party is not bound to close the transaction. In this case, it involved Emami getting a no-objection certificate from the West Bengal government, a less than 1% shareholder in the hospital chain since the land for some of the hospital properties was leased from the state government for a nominal fee.

All the other CPs, as per sources aware, were to be waived.

“Manipal has been left with no choice but to litigate. It has been at this transaction for years, spent money on diligence, audit,” said an official closely involved on the condition of anonymity as the talks are in private domain. “Pai himself has flown down to Kolkata to meet with the state government officials and has also been in discussions to open medical and nursing colleges. While pursuing AMRI, he let go of several M&A opportunities, like Sahaydri and Care Hospitals. Interestingly, even before Manipal actually moved the Delhi High Court, the Emami Group filed a caveat as a pre-emptive measure.”

Sources close to Emami said a meeting held last week in Mumbai between Manipal and Emami’s top brass was the proverbial last straw, leading to a complete breakdown in negotiations.

Separately, Justice Yashwant Verma asked Kolkata-based AMRI Hospitals and 32 others, including Emami Ltd founder and chairman Emeritus Radheshyam Agarwal, to respond to MHE’s petition and posted the matter for further hearing on December 7.

While MHE asked the High Court to appoint an arbitrator to resolve the dispute, Senior Counsel Kapil Sibal, appearing on behalf of AMRI, opposed it, saying there is “no agreement” between them, ET reported.

IPO in Sight

Manipal has been looking to bring on board PE investor KKR, which recently exited Max through the largest single block deal by a private equity firm in India. That was also the first instance of more than 25% selldown by a PE firm. KKR made a near 5X return in two and a half years.

Manipal Health, backed by TPG, Temasek, NIIF and others, has been considering an IPO after completing the AMRI transaction and the KKR investment. It acquired the Columbia Asia hospital chain in November 2020 for Rs 2,100 crore.

In June 2021, it bought Vikram Hospitals in Bangalore from Multiples Private Equity for Rs 350 crore. Bangalore-based Manipal is estimated to have 8,700 hospital beds across 28 locations after the acquisitions. The Pai family holds around 52% in Manipal Health.

As per Care Ratings, AMRI’s total debt stood at Rs 1,654 crore as of 30 September 2021, climbing from Rs 1,587 crore at the end of March last year. The majority of the debt is in the form of unsecured loans from promoter group companies, at Rs 1,352 crore.

For all the latest Health News Click Here

For the latest news and updates, follow us on Google News.